House prices rise as Covid sparks rural relocation

- Published

- comments

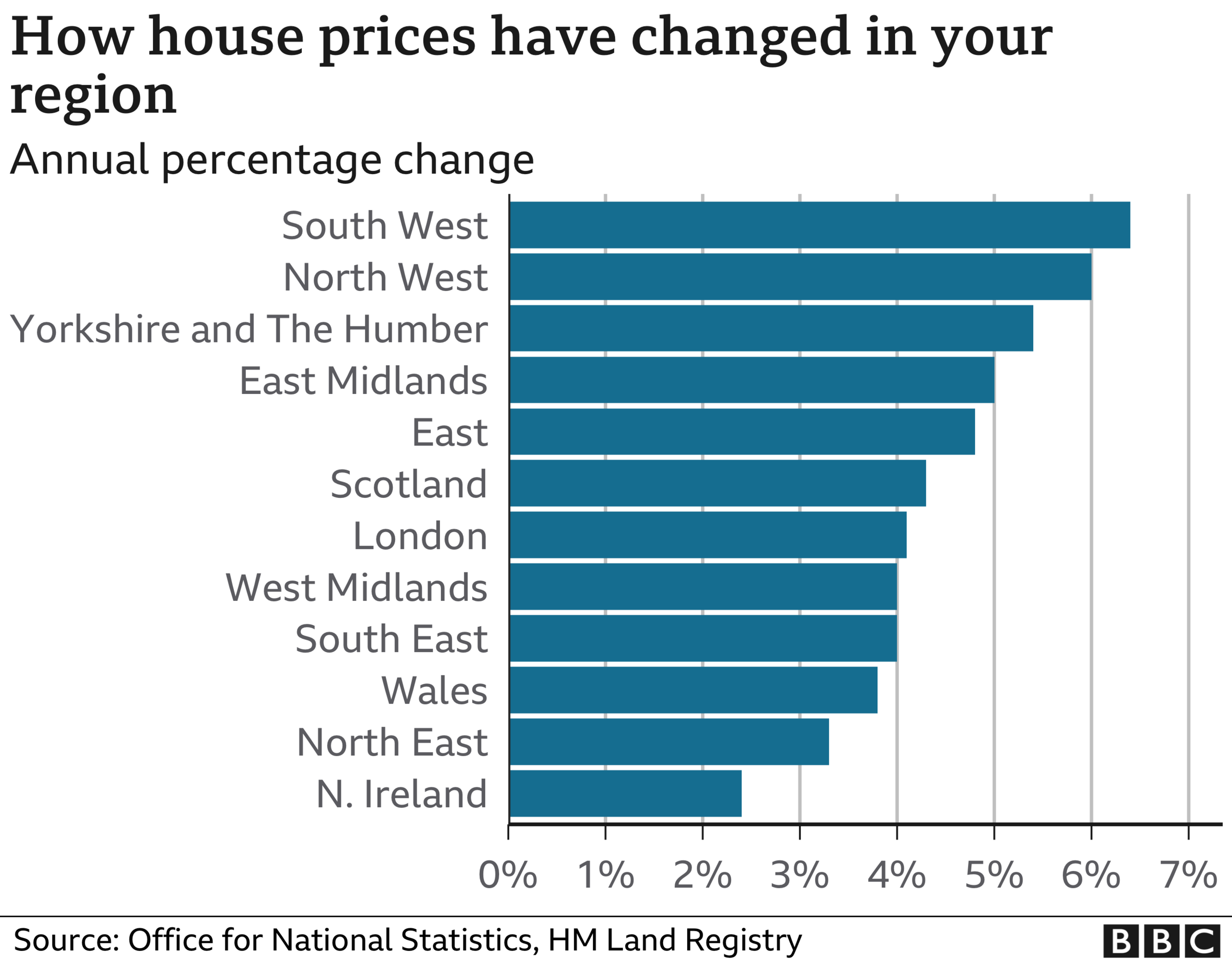

House prices in the South West of England have risen fastest in the UK in the last year amid a Covid-related rethink by many homeowners.

House prices rose by 6.4% in the year to the end of September, compared with a UK average rise of 4.7%, the Office for National Statistics (ONS) said.

Land Registry data also shows that detached homes saw the biggest annual price rises in the UK.

The pandemic has led some people to move to more rural locations.

There was also some pent-up demand during the first national lockdown among those looking to relocate, which was released in the late summer and reflected in these newly-published ONS and Land Registry figures.

However, this has tended to focus on the upper-end of the property market, as some people working from home have looked to buy properties with more space, both inside and outside.

Detached homes rose in price by 6.7% in a year.

"No part of the UK economy has flown over the Covid storm like the property market and the picture in September strengthened across the board," said Nicky Stevenson, managing director at estate agent group Fine and Country.

"The race for space is still the market's main driver. Price growth for flats and maisonettes is muted compared to larger properties, which have been flourishing amid high demand."

Some have been taking advantage of a temporary stamp duty holiday across the UK which began in the summer.

The city of Bath has some attractions for property hunters

The annual price rise recorded in the South West of England in September was double the level seen in the region the previous month.

Prices rose by at least 3% compared with a year earlier in every nation and region of the UK, except Northern Ireland, which recorded a 2.4% increase.

The UK housing market is made up of lots of local markets, with different factors affecting property prices such as the performance of schools and the availability of jobs. The ONS figures are based on sale completions.

Picture for renters

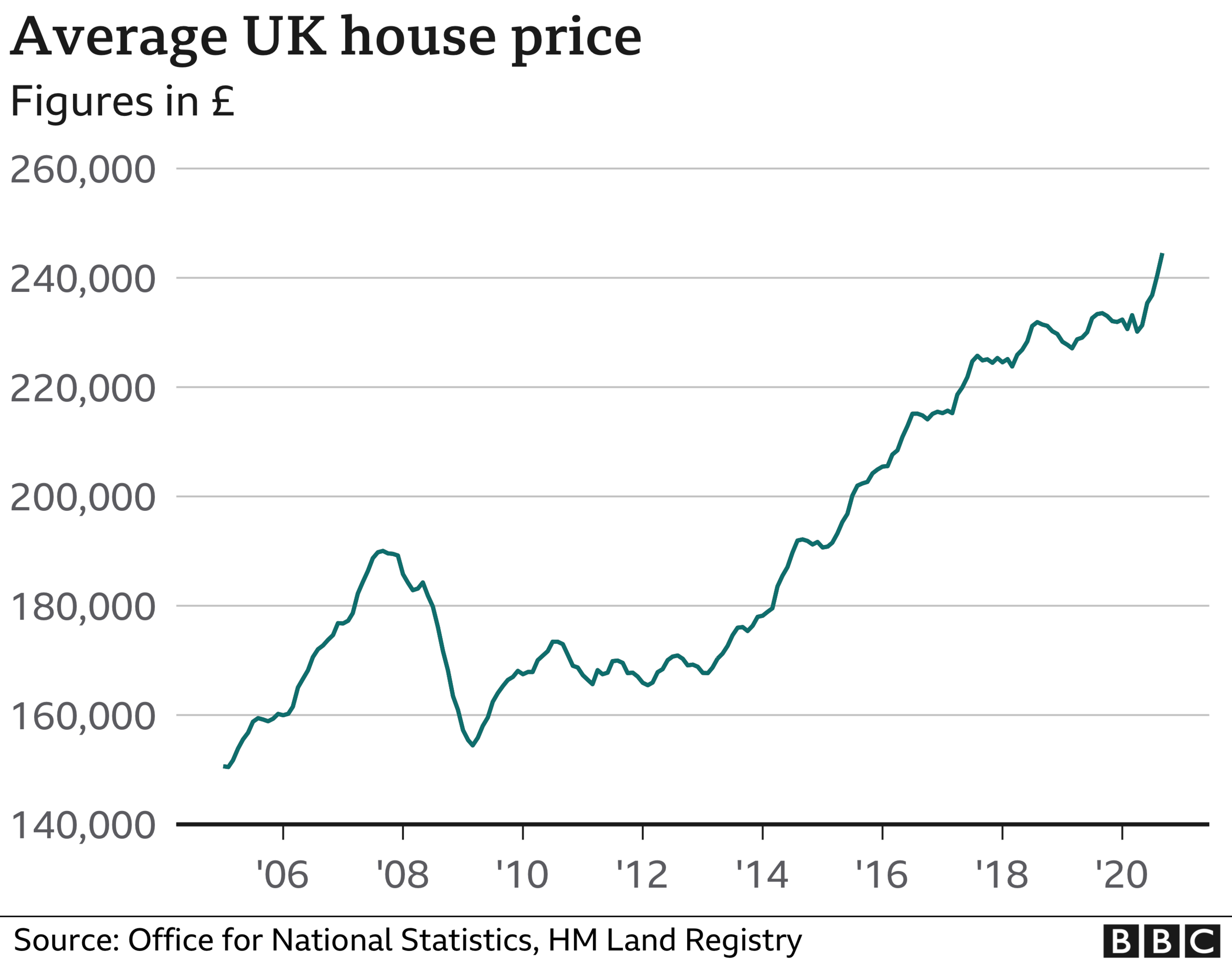

Overall, the UK increase in house prices was 4.7% over the year to September, up from 3% in August, with the average home valued at £245,000.

While property prices may not have risen as fast in London, the city still have the highest average house price, at £496,000.

For tenants of private landlords, rents in the UK rose by an average of 1.4% in the year to October, the ONS said,

London saw its biggest slowdown in private rental prices growth since March 2017, slowing to 0.9% in the year to October, down from a 1.2% rise in September.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published6 November 2020

- Published2 April

- Published9 July 2020