Early Christmas shopping helps boost retail sales

- Published

- comments

Early Christmas shopping and discounting by stores helped to lift UK retail sales in October, the latest official figures have indicated.

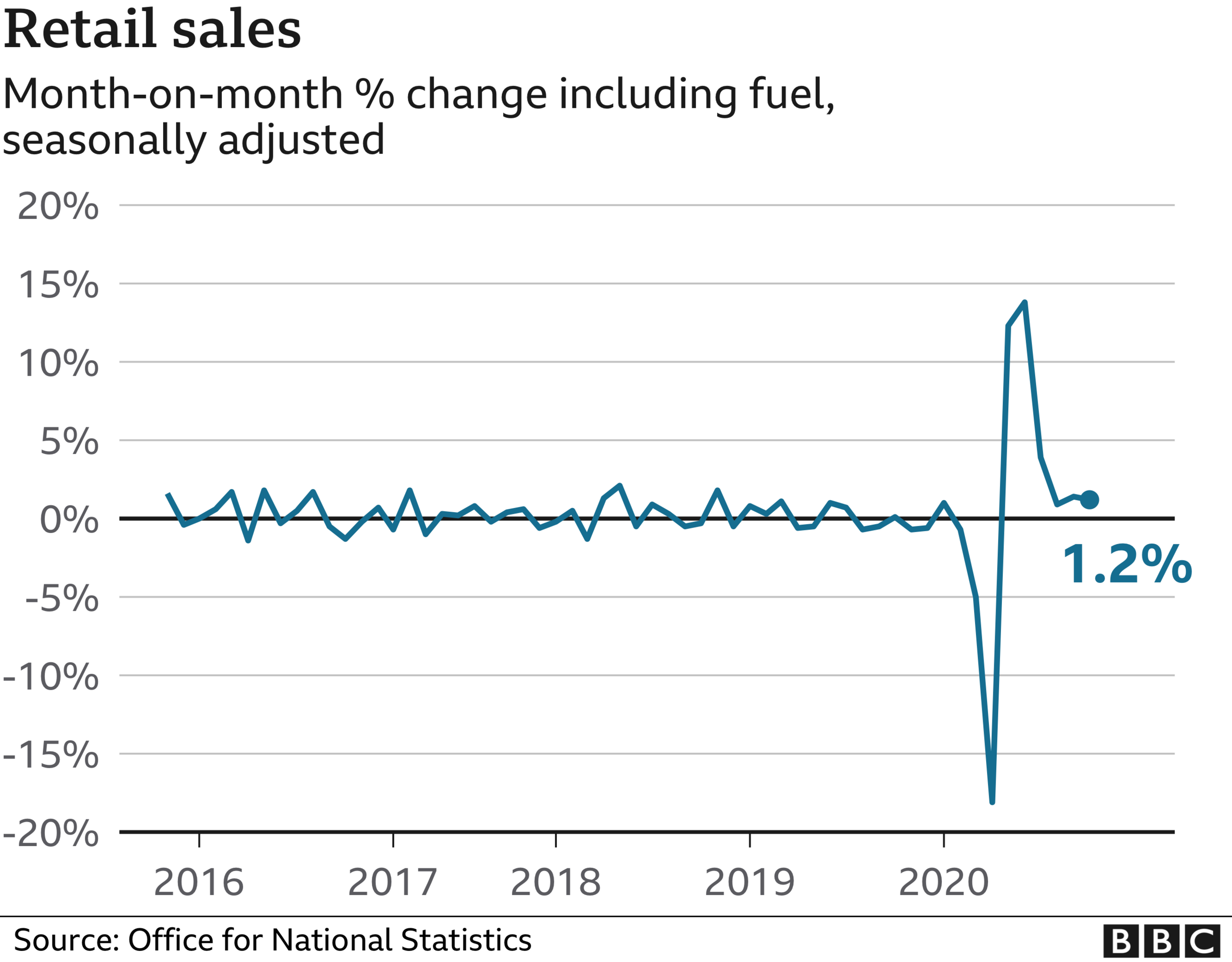

Sales rose by 1.2% last month, the Office for National Statistics (ONS) said, the sixth month in a row that sales have increased.

Online stores did well, but clothing sales weakened, the ONS said.

Analysts warned that sales were likely to fall sharply in November because of the lockdown restrictions in England.

Deputy national statistician for economic statistics Jonathan Athow said: "Despite the introduction of some local lockdowns in October, retail sales continued its recent run of strong growth.

"Feedback from shops suggested some consumers may have brought forward their Christmas shopping, ahead of potential further restrictions. Online stores also saw strong sales, boosted by widespread offers.

"However, the slow recovery in clothing sales has stalled after five consecutive months of increased sales."

The October rise was mainly driven by sales outside of traditional bricks and mortar stores.

This type of retailing, which includes online, has "showed strength over the course of the pandemic and remained at high levels", the ONS said.

But on the High Street, local coronavirus restrictions in October led to reduced footfall, which hit clothing stores.

Fuel sales were also flat, and remained below their pre-March lockdown level, due to reduced traffic on the roads, the ONS added.

These are surprisingly good figures. With consumers having fewer nights out and trips, spending is being transferred from leisure to retail.

Some consumers will also have a bit more money thanks to cancelled holidays, for instance, and working from home. That's led to more spending on home improvements and electrical products.

Another factor is early Christmas shopping. Lots of retailers have reported soaring sales of key essentials, from trees and decorations to turkeys and mince pies.

Fears about availability and further restrictions have prompted some households to get some of their festive shopping in the can.

Although England's lockdown during November will probably mean a fall in overall sales this month, consumers will likely have flocked online.

And the retailers who will do well are those with the strongest online offering and the capacity to deal with this huge shift in shopping behaviour.

Capital Economics said the sales figures - and also the latest government borrowing figures - "suggests that that the economy held up better than expected when the Covid-19 tiered restrictions were being implemented".

However, the economists said retail sales would fall again in November because of the fresh lockdown.

Pantheon Macroeconomics said it had pencilled in a 10% monthly decline in November due to the second lockdown in England.

However, it said this "compares very favourably to the shortfalls of 23% in April and 13% in May, when all non-essential stores had to close".

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that in October shoppers had "piled through the doors" of stores "in a pre-lockdown splurge".

"However, fresh lockdowns in the middle of peak festive shopping season will mean many retailers will still be facing a nightmare before Christmas," she said.

Job losses

Should non-essential stores be allowed to open in December, sales are be likely to "set a new peak" in that month, Pantheon Macroeconomics chief UK economist Samuel Tombs added.

However, many retailers have been "hanging on by a thread", said Richard Lim, chief executive of Retail Economics. "The second lockdown couldn't have come at a worse time for the sector.

"Those that don't have sophisticated online propositions and the capacity to cope with the shift towards online will be under enormous pressure."

The High Street has been one of the big financial losers from lockdown restrictions.

Tens of thousands of jobs have been lost, and on Thursday Peacocks and Jaeger became the latest names to fall into administration, putting 4,700 jobs and 500 stores at risk.

- Published20 November 2020

- Published6 November 2020

- Published23 October 2020