Has Topshop boss Philip Green done anything wrong?

- Published

Business periodically throws up pantomime villains who vault from the financial pages to the front of the tabloids and become the subject of public vilification.

Edward Heath called Tiny Rowland, the corporate raider, "the unacceptable face of capitalism", Robert Maxwell was excoriated for raiding the Mirror Group pensions, and more recently Jeffrey Skilling, the chief executive of Enron, went to jail for 12 years for enriching himself at the expense of shareholders and suppliers.

Sir Philip Green, the boss (but not the owner) of Arcadia Group, is the latest business leader to be put in the pillory.

It began with his sale of the department store BHS to Dominic Chappell for a token sum in 2015. BHS, which was part of Arcadia, collapsed a year later, leaving a big hole in the pension fund.

Sir Philip sold BHS for £1 in 2015, a year before it went bust with a £571m pension deficit, to little-known businessman Dominic Chappell

Sir Philip was accused of having sold the company to Mr Chappell deliberately to avoid the retirement plan liability, a claim he vigorously denied. He later paid £363m to make good the scheme.

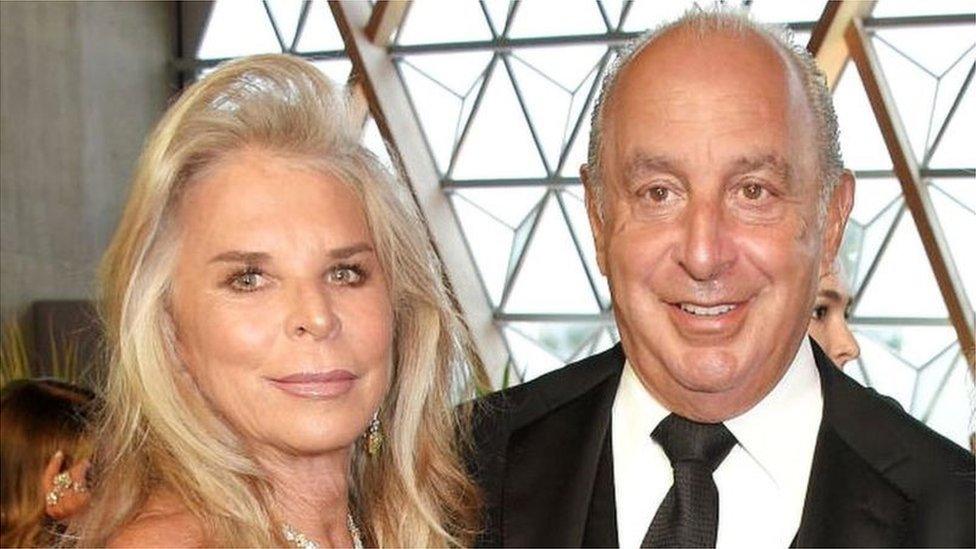

The looming administration of Arcadia puts Sir Philip in the firing line again. He will face calls to repair any deficit in the Arcadia scheme, despite he and the company's owner, his wife Lady Cristina Green, having put substantial additional sums into the pension in recent years.

There will also be accusations of his having been a poor manager. While the rest of the fashion retail world was getting out of the High Street and moving online as quickly as possible, Sir Philip was reluctant to take the plunge, and eventually laid low by the fatal combination of the internet and pandemic-related shop closures.

But has he actually done anything wrong? Lawyers will argue that the company - not its owners - is the legal entity responsible for maintaining the financial health of the pension scheme.

Sir Philip - who runs Arcadia - and Monaco-based Lady Cristina Green - who owns it

As far as is known, Arcadia did not ignore any directions from the pension regulator to mend the pension, and indeed received an endorsement from the Pension Protection Fund for a company voluntary arrangement - a form of insolvency that allows a business to restructure its finances - in June last year.

Several prominent retail businesses have gone into administration in the past two years, but in no case has there been an outcry for the owners to finance pension deficits personally.

There may be no infringement of the law, but what attracts attention to Sir Philip's case is that he and his wife have become immensely rich on Arcadia's back.

In 2005 the company paid Lady Green a £1.2bn dividend, the foundation of the Green fortune. Now that the company has fallen on hard times, should there be a moral duty on the family to help those thrown out of work?

The relevant example here is not Robert Maxwell or Tiny Rowland, but a group of businessmen who were also vilified for their management of a British icon. John Towers, Peter Beale, Nick Stephenson and John Edwards were the "Phoenix Four", who bought MG Rover from BMW in 2000 with the implicit backing of the Labour government and a hefty dowry from the German carmaker.

The Phoenix Four bought MG Rover which collapsed in 2005 with the loss of 6,000 jobs

They proceeded to enrich themselves to the tune of several million pounds apiece while the company slowly spiralled downwards and eventually collapsed. They did nothing wrong - a government report into the collapse found their behaviour "inappropriate" - but they quietly volunteered to be banned as directors in future.

What the inquiry into MG Rover's demise showed was that ownership means just that. Once sold to the Phoenix Four, the once-great Birmingham carmaker became a piece of personal property to be used as the Phoenix Four saw fit.

The same is true of the Greens and Arcadia. Yet even if there is no legal claim for them to refill the Arcadia pension, they might consider the wider court of public opinion, which is much less forgiving than any judge.

Sir Philip can contemplate whether he wants to be remembered as the man who enriched his family, but left others out of pocket, or as the retail tycoon who put his staff first, even when his empire ran out of steam.

- Published30 November 2020

- Published27 November 2020