Calls for better deal for Arcadia pension holders

- Published

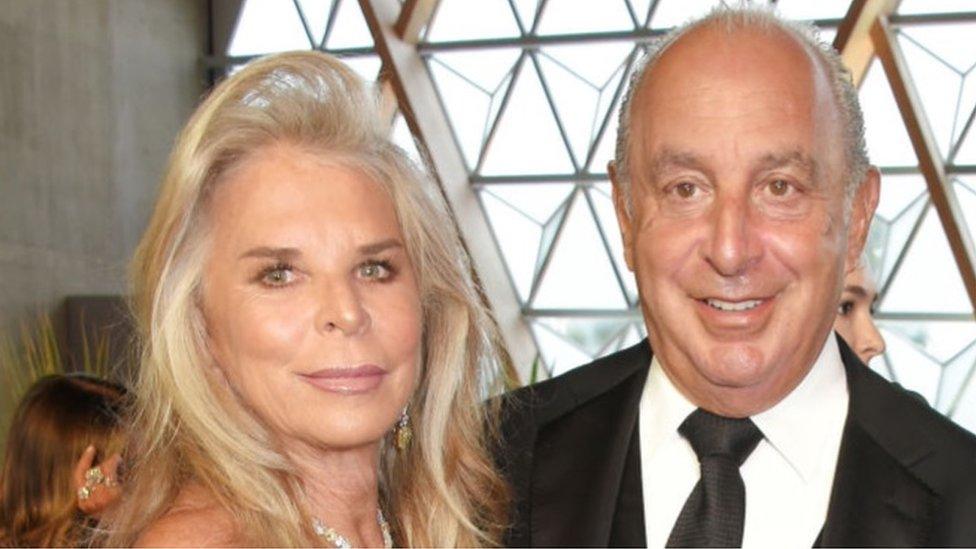

Sir Philip Green and Lady Green have a widely publicised fortune

Workers at Arcadia - the embattled owner of Topshop - should not lose out because of Sir Philip Green's "greed", according to Labour's Ed Miliband.

Sir Philip had a "moral duty" to make up the shortfall in the company's pension schemes, the shadow business secretary told the Commons.

Arcadia owner Lady Green has since brought forward a payment to the fund.

Some members face losing at least 10% of future pension payouts following Arcadia's fall into administration.

Talks regarding an alternative avenue to protect some pensions have emerged.

Retail empire's demise

Arcadia collapsed into administration on Monday, putting 13,000 jobs at risk.

The administration will give Arcadia breathing space from creditors, such as landlords for its shops or clothing suppliers, while a buyer is sought for all or parts of the company.

The plight of those who have pension promises from Arcadia pension schemes is also uncertain.

It is likely the company's pension schemes could go into the official rescue scheme, the Pension Protection Fund.

That would see long-serving staff, or previous employees, who hold defined benefit pensions losing at least 10% of what they were promised in pension payouts when they reach retirement.

Topshop, Burton and Dorothy Perkins are part of the Arcadia stable

Arcadia's pension schemes have an estimated deficit of £350m - that is the difference between pension liabilities and the funds' assets.

Mr Miliband told the Commons: "Philip Green owes the workers at Arcadia a moral duty. His family took a dividend worth £1.2bn from the company, the largest in UK history, more than three times the size of the pensions deficit.

"The workers at Arcadia should not pay the price of Philip Green's greed. So will the minister now publicly call for him to make good any shortfall in the pensions scheme and will he ensure that the pensions regulator takes all possible steps to make sure this happens?"

Similar calls were made by the SNP. Its business spokesman Drew Hendry said: "[Workers] must be given all the help they can get to have all of their pension rights retained."

There is no legal requirement for Sir Philip, who ran the company, or his wife Lady Green, who owns it, to fill the entire pension deficit.

An Arcadia spokesperson said that a commitment from Lady Green, agreed with regulators, to add £100m to the company's pension scheme would be accelerated.

"Two instalments of the amount of £25m each have already been paid. The third and final instalment of £50m was not due to be paid until September 2021," the spokesperson said.

"Lady Green is going to bring this payment forward to be paid in the next seven to 10 days to complete the £100m commitment of payment."

Responding for the government, business minister Paul Scully said it was inappropriate to comment on individual cases.

"The independent pensions regulator has a range of powers to protect pensions schemes and it does work closely with those involved," he added.

"The schemes where the employer goes insolvent, the Pension Protection Fund is there to protect the members. Anybody already in receipt of their pensions will continue to be paid and other members will receive at least Pension Protection Fund compensation levels."

The Pension Protection Fund (PPF) will go through the books and consider whether the Arcadia pension schemes could survive or be bought by a third party, if it thought that would provide better outcomes for pension scheme members.

It has emerged that one potentially interested party is the Pension SuperFund - a new business that pools pension funds in a bid to make them more efficient and bring better investment returns.

As first reported by Sky News, external, early-stage talks have been held on absorbing Arcadia pensions into the Pension SuperFund.

"Pension SuperFund can confirm that it is is contact with the trustees of the Arcadia pension funds. Any transaction would subject to their agreement, the Pension Regulator and/or PPF clearance, as the case may be," said co-founder Edi Truell, a former adviser to Prime Minister Boris Johnson.

"Pension SuperFund is currently of the view that it can offer a safe and secure home to the 9,500 pension members in the Arcadia pension funds."

Trustees for the funds said they were in contact with the PPF and the regulator to ensure members' interests were protected.

Pension superfunds - of which the Pension SuperFund is one of the biggest in the UK - are a source of debate in pension industry circles.

Supporters say they offer a more secure long-term option for savers, because they can consolidate schemes and reap the benefits of investing on a larger scale. They may also be cheaper than a scheme being bought out by an insurance company.

However, critics point to the fact they are governed by a different set of regulations, while trade unions have expressed concern that workers will see their pension shift from their employer to a profit-seeking superfund.

- Published1 December 2020

- Published30 November 2020