Banks can re-start dividend payments, regulator says

- Published

UK banks can start paying shareholders dividends again, according to the Bank of England.

The Prudential Regulation Authority, a regulator and part of the central bank, said banks are strong enough to do so.

Banks bowed to pressure in March and ceased dividend payments.

Banks including HSBC, Lloyds, NatWest, Santander and Barclays were due to pay billions of pounds to pension funds and private shareholders.

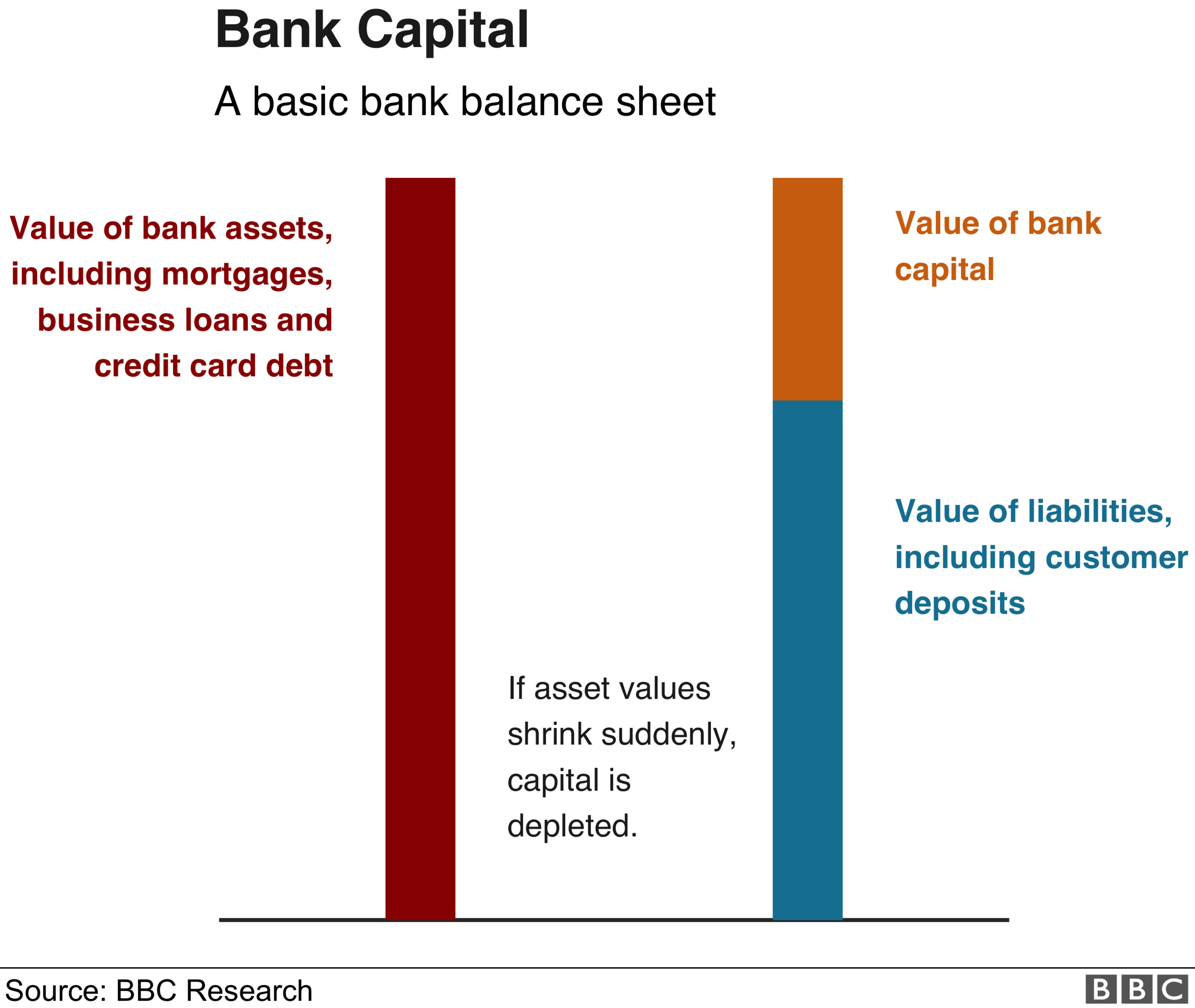

Stopping the payments allowed them to keep the capital and absorb bigger shocks from potential loan losses.

But many loans to businesses made by banks have been backed by the government, reducing risk for the banks.

"The Prudential Regulation Authority [PRA] judges that an extension of the exceptional and precautionary action taken in March is not necessary and that there is scope for banks to recommence some distributions should their boards choose to do so," the regulator said in a statement, external.

Tests from the Bank of England suggests the banks can withstand larger shocks than before

"The PRA will expect to be satisfied that any distributions would not create excess vulnerabilities to stress for a given bank or impede its ability or willingness to support households and businesses," it warned.

The relaxation will allow banks to consider whether a payment to investors will be prudent for the 2020 year. Such payments are usually made around February.

Banks will have to show they will still have enough firepower to absorb losses from bad loans. Should they have had a difficult year, they may decide not to pay a dividend.

Bonus 'caution'

However, most banks are understood to be keen to start paying investors again.

On the topic of bonuses for top earners at the banks, the PRA said it "expects firms to exercise a high degree of caution and prudence in determining the size of any cash bonuses granted to senior staff given the uncertain outlook and the need for banks to deploy capital to support the wider economy."

Critics have questioned why banks would not wait to see the full impact of the current recession before distributing its reserves.

They point to banks' share prices, which have recovered since March, but are still down for the year.

This suggests that investors could be less optimistic than the Bank of England about lenders' strength, despite billions of pounds of support in the form of furlough payments and government-backed loans to businesses.

'Pandering' to banks

The move was criticised as premature by former chairman of the Independent Commission on Banking Sir John Vickers, who has urged caution on bank strength before.

"The PRA should be more prudent," said Sir John, an Oxford University academic whose commission was in charge of constructing a safety plan for Britain's banks in the wake of the financial crisis.

"In the midst of such Covid and Brexit uncertainties, and with bank share prices way down on the start of the year despite huge government support to the economy, this is no time to say that banks can resume payouts."

The reserves could be better put to use in supporting lending and the economy, said Fran Boait, executive director of think tank Positive Money.

"It is deeply concerning that the Bank of England is pandering to commercial banks and allowing them to prioritise shareholder payouts instead of supporting the Covid-19 recovery," she said.

Related topics

- Published1 April 2020

- Published20 May 2020