MPs slam 'woeful' plans to recover Covid-19 loans

- Published

- comments

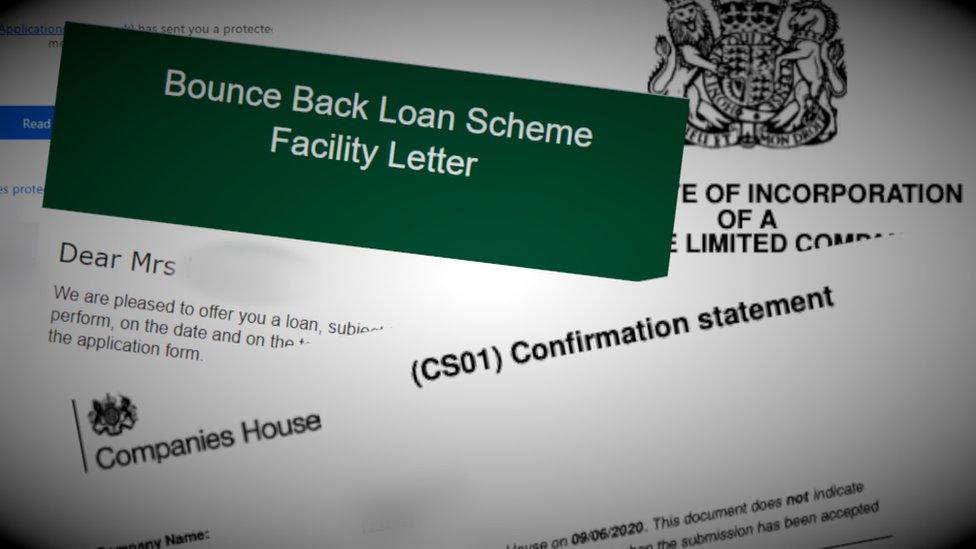

Plans to recoup taxpayer losses on Covid-19 loans are "woefully" behind and the government has yet to assess the extent of fraud, according to a Commons committee.

The Public Accounts Committee (PAC) said the government has no counter-fraud strategy nor clear plans to manage risks to the taxpayer.

It has been estimated the taxpayer faces losses of up to £26bn.

However, a government spokesman insisted it is cracking down on fraud.

The PAC said the Treasury is yet to agree the process and protocols that lenders are expected to follow in recovering overdue loans.

"Government's plans for managing risks to the taxpayer - from both fraud and borrowers who are unable to repay loans - are woefully underdeveloped. Government does not have a counter-fraud strategy for the scheme and has not identified what types of fraud it will prosecute," the report said.

It comes after senior bankers cautioned on Monday that levels of fraud from Covid-19 loans are about five times higher than typical figures. Bosses at Lloyds and Santander told MPs on the Treasury Select Committee that about 1% of bounce back loans have been taken out fraudulently.

In October, the National Audit Office, the government's spending watchdog, estimated that up to 60% of emergency pandemic loans may never be repaid. It said as much as £26bn could be lost from fraud, organised crime or default.

'Rushed'

Chancellor Rishi Sunak launched the bounce back loan scheme at the height of the pandemic, covering 100% of the loans and urging banks to ensure lending could be made quickly.

The scheme had to be rushed out to help keep firms afloat in the initial spring coronavirus lockdown, which meant businesses were able to self-certify and lenders did not have to carry out any credit or affordability checks.

Meg Hillier, chairwoman of the PAC, said: "Rushing to get money out of the door after the fact didn't allow for analysis of how many businesses needed this help, could benefit from it, or could repay it.

"Dropping the most basic checks was a huge issue that puts the taxpayer at risk to the tune of billions."

The PAC called for the government to provide updates on how it plans to deal with fraud on the schemes, while it said the British Business Bank should report back within two weeks with the latest fraud estimates.

It is also recommending the Treasury reviews whether it is right to continue relying on firms self-certifying. It said the Treasury must draw up recovery rules before repayments start becoming due on May 2021 to ensure a "fair and thorough recovery of loans".

"For the remainder of this scheme, and future schemes, HM Treasury must better balance the interests of the taxpayer with the interests of businesses," the report said.

The PAC also highlighted that the schemes have likely reduced competition in the small business lending market, as the five biggest lenders have provided most of the loans.

A Government spokesman said: "We targeted this support to help those who need it most as quickly as possible and we won't apologise for this.

"We are acting to crack down on Covid fraud, with lenders implementing a range of protections including anti-money laundering and customer checks, as well as transaction monitoring controls."

- Published7 October 2020

- Published23 October 2020