Fed: Brighter forecast but challenging months still ahead

- Published

Prospects for the US economy have brightened since September, despite a recent surge in coronavirus cases, America's central bank said on Wednesday.

Federal Reserve officials said they expected growth of roughly 4.2% next year, better than previously forecast.

They forecast a fall in the unemployment rate from 6.7% to 5%.

The update comes as US medical authorities begin to distribute vaccines against Covid-19.

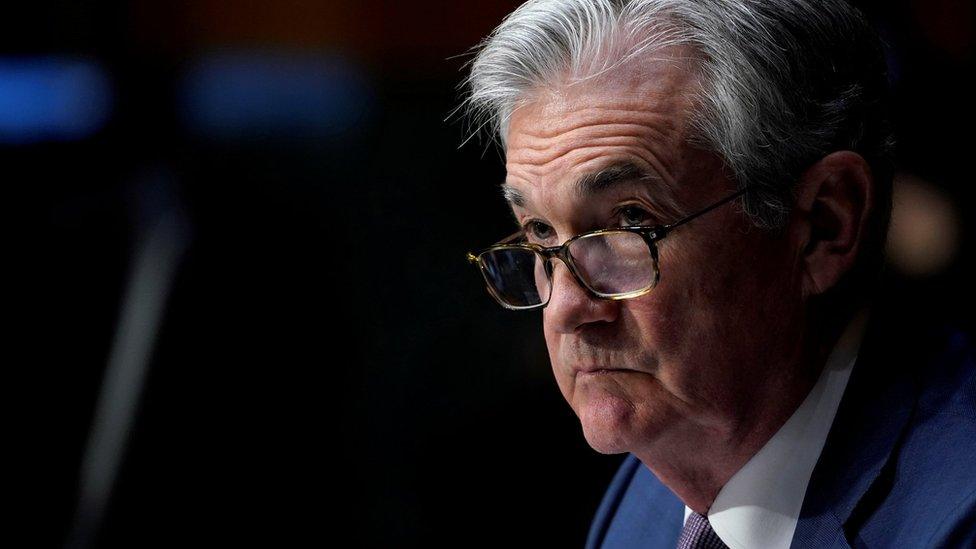

Federal Reserve Chair Jerome Powell warned that the coming months would be "particularly challenging," as the US battles a surge in coronavirus cases, while businesses and the unemployed face deepening hardship.

But he said he was hopeful that widespread distribution of the vaccines would enable a strong rebound in the second half of 2021.

"You have to think that sometime in the middle of next year, you will see people comfortable going out and engaging in a broad range of activities," he said. "The issue is more the next four or five months."

Policymakers said they expected to keep interest rates near zero and continue other stimulus until they saw "substantial" progress toward recovery.

Economic slowdown

In recent weeks, hiring has slowed and retail sales have dropped, as consumers avoid restaurants and cut back spending.

Officials in some places such as California have re-imposed strict lockdowns, while others, such as New York City have warned of such steps.

Meanwhile poverty rates have surged as government virus assistance expires.

Nearly 8 million Americans have fallen into poverty since June, as government assistance programmes expire

Mr Powell said there was need for more support and he was optimistic that Congress would approve additional aid, describing the roughly $900bn (£666.9bn) package being debated in Washington as "substantial".

Analysts have also said they expect the US economy to improve as vaccines become more widely available.

"Until then it is going to be a long bleak winter," wrote Paul Ashworth, chief US economist at Capital Economics.

'Substantial' progress

As the recovery shows signs of faltering, some analysts had suggested the Fed might move to increase its support for the economy by altering its bond-buying programme, which the bank uses to keep financial markets steady, easing the flow of money and credit to households and businesses.

At their meeting this week, officials opted against increasing the bank's purchases of US debt and mortgage-backed securities or changing the composition of the programme.

However, the statement from the bank on Wednesday did tie the programme to economic goals, with officials saying they would continue the programme until there was "substantial" progress to recovery.

Some analysts said the new wording was a signal the programme could continue for longer than expected, but others worried the Fed had missed an opportunity to do more.

Millions of Americans are at risk of losing access to unemployment benefits if Congress does not approve more aid

"We're surprised to see no reference to the deterioration in the near-real-time data," wrote Ian Shepherdson, chief economist at Pantheon Macroeconomics.

"We appreciate that the start of vaccination makes the 2021 outlook brighter - not that it gets a mention here - but in the near term, the economy needs all the help it can get."

In September, Fed leaders had said they expected growth of roughly 4% in 2021, with the unemployment rate falling to 5.5%.

- Published14 December 2020

- Published4 December 2020

- Published4 December 2020