Pre-Christmas lockdown restrictions hit retail sales

- Published

- comments

Food was one of the few sectors to see sales grow

Store closures enforced by Covid curbs pushed down UK retail sales in November, figures have indicated.

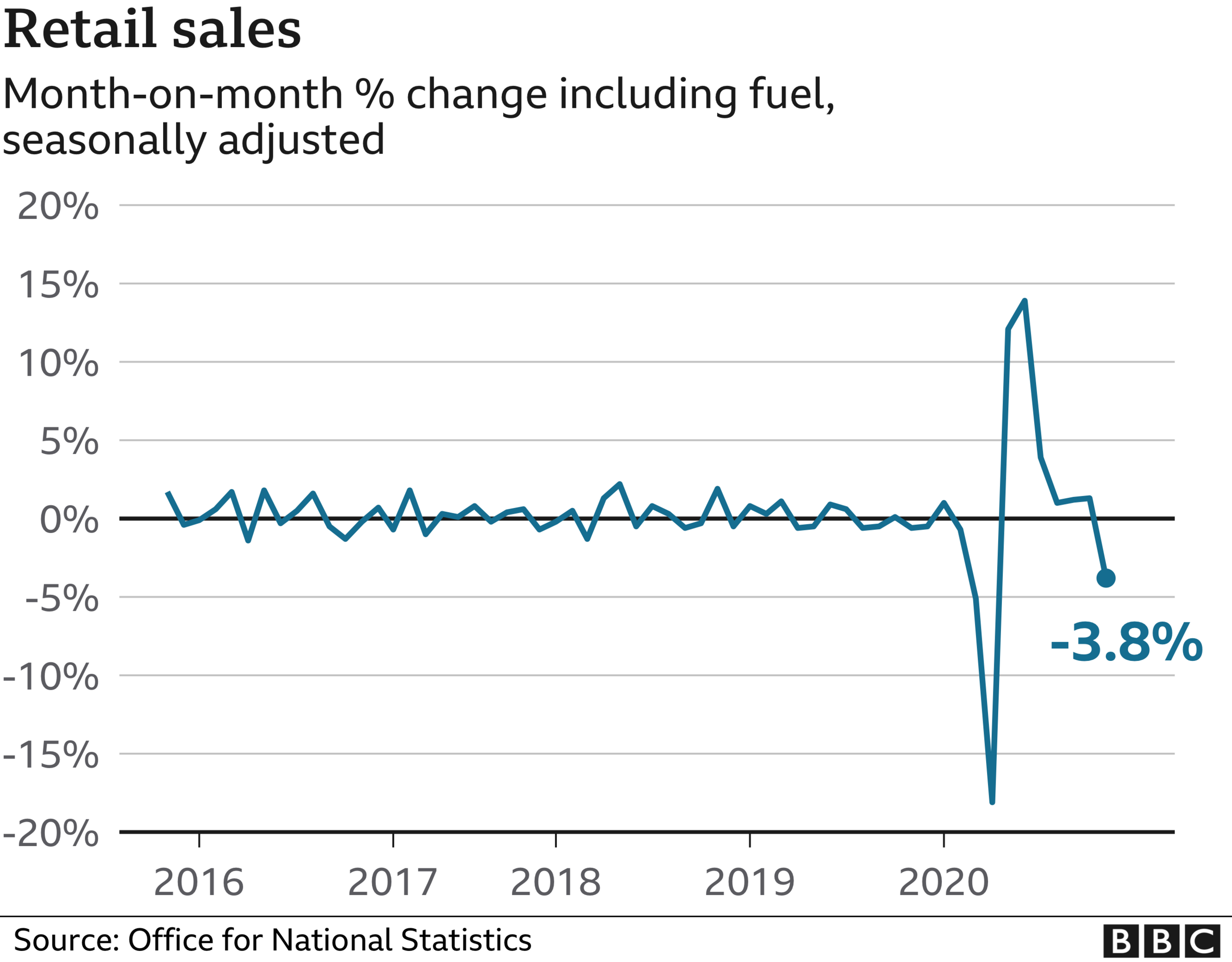

Sales fell by 3.8% last month, the Office for National Statistics (ONS) said, bringing to an end a six-month streak of rising trade.

Clothing store sales saw a sharp fall from the previous month, the ONS said, while food stores and household goods stores were the only sectors that grew.

Despite the monthly fall, overall sales remain above their pre-pandemic levels.

"After a run of strong growth, retail sales fell back in November as restrictions meant many stores had to close their doors again," said deputy national statistician for economic statistics Jonathan Athow.

"Clothing and fuel were particularly hit by the winter lockdown, with their sales falling sharply."

Mr Athow added that food sales, especially click-and-collect, were boosted as people were not able to eat out.

In another sign of the way the pandemic has changed shopping habits, online retailing accounted for 31.4% of the total, compared with 28.6% a year earlier.

The ONS said feedback from businesses suggested that consumers had brought forward Christmas spending.

"In a month where England went back into lockdown and the UK as a whole was subject to tightening restrictions, it's little surprise that physical retail sales growth stalled in November," said Lynda Petherick, head of retail at Accenture UKI.

Consumers had already brought forward Christmas spending, the ONS said

"However, the show must go on when it comes to Christmas shopping, and some retailers have triumphed by preparing their e-commerce operations for the boom in online sales.

"Black Friday and early festive shopping continued to stimulate a sector so desperately trying to build recovery momentum."

Samuel Tombs, chief UK. economist at Pantheon Macroeconomics, said: "Retail sales will rebound in December, probably to a new record high, as people undertake their pre-Christmas shopping over a narrower time period than usual."

He pointed out that consumers had "rushed back to the shops" since non-essential retailers were allowed to reopen on 2 December.

"Retail sales, however, probably will struggle to improve on December's level next year, given that income support schemes will come to an end in April and people will rotate towards consuming more services again once they have been vaccinated.

"What's more, non-essential shops might well be forced to close again to contain a third wave of Covid-19 in January. The collapse of more traditional High Street retailers next year, therefore, seems inevitable."

Home drinking

Meanwhile, a separate survey by trade publication the Grocer has shed further light on how people's shopping habits have altered during the pandemic.

The magazine's annual Top Products Survey, covering the 52 weeks to 5 September, found that supermarket purchases of alcohol had soared as people attempted to compensate for their inability to go to the pub during lockdown.

Sales of lager were up more than a fifth on last year, adding more than £800m to the nation's grocery bill.

Most-favoured brands included San Miguel, which saw sales growth of 63%, and perhaps surprisingly, the unfortunately named Corona beer, up 40%.

At the same time, sales of wine and spirits went up by £717m and £567m respectively.

However, other products lost out. With people confined to their homes for much of the time, the UK bought 22% fewer cosmetics, while hairstyling products sagged by 18%.

Sales of toothbrushes and deodorants both fell 10% for similar reasons.

- Published16 December 2020

- Published17 December 2020

- Published6 November 2020