Soaring house prices in 2020 likely to slow this year, says Halifax

- Published

- comments

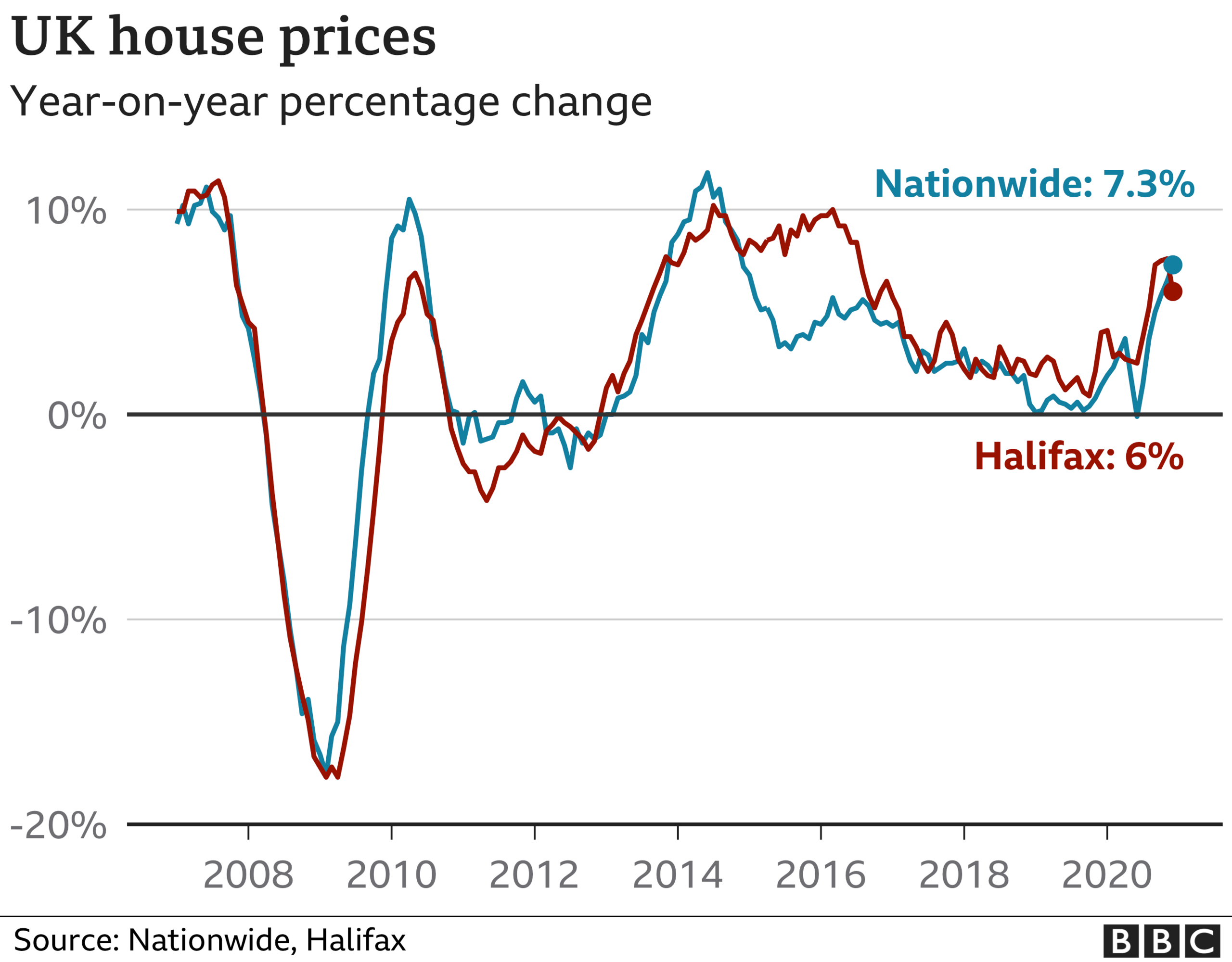

UK house prices rose by 6% last year, according to the Halifax, but the lender is predicting "downward pressure" on values in 2021.

The mortgage lender, part of Lloyds Banking Group, said that prices "soared" in the second half of 2020.

Pent-up demand, a clamour for more space, and stamp duty holidays led to higher prices.

But the Halifax said the economic realities of 2021 meant activity would slow as the year progressed.

"With the pace of the UK's economic recovery expected to be constrained by the renewed national lockdown, and unemployment widely predicted to rise in the coming months, downward pressure on house prices remains likely as we move through 2021," said Russell Galley, managing director at the Halifax.

He said that last year was a market of two halves - starting with slow growth, and stalling when the market was closed during the first national lockdown, but then booming when it reopened.

This meant that overall, demand and price growth were relatively high.

The conclusion mirrors the findings of rival lender, the Nationwide, which said that UK house prices climbed 7.5% in 2020, the highest growth rate for six years.

Both mortgage lenders base their findings on their customer data.

Lucy Pendleton, from estate agents James Pendleton, said: "The simple truth is that extra space has become non-negotiable for legions of homeowners with families, and the usual winter slowdown has met the immovable force that is hundreds of thousands of people all trying to jump to larger properties at the same time."

The Halifax said there were already signs of the market slowing, with prices rising by 0.2% in December compared with the previous month.

That was the slowest monthly rise of the last six months.

The lender said the average home was valued at £253,374.

Related topics

- Published7 January 2021

- Published9 July 2020