'My spending has gone up, not down, in lockdown'

- Published

Caroline Rice couldn't afford the ink to print off her child's maths homework

There are few benefits from lockdown, but one often touted is that people are managing to save a little money: lower transport costs, fewer shop-bought office lunches, cheaper childcare costs and no foreign holidays.

Single mum Caroline Rice gives a wry smile when asked if she's managed to squirrel away extra cash over the past few months during pandemic restrictions.

"My spending is up," she says. "The heating costs are higher because it's very cold. I'm having to shop locally because of lockdown, where the prices are slightly higher. The nearest Asda is 12 miles away."

The small savings on little luxuries that many people are making - fewer coffees or restaurant meals - were never an option for her in the first place.

Her meagre finances meant the registered child minder, who lives in rural County Fermanagh, was already living week-to-week. Now it seems like day-to-day, she says.

"There's a mental stress, fatigue, in having to check the bank balance every day to see how much I'm down," she says. "My child and I haven't bought any clothes in almost a year."

She's having to home-school her child. Many people wouldn't think twice about printing off their child's maths homework project. Caroline had to write it out by hand because they could not afford the ink.

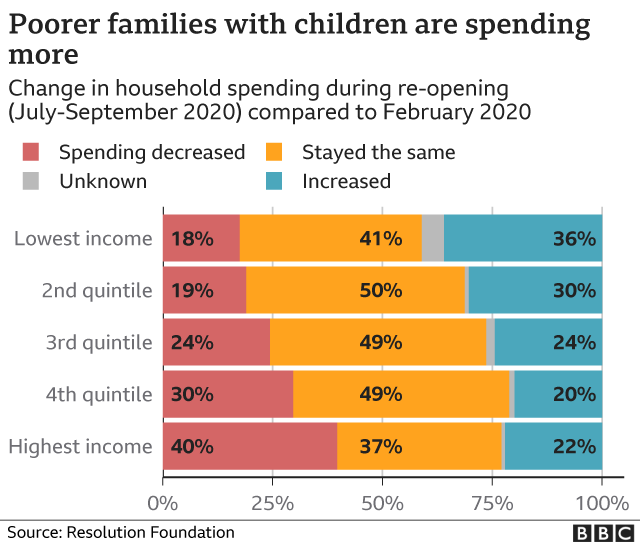

And she is not alone. A new report on the finances of low-income families during the pandemic says they are twice as likely to have increased their spending.

It says extra costs for food, energy and remote learning equipment have piled financial pressure on the poor.

'Worlds away'

The study - Pandemic Pressures - was a collaboration between the Resolution Foundation and the Nuffield Foundation-funded Covid Realities research project at the University of York.

Dr Ruth Patrick, a social policy lecturer at the University of York, says talk of saving money during the pandemic is "worlds away" from the experiences of many low-income parents and carers.

"Parents have found their spending increases, as some of the usual strategies they use to get by on a low income - shopping around for the best deal, going to families and friends for a meal when the cupboards are empty - have become suddenly impossible," she said.

For Shirley Widdop, an increase in food costs has been one of the biggest issues. The disabled single parent, who lives in Keighley, now has to shield for health reasons. That means using online deliveries a lot.

She says: "There's a minimum basket size [with online orders]. You often have to bulk buy in case there's a problem getting delivery slots."

Shirley Widdop has not saved on life's little luxuries - because she could not afford them in the first place

When not shielding, Shirley would seek out food in her supermarket's reduced-price section. "There used to be just a couple of people. Now there are crowds," she says. "Not everyone has easy access to the internet. And not everyone has a functioning bus service."

The report notes that the pandemic has been marked by a huge reduction in overall spending, with entertainment and social activities restricted by lockdown.

Higher-income households have been the main beneficiaries of this "enforced saving", as they spend 40% more of their income on recreation and leisure activities than the poorest fifth of households.

The report says that in contrast to this overall picture, the pandemic has in many cases made it more expensive to live on a low income with children.

More than one in three (36%) low-income households with children have increased their spending during the pandemic so far, compared with about one in six (18%) who have reduced their spending.

Among high-income households without children, 13% have increased their spending, compared with 40% who have reduced it.

Use of food banks has increased significantly during the pandemic

The report highlights three main reasons for these extra pressures:

Parents with children at home 24 hours a day have seen higher food and energy bills, while the need to entertain them during the lockdowns has brought additional costs

Home-schooling has meant extra costs, such as acquiring laptops, paying for internet access and obtaining additional study materials

Families' food costs have risen because of fewer in-store promotions, while shielding has meant using more expensive home delivery options or using more expensive local shops closer to home.

It should also be noted, the report says, that these extra spending pressures are squeezing living standards that had stagnated even before the pandemic.

To ease the burden, the report says the government should be seeking to maintain the £20-a-week rise in Universal Credit (UC) into next year. Otherwise, six million households face having their incomes cut by more than £1,000.

Government action

Mike Brewer, chief economist at the Resolution Foundation, said: "The pandemic has forced society as a whole to spend less and save more. But these broad spending patterns don't hold true for everyone.

"The extra cost of feeding, schooling and entertaining children 24/7 means that, for many families, lockdowns have made life more expensive to live on a low income."

However, a government spokesperson said measures had been put in place to "ensure that nobody is left behind", including extra welfare payments, job protection safeguards, the £170m Covid Winter Grant Scheme, and equipment for home-schooling.

"We are committed to supporting the lowest-paid families through the pandemic and beyond," the spokesperson said.

Sometimes the overall economic figures can not capture the actual on-the-ground financial reality.

The pandemic lockdowns have led to a "K-shaped" recovery. Across the entire economy, staying at home has meant less capacity to spend on going out and a surge in savings. But the economic picture is both up and down at the same time, depending on which household.

The average picture is composed of wealthier people saving a huge amount and poorer families more squeezed than ever. This report shows how children staying at home have increased food and energy bills. The cost of buying food has increased with fewer store promotions and a requirement to use more expensive local shops. The furlough scheme has kept people paid, but not necessarily on full pay.

So the chancellor hopes that the vaccine rollout could unleash pent up demand in the form of huge levels of savings from the already well-off. And yet at the same time, will continue to face pressure over extending support - for example, the £20-a-week increase to universal credit.

- Published8 January 2021

- Published11 January 2021