Covid: Nine million people forced to borrow more to cope

- Published

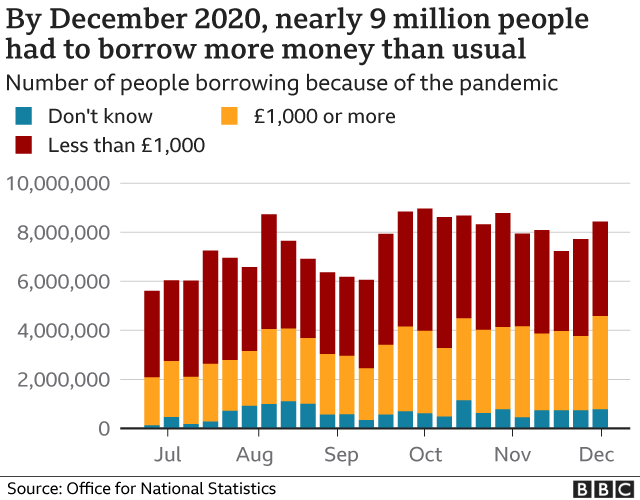

Nearly nine million people had to borrow more money last year because of the impact of coronavirus, government figures show.

Since June last year, the proportion of workers borrowing £1,000 or more had increased from 35% to 45%, said the Office for National Statistics.

Self-employed people were more likely than employees to borrow money.

There was also a large increase in the proportion of disabled people borrowing similar sums, the ONS added.

This was adding to a "widening financial gap" between households.

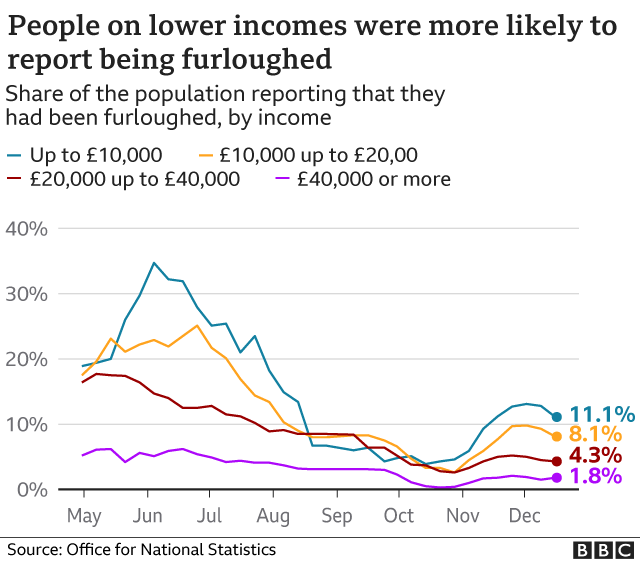

Overall, young people and low earners have been worst hit by the pandemic, according to the ONS survey.

Those aged under 30 and those with household incomes of less than £10,000 were about 35% and 60% respectively more likely to be furloughed than the population as a whole.

Meanwhile, higher-paid workers were more likely to be on full pay if they were unable to work.

There has been much focus on a glut of savings ready to be unleashed into the economy when pandemic restrictions are lifted.

This ONS report shines a light on the reality of this for many ordinary Britons, having to borrow more, amid a hit to incomes during the recession.

Disproportionately this has hit the low paid and the young, and this would have been far worse without the government's support package.

More homeowners and the over-30s by December expected to be able to save for the year ahead. Fewer renters and under 30s expected to be able to save.

Though the analysis does not include the latest national lockdown, the economic impact of schools closure is also clear.

Employed parents were twice as likely to experience income loss, though that gap closed when schools reopened. The fear is that this trend will have returned over the past month.

Gueorguie Vassilev from the ONS said: "Many people took a financial hit in the first months of the pandemic, either being furloughed or working fewer hours.

"What we are seeing now, though, is a widening financial gap between households, where some people are relying on savings or borrowing to make ends meet. Those hardest hit are people on low pay, young people and parents of dependent children."

Parents living with children were almost twice as likely to report a reduction in income as the rest of the population, the ONS added.

This gap gradually narrowed throughout the year as schools reopened. Parents were less likely to have a reduced income during the November lockdown than in the first lockdown, as schools stayed open.

Have you needed to borrow a substantial amount of money because of the impact of the pandemic? Tell us your story by emailing: haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Or fill out the form below

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

- Published19 January 2021

- Published22 June 2020