Brexit parcel price shock: 'I had to pay £30 for a gift'

- Published

Lili Piraki was sent earrings from Greece, but had to pay to receive them

A couple of weeks ago Lili Piraki, a London-based journalist, was surprised by a text out of the blue from delivery firm DHL.

She was delighted to hear a friend had sent her a present: a pair of gold earrings from Greece. She was less impressed that she would have to pay nearly £30 in taxes to receive the gift.

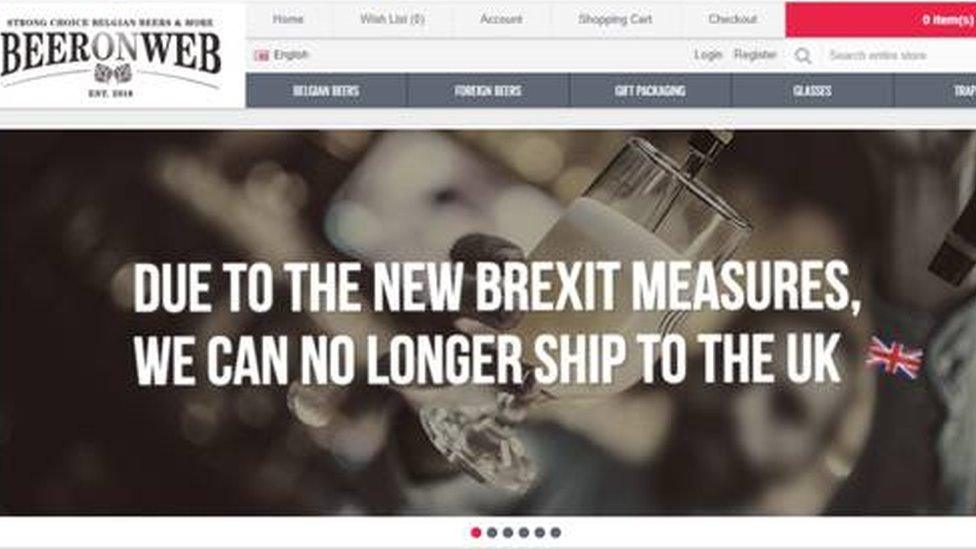

The extra charges are a result of new post-Brexit rules that came into force on 1 January.

Despite the free trade deal agreed before Christmas, which promised to smooth the UK's exit from the EU, new taxes and charges now apply, external to almost everything that goes back and forth between the two, including gifts, second hand items, products bought on Amazon or eBay and from private sellers.

After we reported recently on Londoner Ellie Huddleston's shock at being asked to pay £82 to receive a £200 coat, dozens of you got in touch asking why they were being charged extra.

So we asked some experts to run through five readers' experiences to explain the new charges.

1. 'My model car cost £12 more'

Sascha Grillo was charged an extra £12 when he tried to make an online purchase

Londoner Sascha Grillo was trying to add to his model collection by ordering a new car from a seller in Germany, but when he typed into the website that he wanted delivery to the UK, the price leapt up from £50 to £62.

"I was shocked, because I thought that with the Brexit deal, this wouldn't happen," he said.

"I thought day-to-day commercial transactions would remain the same, but this is not the case."

He decided not to buy.

Sascha collects model cars which he often orders from overseas

Why was he charged more?

The free trade deal means there are no quotas or tariffs on the goods traded between the EU and UK, but that doesn't mean there are no extra taxes or costs.

Since 1 January the UK is no longer part of the EU VAT regime, so the UK government is applying VAT (sales tax) at 20% on goods from the EU, explains Gary Rycroft, a partner at Joseph A Jones & Co Solicitors.

In Sascha's case the new tax was applied at the "point of sale", in other words when he clicked to order. That is how the system is supposed to work on all goods worth under £135, says Martyn James from the free complaints website Resolver.

UK VAT accounts for £10 of the extra £12 that Sascha was asked to pay. Sellers may also be charging higher delivery fees to cover any extra paperwork or border delays they may face.

2. 'I was charged an extra £123 for two handbags from Paris'

Karishma Neog, an IT professional based in Bristol, has a weakness for designer handbags. In the first week of January she ordered two, one for her and one as a present, from a retailer in Paris, spending £600 plus £25 for delivery.

When they arrived she was charged an extra £123.

"I had no inkling it was going to be the case," she says. There was no mention of it on the seller's site.

Why was she charged?

As with Sascha's cars, the charge was probably for UK VAT. But because Karishma's handbags were worth more than £135 she wasn't charged when she clicked to buy.

Instead, when you buy more expensive items the VAT is applied when the items reach you.

Michelle Dale from accountants UHY Hacker Young says the other possibility is that Karishma was charged customs duties.

If you're buying something that comes from the EU, the free trade deal means you won't pay any customs duties. But, while Karishma's bags came from a seller in Paris, they may not be made from French materials, they might not even be made in France.

The devil is in the detail when it comes to these "rules of origin" says Gary Rycroft. But they only apply to items over £135 that come from outside the UK and EU.

So if you're buying a pricier item, it is always worth asking if any additional customs charges will apply.

3. Gifts can come with a nasty surprise

Lili Piraki isn't the only one who was charged to receive a present. Even if the gift was wrapped and posted by a friend or relative it can still incur extra fees.

Some readers thought they'd avoided extra charges by posting before Christmas, but many deliveries ran late, and so - because they arrived after 1 January - came with an extra bill to pay.

The first thing Lili knew about the earrings from her friend was a series of texts from DHL asking for £28.85.

"I received a message from DHL saying in order to receive my gift I had to pay the taxes. I didn't even know anyone had sent me anything."

She checked all the details to be sure it wasn't a scam, and then paid the charges.

Why was she charged?

Gifts worth less than £39 don't attract any extra charges, explains Michelle Dale. But gifts over that, like gold earrings, are eligible for VAT and (if it's over £135) customs duties. And it's always the recipient who receives the bill.

4. 'Second-hand pottery on eBay was more expensive'

When former soldier Hamish Clarke was stationed in Germany in the 1970s he developed an interest in modern European pottery. He still adds to his collection, buying on marketplaces or direct from sellers in Germany and Belgium.

He spied four pieces of pottery he liked on eBay and agreed a price of €160 [£142] with the seller.

"When I tried to pay for it, it was asking for €191 euros," he says.

He wondered whether the charges might have been avoided if he had bought directly from the seller.

Why was he charged?

There's no way around the import VAT, says Michelle Dale, and it applies to second hand items as well as gifts, even if you've bought them from a private individual.

EBay already has its system set up , externalto charge the extra VAT upfront. Amazon says VAT will always be charged at point of sale, external on its site too. But the system won't be running smoothly yet everywhere, warns Martyn James.

5. 'I was asked to pay £78 more for my £150 UK boots in France'

Jemima Brown ordered a £150 pair of boots from a UK company to be delivered to her home in Auvergne, France.

"A week later I received an email from La Poste telling me that when the parcel was delivered it would only be handed over if I paid the €88 [£78] import duty," she says.

The documentation said it was €43 for VAT, €30 for customs tariffs, and €15 handling fees.

She rang the company which said she could reject the delivery and receive a full refund.

Why was she charged?

Shoppers on the continent buying from UK firms face the same rules as UK shoppers do in reverse so Jemima would have had to pay VAT and customs charges, because the boots or the materials they were made from, originated from outside the EU.

Michelle Dale thinks Jemima was lucky to be able to reject the delivery so easily. Some firms are changing their terms and conditions so that customers have to cover the extra charges, even when goods are returned.

Gary Rycroft says if a retailer doesn't make it clear that you might face extra fees, you could argue that these were "hidden costs" that you shouldn't have to pay. But don't expect that to be an easy battle to win.

- Published22 January 2021

- Published21 January 2021

- Published4 January 2021