Royal Dutch Shell sees huge loss as pandemic hits oil demand

- Published

- comments

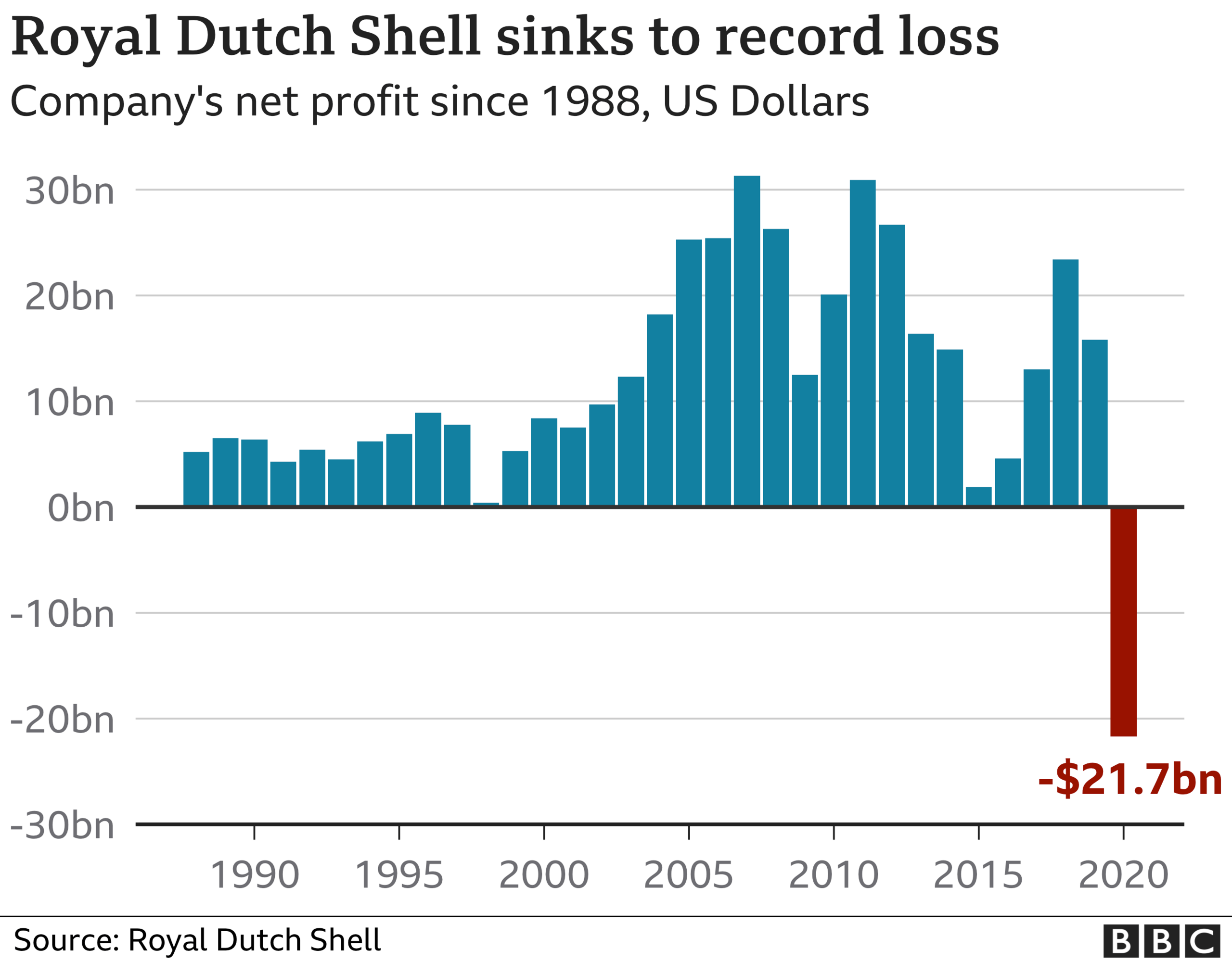

Oil giant Royal Dutch Shell sank to a net loss of $21.7bn (£16bn) last year after the coronavirus pandemic caused demand to slump.

The announcement comes after two of its rivals, BP and Exxon, posted similar big losses.

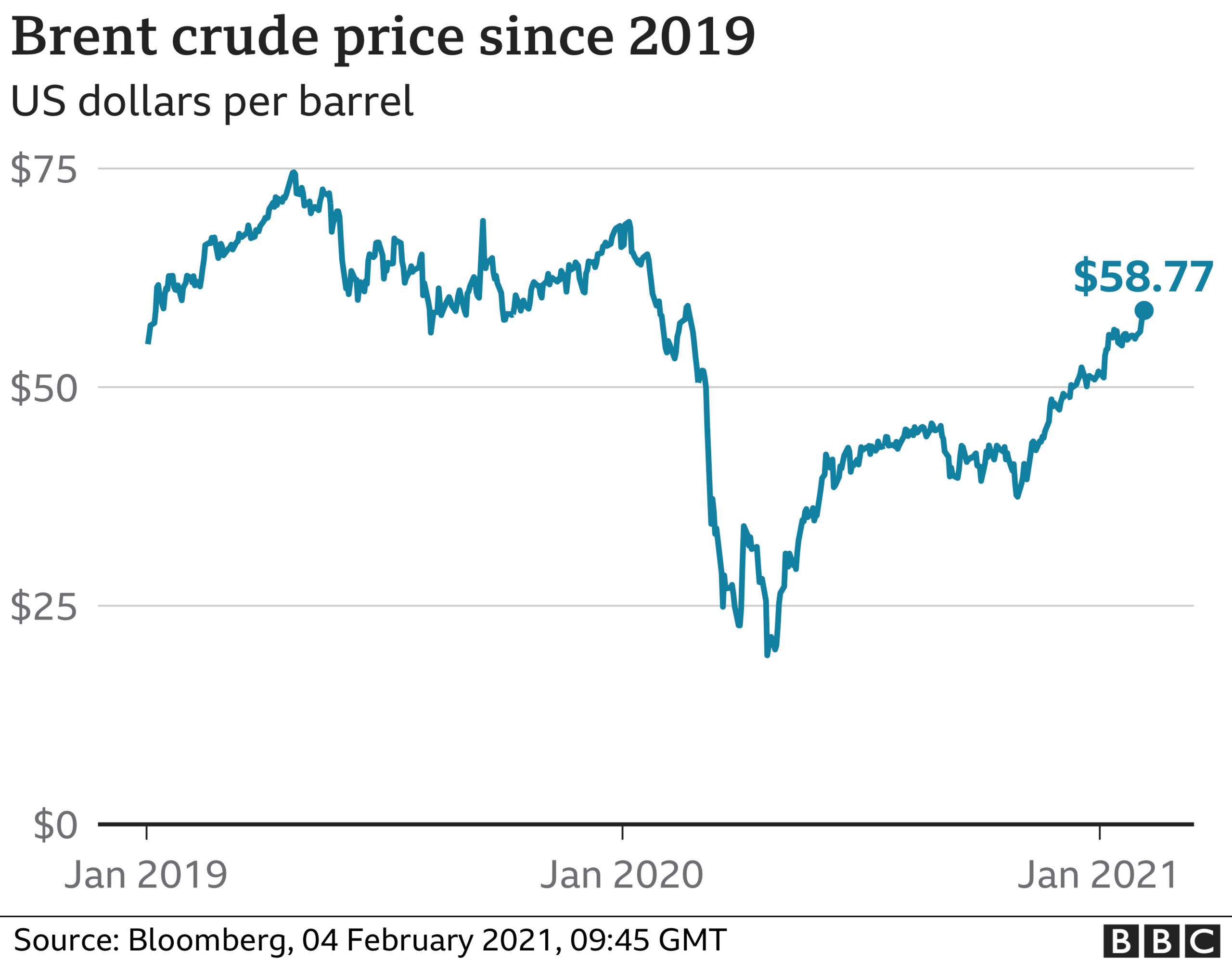

Looking ahead, Shell said "significant uncertainty" would continue to have a negative impact on demand for oil and gas products.

As a result, it said it might need to take measures to cut production.

In September last year, Shell announced that up to 9,000 jobs would go worldwide as the company responded to the effects of the pandemic.

Last month, it said it was cutting 330 jobs from its operations in the North Sea.

Even before the virus struck, the oil industry was already having to rethink its future plans as part of the transition away from fossil fuels.

The Covid impact means companies such as Shell are accelerating that transition.

Some doom-mongers were anticipating Royal Dutch Shell might unveil the largest-ever UK corporate loss, but in the end, the Anglo-Dutch oil group managed to get only halfway there. The £16bn deficit is dwarfed by the £30bn loss posted by Royal Bank of Scotland at the height of the 2008 banking crisis.

The Shell results will also quickly be forgotten. They are largely accounting rather than cash losses, the result of a giant write-down in the future value of the company's oil fields and prospects. Already investors are turning their attention to next week, when chief executive Ben van Beurden will present the company's long-awaited plans to shift the company towards greener forms of energy.

Pension funds and other big investors are pushing hard to get Shell to do more. The same pension funds, however, are reliant on the big stream of dividends that flows from the oil business. They will be hoping that Mr van Beurden will be able to pull off the trick of using that income to fund the investments in green energy that will - hopefully - yield a similar juicy dividend income in the future.

Other big oil companies are also feeling the strain. On Tuesday, BP reported that it lost $18.1bn in 2020, marking its first annual loss in a decade.

On the same day, US giant Exxon Mobil posted annual losses of $22.4bn.

Two other big US firms, Chevron and ConocoPhillips, reported big losses as well.

There are also indications of a potential shake-up in the sector, after media reports emerged this week that Exxon and Chevron held preliminary talks last year on a possible merger.

The two firms declined to comment, but sources told Reuters that the discussions involved Exxon chief executive Darren Woods and his counterpart at Chevron, Mike Wirth.

"This week's huge losses by Shell, BP and Exxon reflect the challenges oil and gas companies face," said David Elmes, professor of practice and head of the Global Energy Research Network at Warwick Business School.

"They are skating on ever-thinning ice as the effects of climate change combine with other events like the Covid-19 pandemic."

Prof Elmes said the slump in demand for oil and gas due to the pandemic had become more prolonged than initially hoped.

"There will be some ongoing need for oil and gas as a fuel for a while yet. There will also be demand for the petrochemicals and other products made from them. But that can't sustain the industry we've seen in the past as we look to address climate change."

- Published12 January 2021

- Published2 February 2021

- Published30 September 2020