Asda: How to buy a £6.8bn supermarket for £780m

- Published

Asda has been interested in the former Nortel site since 2012

Asda has new owners.

The Issa brothers, two entrepreneurs from Blackburn who made billion-pound fortunes running petrol stations, have completed the deal to buy Britain's third-largest supermarket chain.

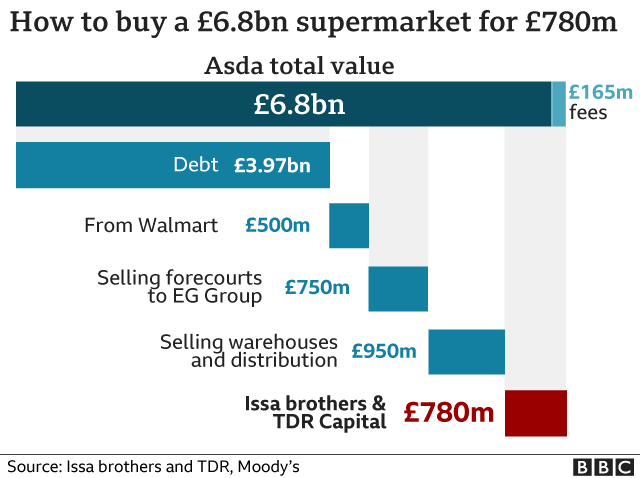

Asda was valued at £6.8bn, but the brothers and the investment firm TDR Capital paid just £780m.

The rest of the money was borrowed. So how does this kind of deal work? And will it leave Asda with too much debt?

How does the deal work?

This kind of deal is called a leveraged buyout - which means that it involves large amounts of debt.

TDR Capital specialises in this kind of deal. It is also co-owner of EG Group, the worldwide petrol station business which built the brothers' fortune, and which also has large borrowings.

The Issas and TDR each contribute half of the £780m in cash to Asda's former owners, Wal-Mart, which has owned Asda since 1999.

Most of the purchase price - just under £4bn - will be borrowed.

Walmart, the American supermarket which owned Asda for the past 21 years, will retain a small stake in Asda, for £500m, along with a seat on Asda's board.

Then the new owners will sell off parts of Asda to raise the rest of the purchase price.

Asda will sell its warehouses and distribution system for £950m. It will still use them, but in future, it will have to pay rent to their new owners.

And Asda's 323 petrol stations will be sold for £750m to EG Group, adding to the portfolio of more than 6,000 around the world.

The deal is still awaiting approval from the Competition and Markets Authority, which is expected by the summer.

How can you buy a business with such a small percentage of the purchase price?

Buying a £6.8bn business for less than £800m has certainly raised eyebrows, but it is not unusual for buyers to put up only a small fraction of the purchase price in such big deals.

"10% looks low, compared to the average for leveraged buyouts as a whole of around 50%," says Roberto Pozzi, senior vice-president at Moody's, an agency which analyses the riskiness of company's borrowings.

"Keep in mind that it depends also on the stability of the business, and there is no more stable business than supermarkets," he adds.

Firms such as TDR Capital, known as private equity firms, have backed nearly 5,000 buyout deals over the past decade, worth a total of £350bn, according to research firm Preqin - although the Asda buyout is the largest in more than a decade.

How much does Asda owe?

With big debts come fears that paying interest on the debt will suck money away from investing in the business or paying staff.

But interest rates are currently extremely low, which will made Asda's debt burden affordable.

On the £3.7bn of Asda's debt which is being raised on public markets, the interest bill will be just £125m a year, according to Azhar Hussain, head of global credit at the Royal London Asset Management. Leasing back the warehouses will cost about £57m a year.

So the £500m or so of cash which Asda makes each year will easily cover the interest costs incurred in the buyout, leaving plenty spare to pay down the debts and reduce Asda's borrowings even further.

The debt burden will be higher than supermarket rivals Tesco and Morrisons, but it's expected to fall over time as new owners pay the debts off.

Asda's new owners - Mohsin (left) and Zuber Issa in Blackburn last year

Will customers notice?

Paying back borrowers will be less of an issue than competition from other supermarkets.

Asda may still find itself needing to cut costs, but not necessarily to pay back debts. "Every grocer is cutting costs anyway, because of competition," says Mr Pozzi.

"Now their plan is to become more efficient and put in place a lower cost structure, because that's what everybody is doing."

The Issa brothers are new to the hyper-competitive world of UK supermarkets and they will have to learn fast, at the same time as running a vast forecourt empire.

"It won't be easy and they will probably have to work harder to stand still," says Mr Pozzi.

As the third-largest supermarket in the UK, Asda has seen its market share fall as discounters Aldi and Lidl have grown.

Asda is behind in the fast-growing and profitable convenience store business, where Sainsbury's Local and Tesco Express have grown rapidly.

The new relationship with EG Group gives it a chance to open convenience stores in petrol stations.

How much difference will customers notice?

What else does private ownership mean?

Buyout deals can be extremely profitable for the new owners. Just suppose they pay 10% of the purchase price in cash. If they increase the value by 10%, all that increase in value goes to them, so they've doubled their money.

Big buyouts are often controversial. The GMB union, which represents Asda workers, said Asda was "a profitable company that does not need to be loaded with debt" and labelled the sale of the warehouses "asset-stripping".

There are stories of businesses where private equity buyouts have led to underinvestment and subsequent collapse. Debenhams is often cited as an example. But most of the thousands of private equity buyouts do not end that way.

Businesses with big debts pay much less tax on their profits. They can deduct the interest payments from their profits before calculating how much tax to pay, which reduces their corporation tax bill.

So that's a lower contribution to the costs of schools, hospitals and everything else taxes pay for.

Companies owned by private investors are not listed on the stock exchange, meaning private investors can't participate in its future success by buying shares.

However, many pension funds will still invest in the new Asda, either by lending their share of that £4bn of debt or investing in TDR Capital.