Budget 2021: The most important Budget for business in a generation

- Published

There has arguably never been a moment in living memory where business and government need each other more than now. Clinging together like the passengers in the front car of a rollercoaster - this Budget is the moment the photo is snapped after the sickening plunge, grimaces fixed for the ride ahead.

Business needs the government to go on another massive spending splurge to get us to the other side of lockdown.

In many ways, the "roadmap" out of lockdown already told us the most important stuff that will be in the Budget. Furlough, the business rates holiday, additional grants and VAT deferrals and cuts for hospitality are all pretty much guaranteed to the end of June, when the government hopes firms will be able to operate with few restrictions.

After that, the roles start to reverse.

Westminster will need help from businesses to preserve and create millions of jobs. Companies will need incentives to invest, build, hire and train - particularly younger workers who have suffered the most and on whose economic future the success of this moment may be judged for decades.

Governments can encourage, but ultimately it is businesses which create.

Increased capital allowances, the expansion of youth training programmes and subsidies like the Kickstart Scheme are all expected in a speech behind which the mantra "jobs, jobs, jobs" will be almost audible from the Treasury building.

The tight embrace between government and business seems a long way since the concerns of business were swatted away with a four-letter "swish" by a prime minister who saw them as an irritant in the project of getting Brexit done.

The UK is in more debt than it's been in for more than 50 years. At over £2 trillion, it is equivalent to 100% of its entire annual income for the first time since the early 1960s, when debt was still on a downward trajectory from spending on World War Two.

By far the most powerful weapon against debt is growth: it has a doubly positive effect. It increases the denominator (the bottom number) of the debt to GDP ratio, while reducing the numerator (the top bit) by keeping the bill for benefits like Universal Credit lower.

That is why the next twist on this rollercoaster ride is the most perilous. No-one really knows how many of the almost five million workers still on furlough have a job to go back to. More than anything, this Budget is about how many of them can return to, or find new, work.

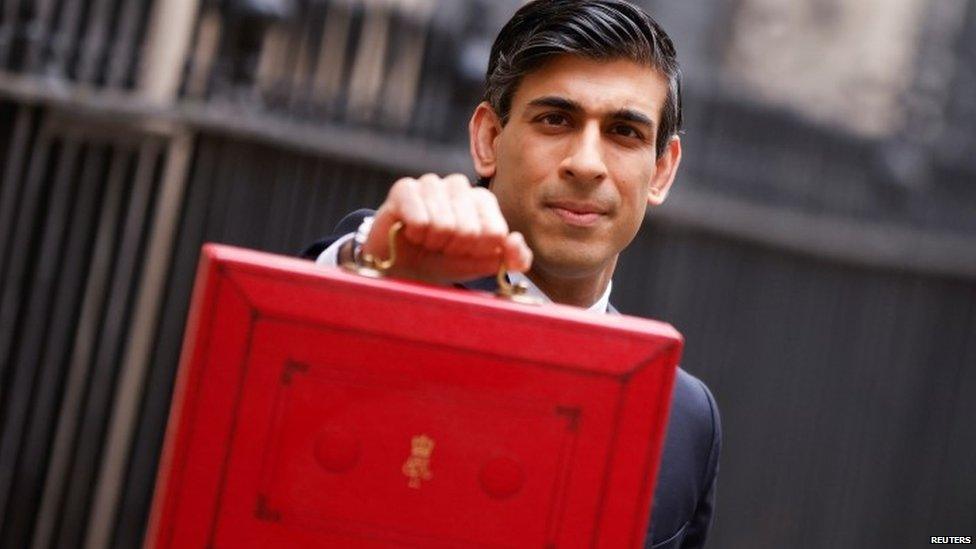

What factors could shape Rishi Sunak's thinking in his 2021 Budget?

There will be some eye-catching whizzes and bangs as the government experiments with ideas like freeports, drums up extra funding for start-ups and proposes looser stock market listing rules to grow new firms and attract international investors.

But sooner or later - and I suspect the emphasis will be later than recent headlines suggest - the government will need businesses help to pay off some the UK's enormous debts.

Corporation tax will rise slowly. But this is perhaps a good example of how little politics figures in this Budget. The chancellor arguably has more to fear from his own backbenches than he does from a Labour party, who find themselves in the unusual position of siding with the very MPs in their opposition on tax rises on businesses - who already enjoy the lowest rates in the G8.

But corporation tax is pretty small beer anyway. It contributes less than 8% of all tax collected by the government, compared with the 45% it receives from income tax and National Insurance from individuals who have - you guessed it - jobs, jobs, jobs.

The government is also scared that the "free money" window may be closing. Ever since the financial crisis, governments have been able to borrow at close to zero rates of interest.

There are signs that is changing. A 1% rise in borrowing costs will cost the government five times more than it will get by raising the corporation tax rate by 1%.

That is why the government and businesses will need to hold each others' hands on a ride they really are in together.

Related topics

- Published28 February 2021

- Published1 March 2021

- Published26 October 2021