Liberty Steel boss Sanjeev Gupta warns over loss-making plants

- Published

Sanjeev Gupta

The boss of the UK's third-largest steelmaker has said the collapse of its main financial backer "creates a challenging situation".

Sanjeev Gupta said some of Liberty Steel's UK operations were loss-making and this needed to be addressed.

He was speaking at crisis talks with unions concerned for Liberty's future after specialist bank Greensill Capital went into administration.

The collapse puts 5,000 jobs at risk at Liberty Steel and other firms.

Mr Gupta said his group was taking "prudent steps" to manage cash and was seeking new funding.

Greensill Capital was the main lender to Mr Gupta's sprawling empire, GFG Alliance, which includes Liberty Steel.

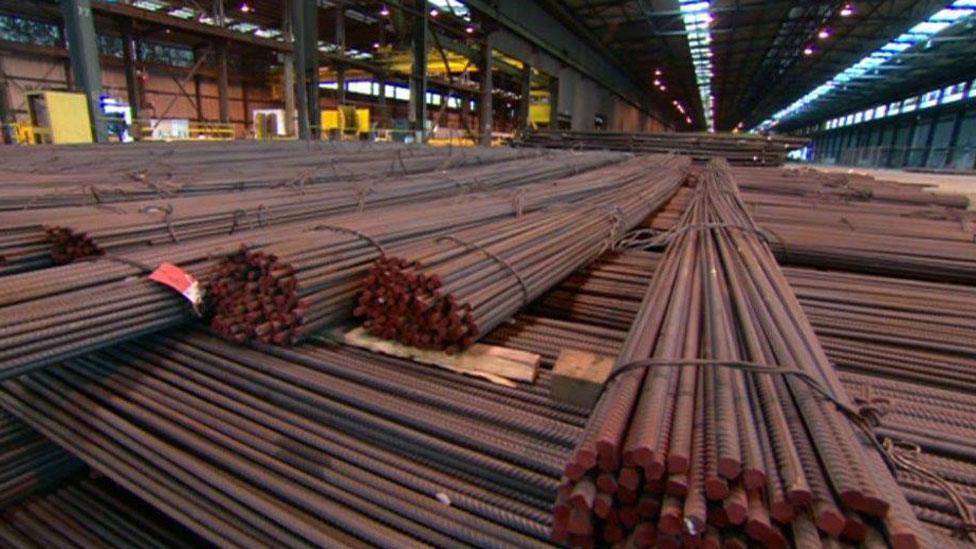

Liberty owns 12 steel plants in the UK including in Rotherham, Motherwell, Stocksbridge, Newport and Hartlepool.

In a joint statement issued after the talks, the Community, Unite and GMB unions described the meeting as "positive and constructive".

"We recognise Mr Gupta's desire to see Liberty Steel succeed and recognise also his personal contribution in giving distressed UK steel assets a new lease of life," they added.

They described the company as "a strategic business for the UK" and called on the government to take "an active role" in safeguarding its future and protecting jobs.

It's the birthplace of modern steelmaking, but the UK now barely makes it into the global top 30 of producers. For every tonne produced in Britain, China turns out 100, at a far lower cost. The economics is against us

So why does an industry that makes up just 0.1% of the economy garner so much government attention, particularly when other sectors such as retail are also in crisis?

First, steelmaking provides highly skilled manufacturing roles, sometimes in areas where they are otherwise in short supply, commanding a wage more than 25% above the national average. And it doesn't stop with the steel plant. For every one person directly employed (there are more than 30,000 in total), the industry supports two more livelihoods across the supply chain, plus more jobs in the local economy.

Crucially, though, steel is seen as a strategic industry. It's integral to our national security and well-being, used in aircraft carriers, railways and hospitals. So relying heavily on others such as China to provide runs the risk of supply disruption, particularly if relations sour.

Steel remains the second most widely used man-made material. Successive governments have struggled to keep the industry afloat - but the focus is about far more than nostalgia.

After administrators were appointed on Monday, Greensill said in a court filing that Mr Gupta's operations were in "financial difficulty" and defaulting on debt.

But in his address to union representatives on Tuesday, Mr Gupta said: "We have adequate funding for our current needs while we bridge the gap to refinancing the business."

Mr Gupta said GFG Alliance as a whole was "operationally strong" and benefiting from a 13-year high in steel prices.

But he added: "There are some exceptions and I'm sorry to say that includes some of our UK steel businesses."

He said demand for some products had fallen as much as 60% during the pandemic following "the severe downturn in the aerospace sector due to Covid-19".

Putting staff on furlough and tightening cost controls were among the measures being taken, he said.

It was impossible to ignore the rather ominous warning in Sanjeev Gupta's letter to staff this morning.

While he insisted the wider GFG group had adequate funding for its current needs and was benefiting from the highest steel prices in more than a decade, some of its UK businesses faced particular challenges.

High energy costs and plunging demand from a Covid-stricken aerospace sector meant its speciality steel business was under pressure. That will be heard loud and clear in Stocksbridge and Rotherham, where this business is concentrated.

The Community, Unite and GMB unions met with Mr Gupta via Zoom this morning and described the meeting as positive and constructive.

Mr Gupta has been something of a hero in recent years, rescuing plants and jobs that few thought could succeed. They are not about to go after him now.

But what the unions were keen to emphasise was not just the jobs, but the strategic importance of these domestic steel works to sensitive industries such as aerospace and defence. Mr Gupta has also been an evangelist for lower-carbon steel production.

The message to government was clear: give this company, this man, these workers all the help you can.

Mr Gupta said securing alternative long-term funding was "progressing well", but would take "some time" to organise.

"We had been preparing to refinance the business to diversify away from Greensill and broaden our capital base," he added.

Mr Gupta said he was working on securing working capital facilities to support Liberty and "bridge the funding gap" while refinancing took place.

He also outlined longer-term measures to address the loss-making parts of the business, including possible partnership opportunities.

The Community union has said the future of Liberty's strategic steel assets "must be secured" and that it is ready to work with "all stakeholders to find a solution".

Related topics

- Published9 March 2021

- Published8 March 2021