'Thrill of investing' leads young to take risks

- Published

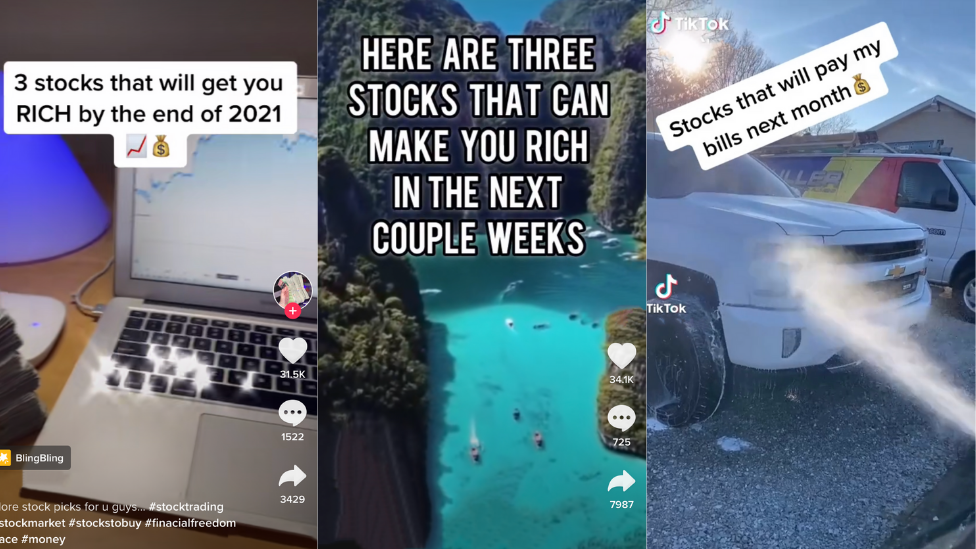

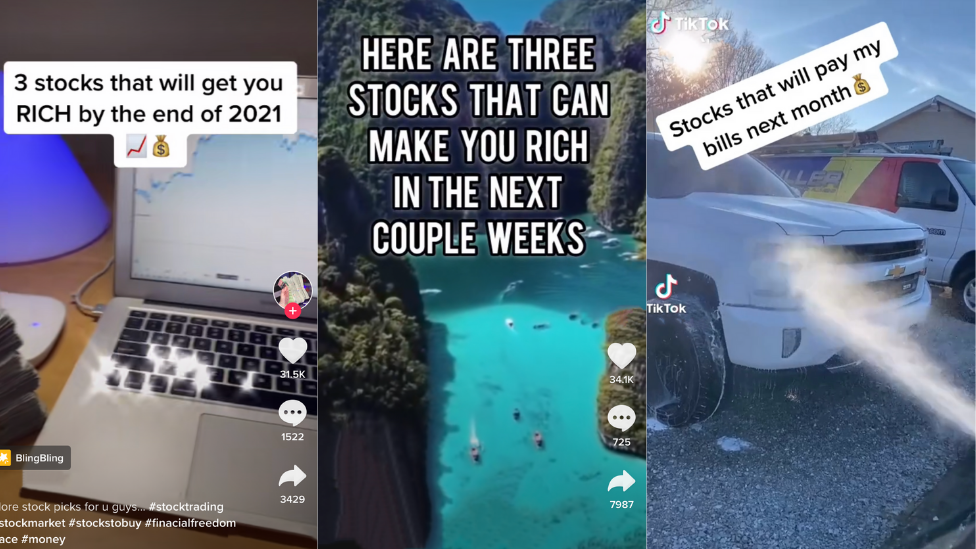

Young people are investing in high-risk products for the "challenge, competition and novelty" it involves, the City regulator has said.

The Financial Conduct Authority (FCA) warned they were getting involved in cryptocurrencies and foreign exchange, but could be taking on big risks.

It said they were often more likely to be women, aged under 40 and from a diverse ethnic background.

They were attracted by the "thrill", rather than saving for the future.

The FCA commissioned research looking into "self-directed" investors - those who trade themselves rather than seeking financial advice.

The study found many investors were willing to "have a go", had been tempted by using investment apps, and went with options because they had been "hyped" and assumed big name brands were "safe".

Questions to ask

The FCA has launched a campaign to prevent investment harm, using online advertising, advising people to ask:

Am I comfortable with the level of risk?

Do I fully understand the investment being offered to me?

Am I protected if things go wrong?

Are my investments regulated?

Should I get financial advice?

Sheldon Mills, executive director, consumer and competition at the FCA, said: "Much of the consumer investments market meets consumers' needs.

"But we are worried that some investors are being tempted, often through online adverts or high-pressure sales tactics, into buying higher-risk products that are very unlikely to be suitable for them.

"This research has helped us better understand what drives and motivates consumers so we can tell them about the risks involved in these investments through our investment harm campaign.

"We want to make sure that we encourage the ability to save and invest for lifetime events, particularly for younger generations, but it is imperative that consumers do so with savings and investment products that have a suitable level of risk for their needs.

"Investors need to be mindful of their overall risk appetite, diversifying their investments and only investing money they can afford to lose in high risk products."

Becky O'Connor, from investment platform Interactive Investor, said: "We want young people to invest - in their pensions and for their families' futures. But we want them to think long and hard about it, do their research and take the time and effort to understand things like risk from different types of asset classes.

"Most young people don't have money to burn - so potentially throwing it away on high risk investments is a big waste when there are so many life challenges down the road for them that they might need that cash for."

Related topics

- Published9 February 2021

- Published7 February 2021

- Published1 February 2021