Crypto firm Coinbase valued at more than oil giant BP

- Published

Coinbase staff in New York ahead of the crypto firm's listing on the Nasdaq

Cryptocurrency firm Coinbase, which runs a top exchange for Bitcoin and other digital currency trading, hit a market value of nearly $100bn (£72.5bn) in its stock market listing.

Shares debuted on the Nasdaq at a price of $381, but later closed below $330.

The initial valuation put Coinbase ahead of many well-known firms, such as oil giant BP and key stock exchanges.

The listing was seen as the latest step toward cryptocurrencies gaining wider acceptance among traditional investors.

The price of Bitcoin surged more than 300% last year - and has climbed even higher in 2021 - as firms including Tesla, Mastercard and BlackRock unveiled plans to incorporate digital currencies into their businesses.

It hit a record of more than $63,000 on Tuesday, ahead of the Coinbase listing.

Less well-known digital currencies have also made gains with Dogecoin, which was created as a joke, rising more than 70% to more than 13 cents.

US-based Coinbase, which makes money primarily by charging transaction fees, has benefited from the soaring demand.

'Barometer' for crypto

Founded in 2012, Coinbase had more than 56 million users across more than 100 countries and held some $223bn in users' assets at the end of March.

It reported $1.8bn in estimated revenue in the first three months of 2021 - more than its total for all of 2020 - as interest in Bitcoin and other digital currencies boomed.

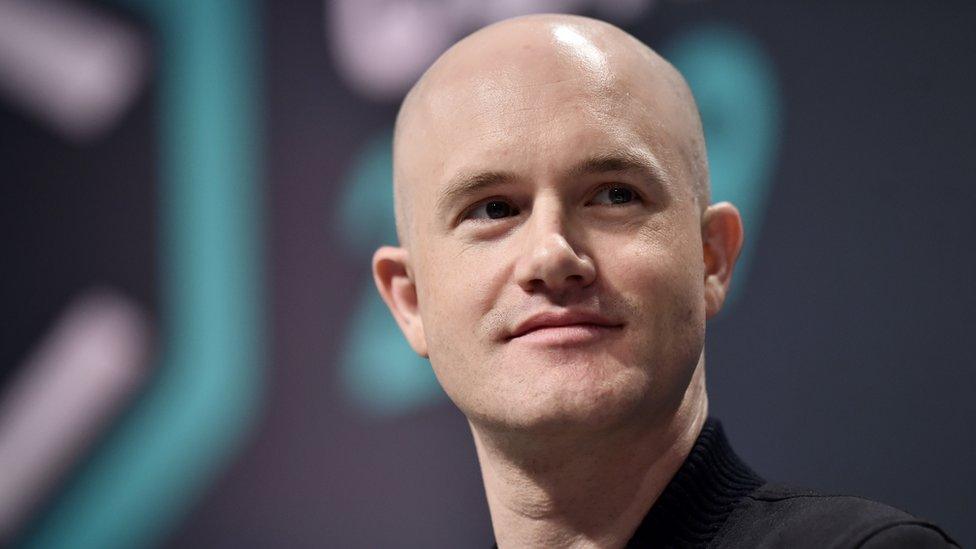

The listing has made Coinbase co-founder Brian Armstrong one of the wealthiest people in the world

Compared to 2018, when investors reckoned Coinbase was worth $8bn in a private funding round, the firm's value has increased more than ten-fold.

Wednesday's listing was set to make Coinbase co-founder and chief executive Brian Armstrong one of the wealthiest people in the world. The 38-year-old, a former Airbnb software engineer, owns a roughly 21% stake in the company.

For outside investors, buying shares in Coinbase is seen as a potentially less risky way to tap into the activity in the crypto market, without investing directly in Bitcoin or other digital currencies, which have attracted warnings from financial regulators.

But Jane Foley, senior currency strategist at Rabobank said tougher rules, if enacted, could change the outlook for Coinbase.

"There does appear to be a little bit of a slow march towards acceptability," she said.

"There's a lot of concern that at some point the regulators, the central banks, might just say, 'well, no,' and make this a lot more difficult and at that point many people could stand to lose a lot of money."

Last year, Coinbase's revenues hit $1.3bn, more than double that of 2019. Profits were $322m, compared to a loss of more than $30m in 2019.

On Wednesday, the company's share price initially jumped, hitting a high of nearly $430 at one point. But it later dropped back, hitting a low of $118 before ending the trading session at roughly $328.

That would give the firm a valuation of about $86bn.

Crypto credibility?

This is a bit of a moment for crypto currency.

Digital currencies have long been seen as a high risk bet for investors - a 'you only live once' investment.

Over the years though, crypto has slowly gained some credibility - and has delivered astonishing returns for some investors. Several major companies have said they want to introduce crypto as a form of payment.

But this is perhaps an even greater step on the road to crypto credibility.

The attraction for investors is that it feels like a safer way to invest in crypto itself.

Coinbase's market price will be linked to how well currencies like Bitcoin and Ethereum are doing.

But the fact that the firm has such an range of currencies you can buy and sell means investors may feel they are more insulated from wild changes in the price of a single currency.

The big worry for investors taking a punt on crypto is that authorities will move to limit or even shut them down.

Mining some digital currencies can be hugely environmentally damaging, and the currencies themselves have been linked to organised crime.

Coinbase, then, may be seen as a more acceptable place for funds to take a punt on digital currencies.

Executives said the firm's performance would vary amid the swings in notoriously volatile digital currencies, but over the long term it was poised for growth.

"There's going to be volatility with new technologies and the companies associated with them. That's ok. That's a feature, not a bug," Coinbase president Emily Choi told the BBC.

"If you believe in the long term idea about digital value and what crypto assets create, you're just going to play this as a long-term thing."

Coinbase's market debut comes at a time when investors have shown high demand for newly listed companies, sending their valuations soaring at trading launches.

The firm listed its shares with a sale of existing stock, rather than issuing new equity as would occur in a more typical initial public offering.

Related topics

- Published14 March 2021

- Published9 February 2021

- Published10 February 2021