Labour: Save Liberty Steel before it goes bust

- Published

- comments

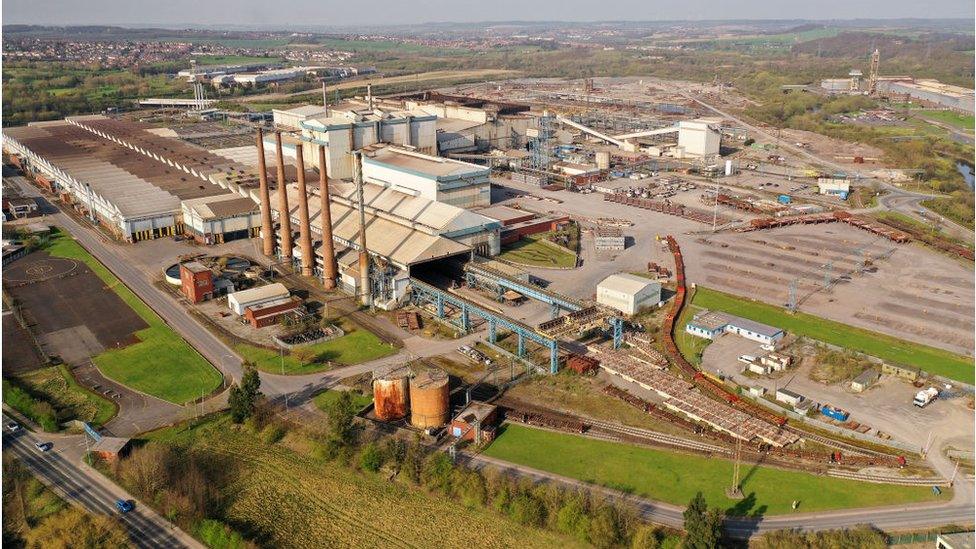

The government should step in to save Liberty Steel before, not after, it collapses to save thousands of supply chain jobs and millions of pounds, the Labour Party has said.

Liberty Steel and its parent firm GFG Alliance have been in distress since its main financial backer Greensill Capital went bust in early March.

The government has pledged to preserve Liberty Steel in some form.

It said it was "closely monitoring developments" around the firm.

Labour drew parallels between Liberty Steel and British Steel, which collapsed before being bought by Chinese firm Jingye.

The government's decision to wait until British Steel was insolvent cost the company's supply chain £500m in unpaid bills, Labour said.

"Labour is calling on ministers to intervene early before liquidation to save workers jobs, terms and conditions, and give customers and suppliers confidence that orders will be fulfilled, bills paid, and domestic steelmaking capacity will be safeguarded," said shadow minister for business and consumers Lucy Powell.

British Steel was run on government life support by the Official Receiver for five months at an additional cost of £500m to the taxpayer before being sold to Jingye for £50m.

The government said that its intervention enabled British Steel to continue to trade, customers to receive orders, and key suppliers to maintain their services, safeguarding more than 3,000 jobs in Yorkshire and the Humber and the North East.

Regarding Liberty Steel, the government said it "continues to engage closely with the company, the broader UK steel industry and trade unions".

This is not a straightforward situation. Greensill's spectacular and rapid disintegration, despite the controversial efforts of former Prime Minister David Cameron to lobby on its behalf, have left a complicated Greensill carcass for administrators to pick through.

The government is not keen on being seen supporting Liberty Steel tycoon Sanjeev Gupta

Invoices issued by Liberty and GFG, which were bought by Greensill for a discount and then sold on to investors, have left many of them billions out of pocket.

Swiss bank Credit Suisse, whose customers indirectly bought the invoices, have issued claims for billions against companies in the GFG group for repayment.

The question for Labour may be, if you rescue Liberty before it goes bust - are you suggesting the taxpayer should pay off those debts?

The government is also keen not to be seen supporting steel tycoon Sanjeev Gupta, who was once known as the saviour of steel thanks to his rescue of many loss making steel plants across the UK. Mr Gupta bought a £42m house in London before asking the UK government for a £170m taxpayer bailout.

The lobbying efforts of Mr Cameron and the access of his banker boss Lex Greensill to Number 10, government departments and the senior ranks of the civil service has provoked widespread outrage and charges of cronyism.

That will not be uppermost in the minds of 5,000 workers at Liberty and other GFG companies who face a nail-biting wait to see if Mr Gupta can find another financier to replace Greensill - or see the company fall into some form of public ownership.

The government has pledged to preserve the company in some form. For the Labour Party, sooner is better to avoid the collateral damage of an insolvency - but this is a very tangled and potentially expensive web to untangle.

- Published13 April 2021

- Published30 March 2021