AT&T and Discovery to create new streaming giant

- Published

- comments

US telecoms giant AT&T has agreed to combine its WarnerMedia business with Discovery in a deal to create a new streaming giant.

The tie-up brings one of Hollywood's biggest studios and Discovery's channels under the same ownership.

AT&T owns CNN, HBO and Warner Bros, after acquiring many brands in a $108.7bn (£77.1bn) purchase of Time Warner in 2018.

The deal also marks the entry of another player into a crowded market.

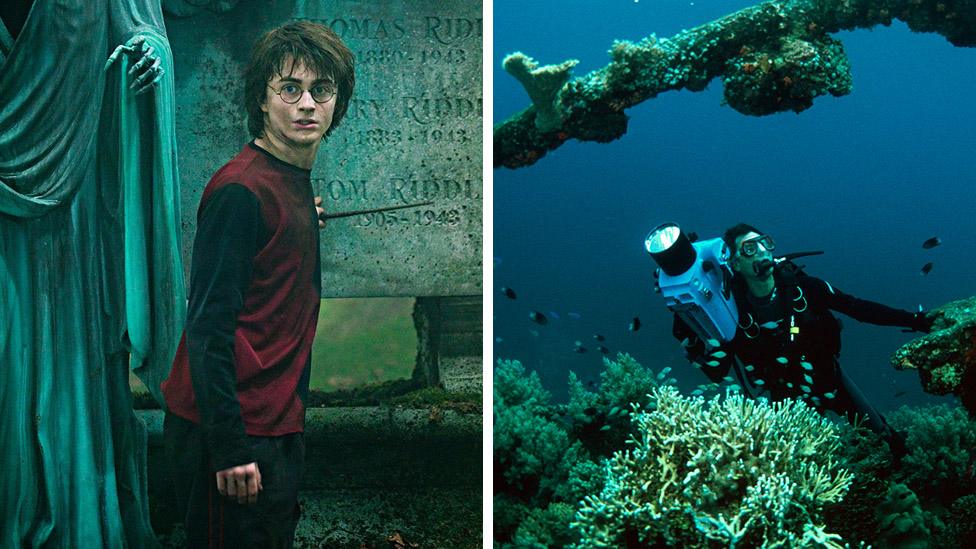

The proposed merger , externalwould put together movie giant Warner Bros. Entertainment, which owns the Harry Potter and Batman franchises, with Discovery's home, cooking, nature and science shows.

"This agreement unites two entertainment leaders with complementary content strengths and positions the new company to be one of the leading global direct-to-consumer streaming platforms," said AT&T chief executive John Stankey.

"It will support the fantastic growth and international launch of HBO Max with Discovery's global footprint and create efficiencies which can be re-invested in producing more great content to give consumers what they want."

'Streaming arms race'

WarnerMedia-owned HBO and HBO Max now have around 64 million subscribers worldwide, with hits such as Game of Thrones and Succession under its belt.

But it is currently dwarfed by larger rivals Netflix, which has 208 million subscribers, and Disney+, which has more than 100 million.

Discovery, whose portfolio includes Animal Planet and the Discovery Channel, reaches more than 88 million US homes, while its Discovery+ streaming service, which launched in January, has 15m subscribers.

Discovery's president and chief executive David Zaslav is set to lead the joint company, according to AT&T.

"This is a streaming arms race and AT&T is making an offensive strategic move to further bulk up its content in the battle versus Netflix, Disney, and Amazon," Dan Ives from Wedbush Securities told the BBC.

"The Time Warner acquisition and the golden jewel HBO asset was the first step with Discovery - a doubling down on this streaming endeavour," he added.

Under the terms of the deal, AT&T will receive $43bn and its shareholders will own 71% of the new company, while Discovery shareholders will hold 29%.

However, before the deal was confirmed, David Cummings, chief investment officer at Aviva, told the BBC that shareholders may be uneasy.

He agreed that AT&T, in the face of huge streaming competition, needed to increase its amount of content, but added: "The market might feel this deal is a bit too late; I expect the market might be a little sceptical."

WATCH: The BBC speaks exclusively to the author who wrote the books that inspired the Netflix series Bridgerton.

When AT&T took over Time Warner three years ago it planned to create a media and telecoms giant that combined content and distribution.

However, that proved to be a highly costly approach as the company was also expanding its next generation wireless services at the same time.

AT&T recently added $14bn to its debt pile to fund the purchase of wireless spectrum.

The Discovery deal is the latest move in the company's steps to reduce those debts.

It is subject to approval by regulators, but the companies said they expect the deal will close in the middle of next year.

Some analysts said, however, that they could see "several other potential suitors entering the fray" for Discovery or perhaps proposing other mergers.

In February, AT&T also agreed to sell a major stake in satellite television service DirecTV, in deal that valued the business at less than a quarter of its purchase price in 2015.

The US firm is the world's largest telecoms company in the world by revenues. It was established in 1877 by Alexander Graham Bell, who obtained the first US patent for the telephone.

Related topics

- Published21 April 2021

- Published29 March 2021

- Published23 March 2021