US business groups team up to oppose tax rise proposals

- Published

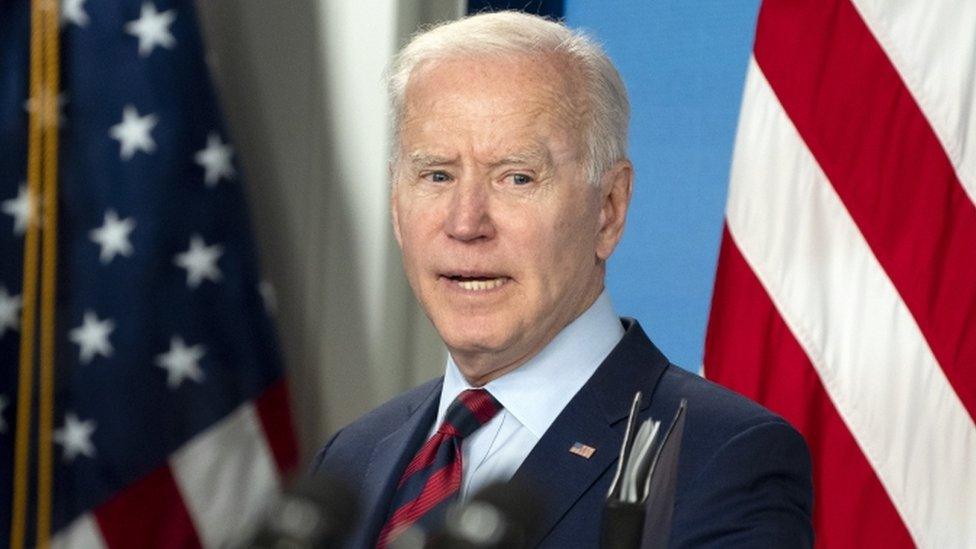

President Biden's administration has proposed funding infrastructure spending largely through tax increases

US business groups have teamed up to form a coalition opposing tax increase proposals by the Biden administration.

The US government is proposing a global minimum corporation tax rate, as well as increasing the tax in the US to pay for infrastructure projects.

Twenty eight industry groups have now created an alliance called "America's Job Creators for a Strong Recovery".

One organiser for the new group said the tax proposals "could not come at a worse time".

The alliance has been formed as President Biden is seeking to pass a $2.3tn (£1.7tn) infrastructure package, which would direct billions to initiatives such as charging stations for electric vehicles and eliminating lead water pipes.

The White House has promoted its plans as the most ambitious public spending in decades, saying the investments are necessary to keep the US economy growing and competitive with other countries, especially China.

Stalling recovery?

But Eric Hoplin, president and chief executive of the National Association of Wholesaler-Distributors, which is leading the coalition, warned: "The record tax hikes that Democrats are seeking to ram through could not come at a worse time for America's job creators who are just beginning to recover from a crippling pandemic.

"Employers support smart infrastructure to ensure America's 21st century competitiveness, but it shouldn't be used as a Trojan horse to enact record high taxes on America's individually and family-owned businesses."

Other business groups signed up to the coalition include the American Hotel and Lodging Association, American Rental Association, Auto Care Association, National Grocers Association and the Wine and Spirits Wholesalers of America.

Chris Smith, executive director of Main Street Employers Coalition, added: "The pandemic has taxed individually and family owned businesses enough - taxing them again while they are still struggling to recover just goes too far."

A spokesman for the group acknowledged that the infrastructure bill does have strong support, but said that "it quickly becomes unpopular when you talk about taxes on job creators".

The coalition of lobby groups also expects to add more members in the coming weeks and will conduct research on messaging around the President's proposals.

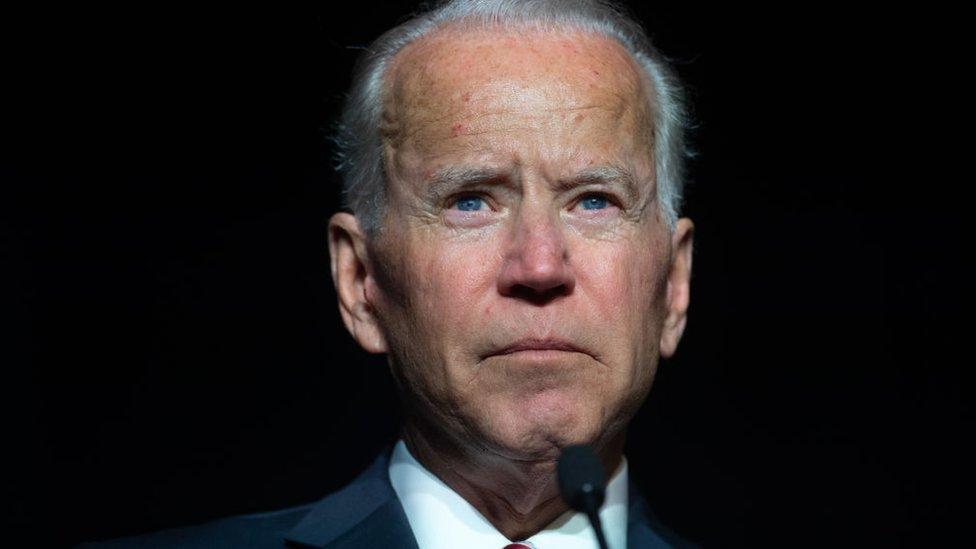

Treasury Secretary Janet Yellen's speech on taxes to the US Chamber of Commerce was met with a mixed response

Treasury Secretary Janet Yellen was met with a mixed response earlier in May after delivering a speech to the US Chamber of Commerce to pitch higher taxes to fund infrastructure spending.

Ms Yellen told business leaders that corporation taxes in the US were at a "historic low". The proposed hike would see them increased from 21% to 28%.

She said: "We believe the corporate sector can contribute to this effort by bearing its fair share: We propose simply to return the corporate tax toward historical norms."

After the infrastructure package was unveiled in late March, the Chamber slammed the plan as "dangerously misguided".

"Properly done, a major investment in infrastructure today is an investment in the future, and like a new home, should be paid for over time - say 30 years - by the users who benefit from the investment," the group said in a statement at the time.

Other business leaders, such as Amazon's Jeff Bezos, have said that they support the increase, having previously been criticised over the level of tax they pay in the United States.

Countries such as France, Germany, Japan and Italy have also welcomed proposals to introduce a minimum corporation tax floor globally of "at least" 15%.

UK Chancellor Rishi Sunak has yet to comment publicly on the proposals, but announced at the March Budget that the UK's corporation tax rate would increase to 25% by 2023.

Related topics

- Published19 April 2021

- Published8 April 2021