'I've been ghosted by my insurer'

- Published

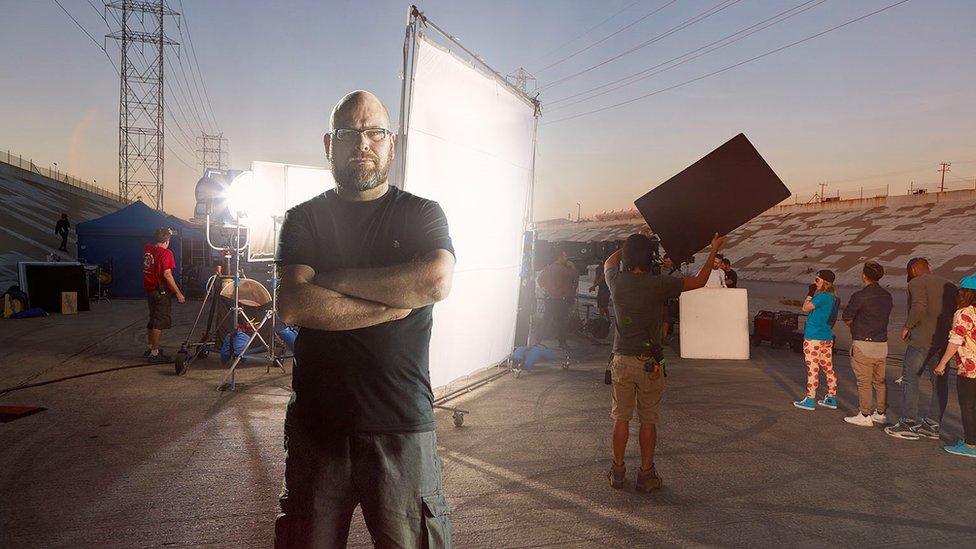

Martin Brent feels he's been left in the dark over his Covid insurance claim

Martin Brent's commercial photography business ground to a halt when the pandemic hit last year.

"I literally had no work for months on end," he told BBC 5 Live's Wake up to Money. "Our income was reduced to zero."

More than a year later, he's one of thousands waiting to hear about his business interruption insurance claim.

That's despite a Supreme Court ruling in January that insurers should recognise many claims.

"The court case seemed to be clear - then we got to the stage of hearing nothing from Hiscox," said Mr Brent from Bromsgrove. "Eventually we were given a link to a portal to go through the eligibility check. From that point I've heard nothing.

"In internet terms I feel like we've been blanked, or ghosted, by Hiscox [the insurance firm]. It's just a ridiculous situation."

"I've emailed quite a few times, I just don't get a response. I just don't know where I am with this company. It's very frustrating, there just does not seem to be any way forward with them," he added.

Hiscox said that assessing claims is a complex process and it is making payments "as quickly as possible". But Wake up to Money spoke to two other Hiscox customers who say they had to turn to their MPs to get the company to take their cases seriously. One has been paid, one has not.

Business interruption policies are designed to cover financial losses if a firm cannot operate.

But as the pandemic took hold, many insurers refused to pay, arguing that only the most specialist policies had cover for such unprecedented restrictions.

The regulator, the Financial Conduct Authority (FCA), took the unusual step of launching legal proceedings against a number of insurers. It asked a judge to decide whether the losses of 370,000 businesses across the country should be covered.

The court found that some of those insurers, including Hiscox, should have paid out on some claims. However the insurers again refused and appealed to the Supreme Court, which, at the beginning of this year, also found in favour of the small businesses.

Since then the insurers involved in the case have begun paying claims, but some more promptly than others.

According to figures from the FCA, insurers paid out more than £700m in interim and final claims in the months to 5 May. About half the 36,000 policyholders who've had claims accepted have received at least an interim payment.

About 50 different insurers are involved, but Hiscox has the most claims. It has accepted 6,692 and is considering another 3,122. But it has only paid 151 claims in full. An interim payment has been made in 1,068 cases.

'Complex'

A spokesman for Hiscox said: "Business interruption claims are complex, requiring detailed financial information and often multiple conversations with the customer to ensure that we have a full understanding of their information.

"We are paying claims as quickly as possible in line with the Supreme Court judgment. In total, we expect to pay out $475m (£336m) in Covid-19 claims, including for business interruption."

But even if Mr Brent does eventually get paid, the delay is taking its toll.

"This is affecting the business now," said Mr Brent. "We're at the stage now where we would be investing in new equipment. We can't commit to any kind of expenditure.

"We've taken out a [government-guaranteed] Bounce Back Loan, which obviously is debt, and we're in kind of limbo. It's not good for us and it's not good for our suppliers. This is a whole chain of people who depend on us to spend our money with them.

"It's a big picture, it's incredibly frustrating for me as a business owner, but I think also from a societal point of view it's outrageous.

"What is the point of government trying to help businesses and prop them up if a private insurance company is reneging on its responsibilities?"

Related topics

- Published29 March 2021

- Published15 January 2021