G7 tax deal: What is it and are Amazon and Facebook included?

- Published

A group of the world's richest nations has agreed to make multinational businesses such as Amazon and Facebook pay more tax.

The plan, by the G7 (Group of Seven), also aims to stop the world's largest companies avoiding tax by moving their operations between countries.

How would the deal work?

There are two parts to the deal, which will be signed by the G7 nations (Canada, France, Germany, Italy, Japan, the UK and the US) at a summit in Cornwall this weekend.

Firstly, multinational companies - which operate in several countries - would have to pay more tax wherever they sell products or services.

At the moment, a company can earn billions in a particular country but still pay very little tax there. This is because they can choose to put their headquarters in a country with a lower tax rate and take their profits there.

For example in 2018, Facebook, which has its international HQ in Dublin, paid £28.5m in tax to the UK, although its revenue was £1.65bn.

However, under the G7 deal, companies could be taxed in any country where they make more than 10% profit on sales.

Above that point, the company would have to pay 20% tax.

The deal is "all about changing which country gets to tax the companies", says Chris Sanger, head of tax policy at accountancy firm EY.

G7 finance ministers agreed the deal on 5 June at Lancaster House, London

What other tax changes does the G7 plan?

The second part of the deal is a global minimum corporate tax rate of 15%.

The aim of this is to stop nations undercutting each other's tax rate to attract multinational companies.

Ireland has operated a policy of attracting US technology companies to set up their headquarters there, chiefly through the offer of a low corporation tax rate of 12.5% (the UK's is 19% and set to rise to 25% by 2023).

Along with Facebook, Google has its international headquarters in Dublin's Grand Canal Quay, with TripAdvisor and AirBnB nearby.

If the G7 deal goes ahead, the tax advantages which have attracted these companies would cease to exist.

Ireland has said the concerns of smaller countries must be heeded, but it is also a member of the EU, which is firmly behind the deal.

Germany's finance minister Olaf Scholz told the BBC that the likes of Ireland needed to "get on the train".

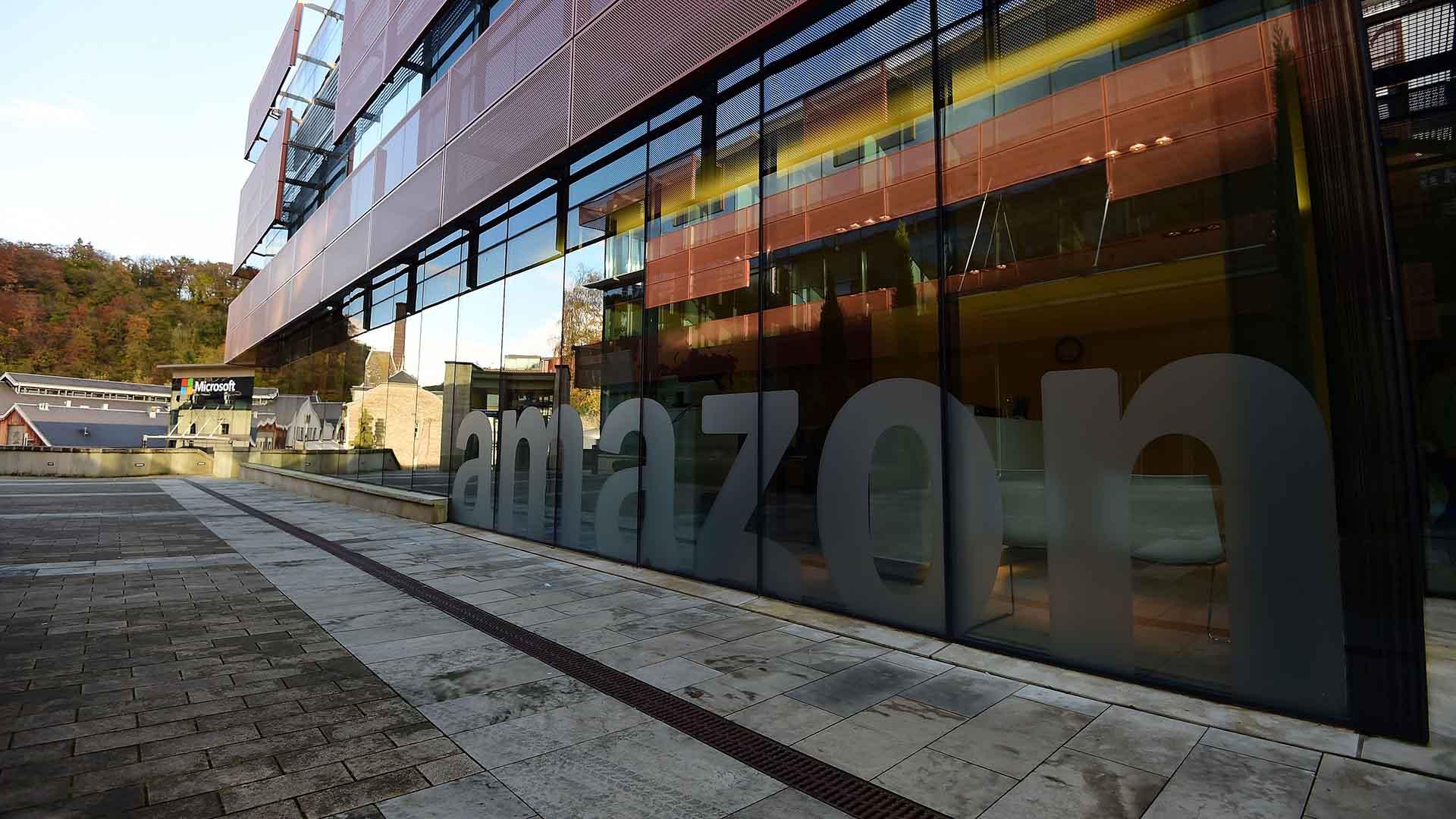

Amazon's headquarters in Luxembourg

Why is this deal needed?

The rapid rise of tech firms such as Amazon and Facebook has highlighted the problem of how to tax the world's biggest companies

Unlike, say, the steel industry, most tech companies are mobile and can easily move between countries.

At the moment, it's hard for a country acting alone to do anything about this.

If the country tries to raise corporate taxes, companies can and will move, and they are often welcomed elsewhere.

This is perfectly legal, but many governments think business has a moral duty to pay more tax - especially after an international crisis such as the pandemic.

US President Biden has made this a priority since his election.

Last month, a US Treasury statement said "a race to the bottom" on corporate taxes was "undermining the United States' and other countries' ability to raise the revenue needed to make critical investments".

The G7 deal is the first co-ordinated international attempt to deal with the issue.

If it works, then billions of dollars may flow to governments to pay off debts built up during the Covid crisis.

President Biden (centre) has made corporate tax one of his priorities

Will it work and will Amazon and Facebook be affected?

A lot of detail is still to be worked out, including which companies are going to be covered, and what tax changes countries will see.

There have been concerns Amazon may not be affected.

Although the company makes huge profits in some areas, it currently makes less than the 10% profit needed to be included in the new tax rules.

However, US Treasury Secretary Janet Yellen said Amazon and Facebook "would qualify by almost any definition".

Meanwhile, aid charities have complained that the agreed minimum rate of 15% is too low, and will not stop tax havens from operating.

Oxfam's executive director Gabriela Bucher said the deal would benefit G7 states, but not poorer nations.

What about the countries that haven't signed up?

The agreement is a major moment, but it is only a deal between the seven most advanced economies.

Other major nations, such as China and Russia, will discuss the deal at the G20 meeting in July, before 139 countries analyse it.

If the largest countries sign up, then the deal might "build momentum to get many more to follow suit", according to Mr Sanger.

However, the deal is far from done and will take years to negotiate.