People moving home drive mortgage borrowing surge

- Published

- comments

Home movers were responsible for a record proportion of mortgage borrowing in the first three months of the year as they dominated demand for property.

Some 42% of total mortgage lending went to this group - the highest level since comparable records began in 2007, the Financial Conduct Authority (FCA) said.

This was up from 27% of lending a year earlier, the regulator said.

It was in contrast to first-time buyers whose share of loans was up by just two percentage points in the same period.

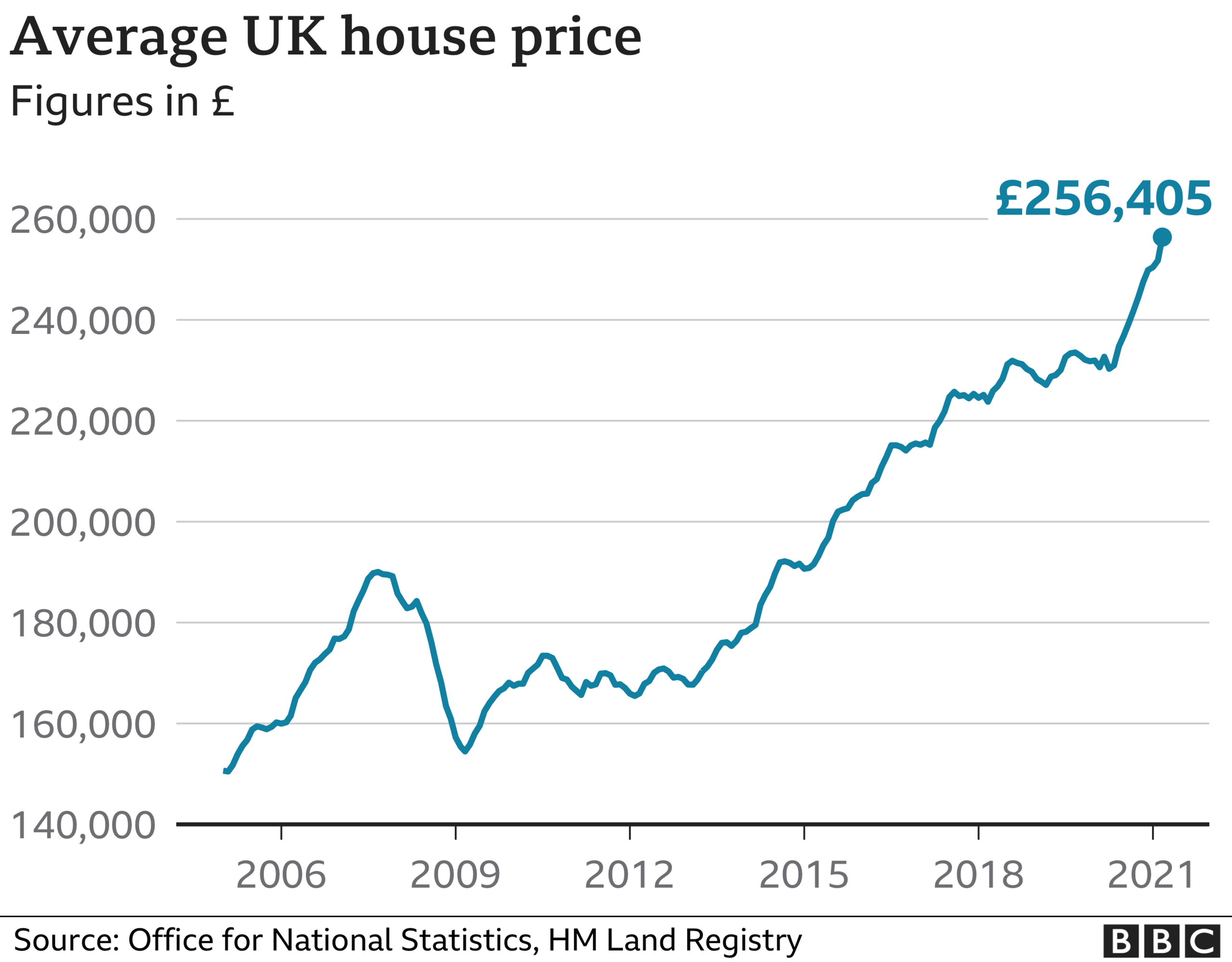

The UK housing market has been surging this year with potential buyers competing for homes.

This demand has not been matched by supply, which has led to rising prices.

Official figures show they have been increasing at their fastest rate for more than a decade despite the country being gripped by a pandemic.

Total gross mortgage lending in the first three months of the year was 26.5% higher than the same period a year ago at £83bn, figures from the FCA show.

The data, external confirms that it is home movers who were being advanced an increasing proportion of home loans, whereas the share that went to owners who were remortgaging fell sharply, down by 14 percentage points to its lowest level since 2007.

The share that went to buy-to-let property owners and first-time buyers was relatively unchanged.

Part of the reason for this trend has been home movers' race for space, seeking larger homes to live and work after reconsidering their priorities during lockdown.

Significant demand for property is expected to continue with stimulus measures such as stamp duty holidays in place.

Lenders have suggested that activity levels could remain high even after those incentives are wound down.

Related topics

- Published2 June 2021

- Published7 June 2021