Bank governor warns against overreaction to higher inflation

- Published

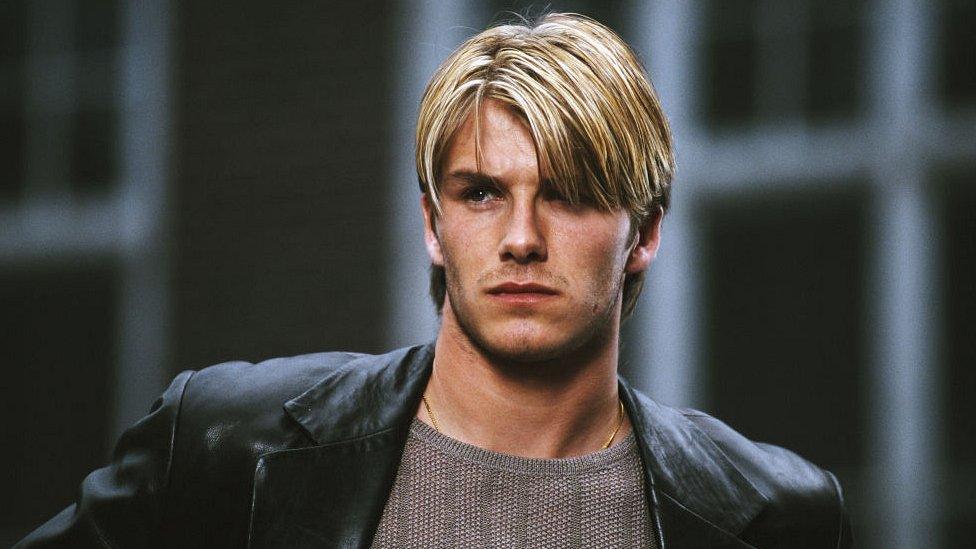

David Beckham's hairstyle from the 1990s is all the rage, according to Bank of England governor Andrew Bailey

The Bank of England governor has warned against an overreaction to rising inflation after its former chief economist said it could hit nearly 4%.

Andrew Bailey said that while inflation would continue to accelerate this year, this was likely to be temporary.

On his last day at the Bank this week, economist Andy Haldane told an audience that the UK faced "a dangerous moment".

But Mr Bailey said he felt the reasons for why the pick-up inflation was unlikely to last were "well-founded".

In a speech, Mr Bailey said the increase in the inflation rate was expected to be a "temporary feature" of the UK economy's "bounce-back" from Covid.

"It is not a vain hope or a matter of whistling in the wind," he said.

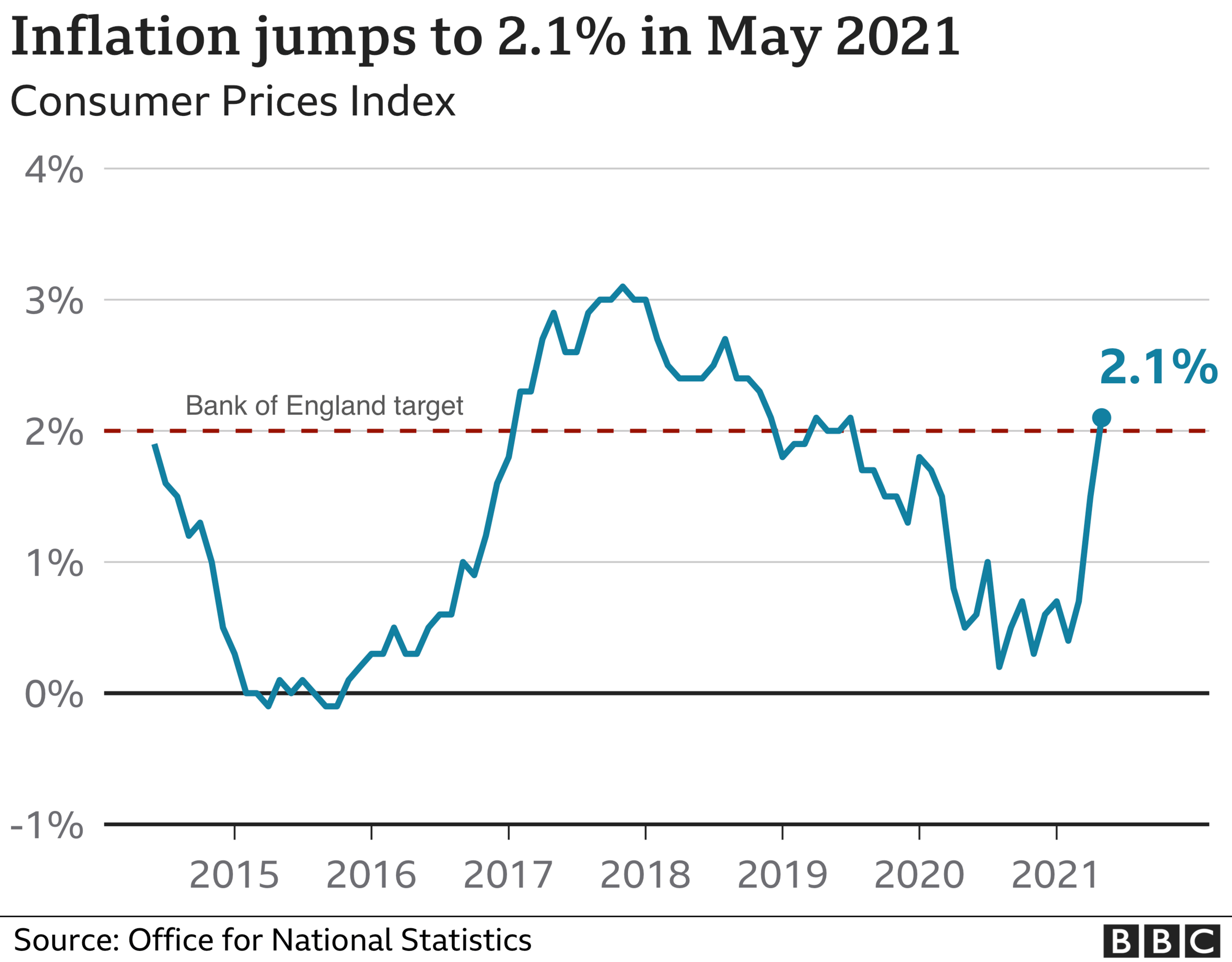

In May, the UK rate of inflation rose to 2.1% - above the Bank of England's 2% target - after lockdown measures eased and consumer spending picked up.

Mr Haldane, who left the Bank on Wednesday after 32 years, told the Institute of Government that "everyone would lose" from higher inflation.

"Overall, inflation expectations and monetary policy credibility feel more fragile at present than at any time since inflation-targeting was introduced in 1992," he said.

Mr Haldane added that he expected inflation to be closer to 4% than 3% by the end of the year, and this could mean the Bank would have to raise interest rates more quickly or higher than previously expected.

But on Thursday, Mr Bailey said: "It is important not to over-react to temporarily strong growth and inflation, to ensure that the recovery is not undermined by a premature tightening in monetary conditions."

Andrew Bailey, governor of the Bank of England

However, he added: "It is also important that we watch the outlook for inflation very carefully."

Commenting on what had sent inflation higher in May, Mr Bailey said that while there had been price increases and higher demand it was varied across different parts of the economy.

"Goods prices were strong, while consumer food prices ticked down slightly, and the pattern for services prices was very mixed," he said.

The Beckhams

He said hairdressing and personal grooming inflation "was strong in particular", due to: "Pent-up demand, essential need, or recreating the early 1990s David Beckham look, I leave that to others to judge."

But he said that while "food input prices were up, and producer input inflation was around a 10-year high", these rises were "not universal".

Helping Britain's economy? Andrew Bailey says Victoria Beckham has knocked 40% off the price of her dresses

"For balance I should note that we also learned last week that Victoria Beckham is reducing the average selling price of her dresses by almost 40%," Mr Bailey said.

He said there were a number of factors that point to the rise in the inflation rate being temporary. These include the fact that prices were much weaker a year ago during periods of lockdown, and he also pointed to imbalances in supply and demand.

Mr Bailey used lumber prices in the US as an example. Before Covid, lumber prices were around $400 (per thousand board feet), but soared to $1,700 in May as demand outstripped supply. However, the price has now drifted lower to $800 as more material comes back into the market.

Imbalances in supply and demand "should not last", he said.

Overall, Mr Bailey said the UK economy is "bouncing back rapidly" from Covid.

"The good news is that the economy is only around 5% smaller than it was 18 months ago, and in view of what we have experienced, that is good news, and the gap is closing quite rapidly," he said.

Related topics

- Published30 June 2021

- Published24 June 2021