House prices dip as stamp duty holiday ends

- Published

- comments

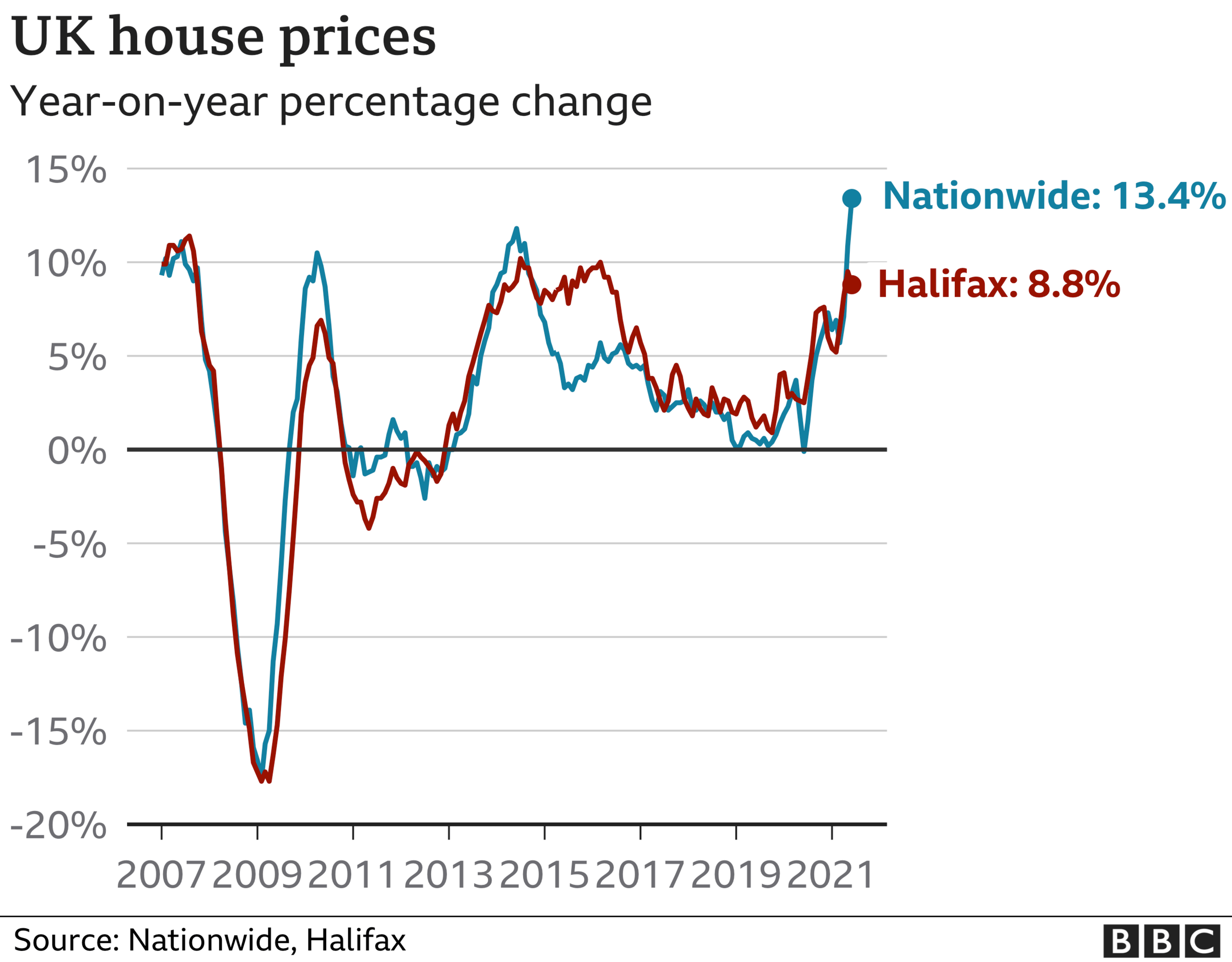

House prices dipped 0.5% in June as the stamp duty holiday began to be phased out, according to the Halifax.

Prices rose 8.8% over the year, leaving average prices still more than £21,000 higher, following a broadly unprecedented period of gains.

The lender said it was "important to put such a moderate decrease in context."

The Government removed the need to pay stamp duty on certain properties throughout much of the pandemic.

In the last year the housing market has been stimulated by stamp duty holidays in England, Wales and Northern Ireland, introduced by the government to boost the property market.

From June 2020, buyers didn't have to pay any stamp duty on the first £500,000 of their purchase price. However, at the start of this month, stamp duty breaks began to return to pre-pandemic levels.

Now a 5% tax kicks in at £250,000 for properties up to £925,000. Rates on properties above that are higher.

From October rates are due to return to normal which means the point homebuyers start paying stamp duty will revert back to £125,001.

High demand

Russell Galley, managing director of the Halifax, said: "The power of homemovers to drive the market won't fade entirely as the economy recovers,."

He pointed out that people have been spurred on by increased time spent at home during the pandemic to still look to find properties with more space.

"Coupled with buyers chasing the relatively small number of available properties, and continued low borrowing rates, it's a trend which can sustain high average prices for some time to come," he said.

The average price of a UK property according to the lender is now £260,358.

Demand remains high among buyers searching for larger family homes with the average price of a detached property climbing faster than any other type over the past 12 months.

These were up by more than 10% or almost £47,000 in cash terms.

Detached homes now cost on average more than half a million pounds, £200,000 more expensive than the typical semi-detached house.

However Mr Galley predicted that annual growth will slow more by the end of the year, with unemployment expected to edge higher as job support measures unwind, and the peak of buyer demand now likely to have passed.

Vicious cycle

"This may be the first sign house price growth is starting to run out of steam, but this slight cooling does not mean prices will come crashing back down to where they were last summer," said Lucy Pendleton of estate agents James Pendleton.

She said some buyers are holding off marketing their property because they cannot see anywhere to move to: "That creates a vicious cycle of low supply and consequently causing intense up-bidding on the most desirable properties."

North London estate agent Jeremy Leaf said despite the beginning of the end to the stamp duty holiday there was still strength in the market: "We don't expect this new balance between supply and demand to change much over the next few months, particularly if economic growth can make up for the ending of the furlough scheme."

Related topics

- Published7 June 2021

- Published2 June 2021