SFO probes Gavin Woodhouse over suspected care home fraud

- Published

Gavin Woodhouse ran six hotels that have gone into administration

The Serious Fraud Office has launched a major fraud investigation into care home entrepreneur Gavin Woodhouse.

The probe will focus on investments he offered in care homes and hotels between 2013 and 2019.

He raised more than £80m from amateur investors, promising generous returns.

The SFO said it "is investigating suspected fraud and money laundering in relation to the conduct of business by Gavin Woodhouse and individuals and companies associated with him".

It has asked investors into the suspected fraudulent schemes to complete a questionnaire by 30 September.

It said the information provided "will help us to establish the circumstances of the investments offered, to identify and pursue new information, and to progress the investigation as quickly as possible".

What happened?

Gavin Woodhouse is an entrepreneur who raised more than £80m from amateur investors between 2013 and 2019.

He said the cash would be used to build care homes and buy and refurbish hotels.

He gave investors the chance of buying a room in a care home, a hotel or another form of holiday accommodation.

He typically promised 10 yearly dividends of about 10% - paid out of the rent the room would generate - plus a commitment to buy the room back after a decade at 125% of the purchase price.

But an investigation by The Guardian and ITV News, external into the scheme in 2019 revealed that many of Mr Woodhouse's projects were incomplete, while the businessman's firms had a multimillion-pound black hole.

That led to some of Mr Woodhouse's creditors taking him to court in the summer of 2019, seeking to place his businesses into interim administration.

A high court judge put the businesses into administration ruling that Mr Woodhouse's business model appeared to be "thoroughly dishonest" and a "shameful abuse of the privileges of limited liability trading".

'Pure madness'

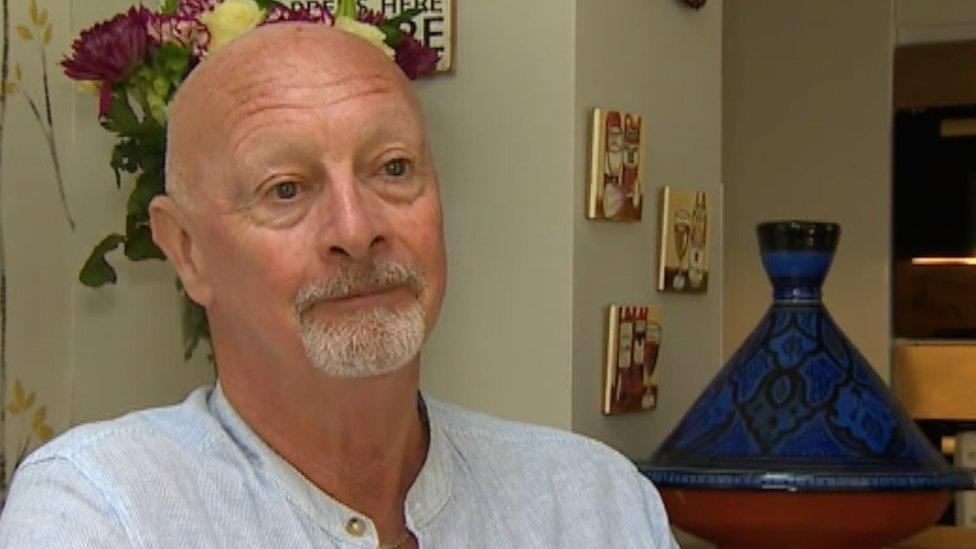

Derrick Towlson: "I retired early but it looks like I might have to go back to work now"

One victim told the BBC he invested £75,000 in the scheme.

Derrick Towlson told BBC Wales in 2019 he and his wife had spent the money on a Tenby hotel room.

They were told their investment would help fund the renovation of the hotel, and that it would earn a 10% return on their investment plus two weeks' free use of the room per year.

After 10 years, the company pledged to buy back the room at a 25% profit.

But after two years the couple had seen no payments and were left angry when administrators were called into the business in 2019.

"You feel stupid one minute, angry… when you look back now I think it's pure madness really, but it was so convincing," he said.

What now?

The SFO said it would make no further comment on the case "As this is a live investigation".

It said it "is committed to supporting victims and invites those who believe they have been a victim in connection with this investigation to check this page, external for updates and information on support services".

Will victims of the scheme get their money back?

The SFO said: "The administrators/liquidators will assess the company's assets, undertake all appropriate recovery actions and distribute any monies to creditors in accordance with their statutory duties, as regards the respective administrations/liquidations."

It added: "If we obtain convictions and compensation is appropriate and possible, we will seek to return monies to victims."

Related topics

- Published9 November 2019

- Published25 September 2019

- Published28 June 2019