E.On boss: Remove green levies to cut energy bills

- Published

- comments

The UK government should cut rising energy bills by getting rid of levies that subsidise renewable energy, the boss of E.On UK has said.

Speaking to the Financial Times, external, Michael Lewis said green subsidies should be funded through tax instead.

Regulators have warned that consumer energy bills will be hit by soaring prices of fossil fuels globally.

Wholesale energy prices rose on Thursday after a key electricity cable between Britain and France shut down.

Mr Lewis said: "This is going to be a very challenging winter for customers and for suppliers and there is a real short-term imperative to do what we can to help consumers."

Green levies account for around a quarter of energy bills, he said.

Mr Lewis recommended removing green levies and paying for subsidies through general taxation, "so these costs are funded more progressively and we level the playing field on the cost of cleaner heating."

"Then we can also start to apply something like a carbon tax on gas on a 'polluter pays' principle," he added.

A government spokesperson said: "Our energy price cap will protect millions of customers this winter from sudden increases in global gas prices.

"Millions of low-income households will also benefit from a £140 discount on their bills, with added support offered to pensioners and the most vulnerable over the colder months."

The fire at the National Grid site broke out just after midnight on Wednesday

Fire damage

A jump in prices after a UK electricity interconnector was taken offline after a fire has been fuelling concerns about inflation and the potential impact on businesses just as the country's economy starts to recover from the worst effects of the coronavirus pandemic.

National Grid said the fire and planned maintenance at a site near Ashford in Kent meant the cable will be totally offline until 25 September.

Half of its capacity, or one gigawatt (GW) of power, is expected to remain unavailable until late March 2022.

On Wednesday, British electricity prices for the following day jumped by 19% to £475 per megawatt hour (MWh).

The energy regulator told the BBC that increasing prices, for gas in particular, "will feed into all customer energy bills in the UK".

The price cap, which limits the price firms can charge customers who have not recently changed their energy tariff, will increase in October in order to cover rising wholesale costs.

National Grid reassures

The fire at the Interconnexion France-Angleterre (IFA) site broke out in the early hours of Wednesday. The site was evacuated and there were no reports of casualties.

After the fire an electricity interconnector running under the English Channel was "not operating", the National Grid said in a statement.

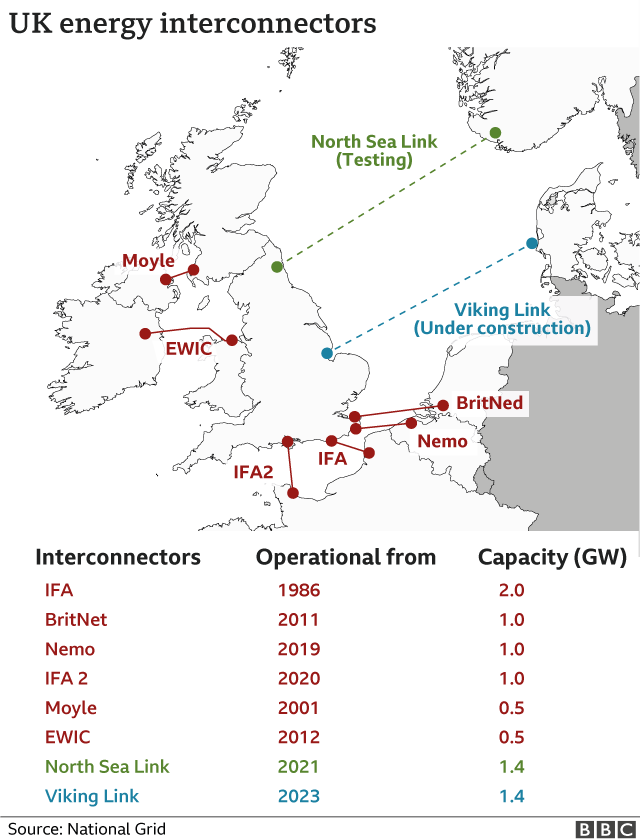

Electricity interconnectors, external are high-voltage cables that connect the electricity systems of neighbouring countries, and allow them to share excess power.

A spokesperson for National Grid's electricity system operator, which balances power supplies in the UK, said it expects to "continue supplying electricity safely and securely" despite the incident.

The link can carry up to 2GW of power, and had been importing electricity from France in recent days, after UK prices hit a record high of £540 per MWh on the wholesale energy market.

Price volatility

Analysts are now closely watching National Grid's efforts to get the facility fully back online as winter approaches and with it higher energy demand.

Glenn Rickson, head of European power analysis at S&P Global Platts Analytics, told Reuters: "The outage is going to lift the potential for price volatility as long as it's offline... and of course demand will get higher as we move further into winter."

UK Steel director general Gareth Stace pointed out that the "extortionate" electricity prices had already forced some steelmakers to suspend operations.

"Even with the global steel market as buoyant as it is, these eye-watering prices are making it impossible to profitably make steel at certain times of the day and night," he said.

Other analysts have suggested that as a result, the UK may have to rely more heavily on gas-fired power stations in the coming months.

Wholesale gas prices are already elevated for several reasons, such as low winds meaning less renewable energy is generated, outages at some nuclear stations and lower flows into the UK of the gas from Norway.

On Wednesday, fertilizer producer CF Industries Holdings said it was suspending operations at both its Billingham and Ince manufacturing complexes due to high gas costs.

Net importer

National Grid said its investigation into the fire at the IFA site was continuing and it would "update the market with any changes as necessary".

Britain is a net importer of electricity and near neighbour France is its biggest supplier of power through the interconnectors that run under the English Channel.

The IFA2 interconnector, a second link between Britain and France, is currently operating at its full capacity and not affected by the problem.

The 1GW connection is a £700m shared investment with French power firm RTE and the UK's fourth power exchange with continental Europe.

You may also be interested in:

A new global survey illustrates the depth of anxiety many young people feel about climate change.

Related topics

- Published15 September 2021

- Published14 September 2021

- Published22 January 2021