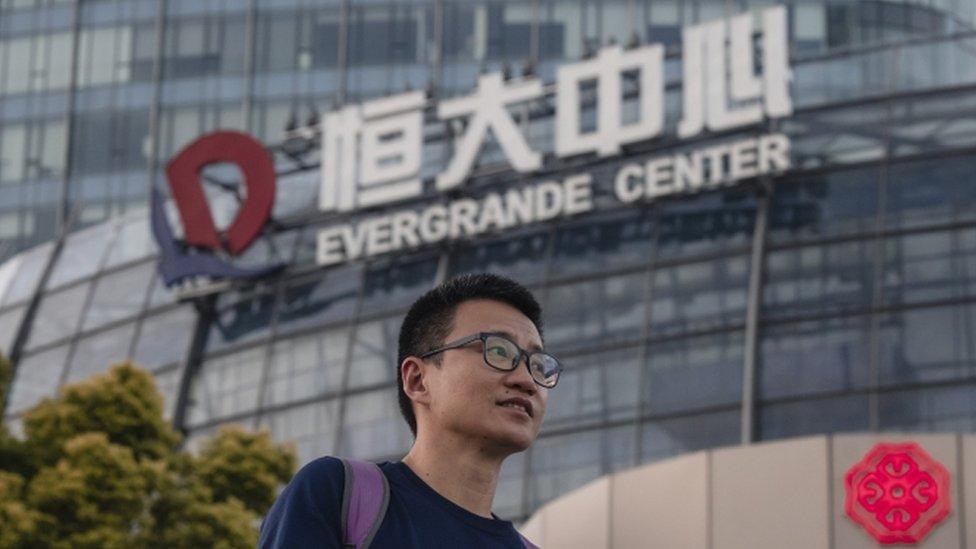

Evergrande: Struggling firm to raise $1.5bn as debt payment looms

- Published

Chinese property giant Evergrande has said it is selling a $1.5bn (£1.1bn) stake it owns in a commercial bank, as it scrambles to raise money owed to customers, investors and suppliers.

The almost 20% stake in Shengjing Bank is being bought by a state-owned asset management company.

It comes after Evergrande missed a bond interest payment last week.

The cash-strapped company also faces a deadline on Wednesday for another bond interest payment of $47.5m.

Under the agreement announced to the Hong Kong Stock Exchange, external, the proceeds of the sale will be used to pay money Evergrande owes to Shengjing Bank, which is one of the main lenders to the heavily-indebted firm.

This suggests that Evergrande will not be able to use the money raised by the sale for other purposes, including the interest payment for the overseas bond on Wednesday.

The latest payment deadline is being closely watched by investors as they look for clues on the company's ability to meet its financial obligations.

The latest move comes after reports that Beijing has been encouraging state-owned firms and government-backed property developers to buy assets from Evergrande to help it raise the money needed to meet its obligations.

The crisis engulfing the world's most indebted property developer has transfixed global markets in recent weeks as the firm struggled to secure funds to service its more than $300bn of debt.

Investors have been watching the crisis unfold as the firm teeters between a messy collapse with potentially far-reaching implications, a managed breakup or the less likely prospect of a bailout by the Chinese government.

The company has lost around 80% of its stock market value over the last year.

Last week, Evergrande missed a $83.5m interest payment on an overseas bond, although it did strike an agreement with domestic investors over a $35.9m payment which was also due.

Evergrande shares closed 15% higher in Hong Kong trade on Wednesday. Shengjing Bank shares are not publicly traded.

What China's Evergrande crisis means for the world

Related topics

- Published24 September 2021

- Published27 September 2021

- Published22 September 2021

- Published29 January 2024