UK job vacancies reach 20-year high

- Published

- comments

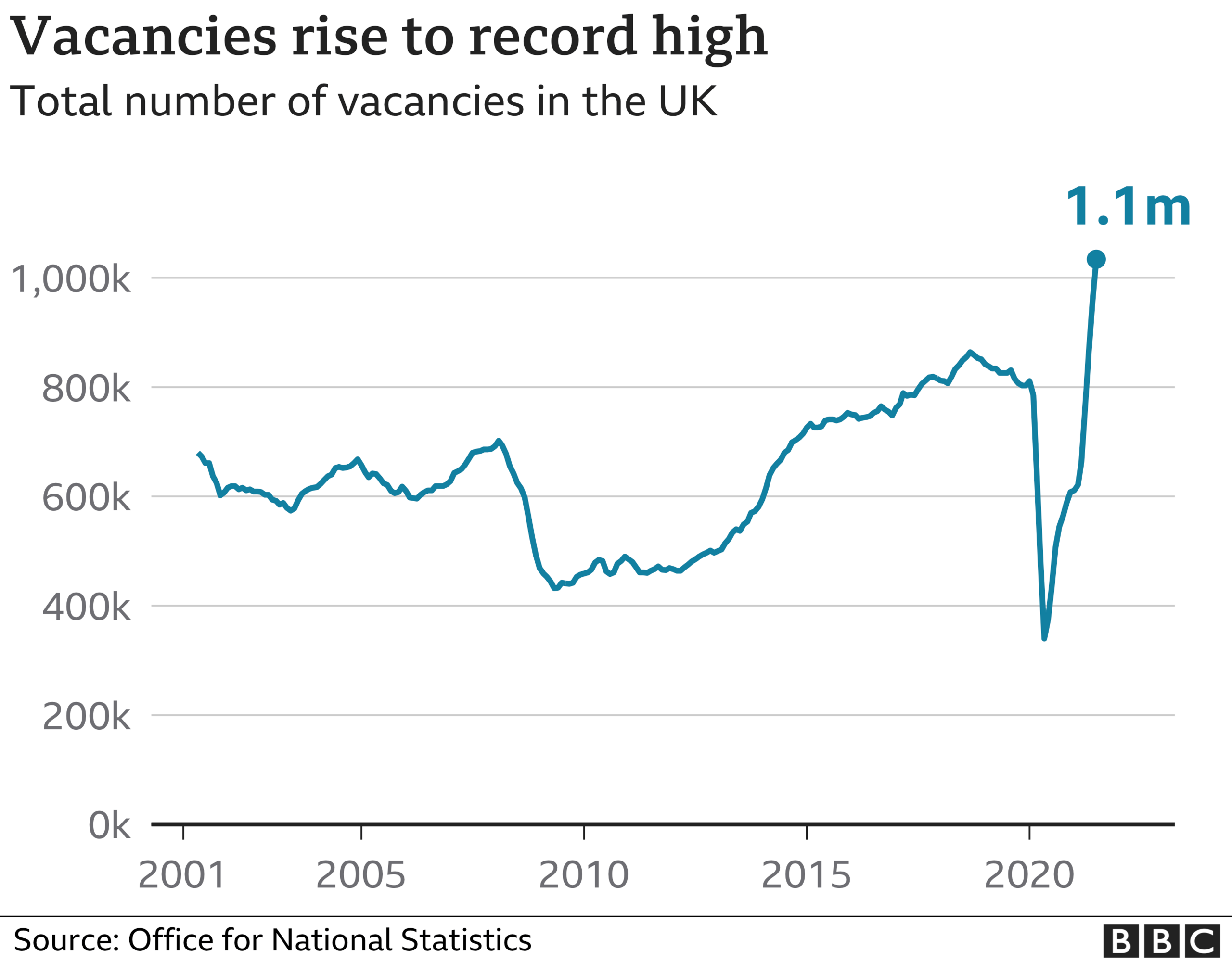

The number of job vacancies in the UK has hit a record high, according to the latest official figures.

Vacancies hit 1.1 million between July and September, the Office for National Statistics said, external, the highest level since records began in 2001.

The largest increase in vacancies was in the retail sector and in motor vehicle repair, it said.

The UK unemployment rate was estimated at 4.5%, compared with a rate of 4% before the pandemic.

The ONS said the number of employees on payrolls showed another monthly increase, rising 207,000 to a record 29.2 million in September.

"The jobs market has continued to recover from the effects of the coronavirus, with the number of employees on payroll in September now well exceeding pre-pandemic levels," said Darren Morgan, director of economic statistics at the ONS.

"Vacancies also reached a new one-month record in September, at nearly 1.2 million, with our latest estimates suggesting that all industries have at least as many jobs on offer now as before the onset of Covid-19."

Recovery concerns

Chancellor Rishi Sunak said it was "encouraging" to see the government's jobs strategy working.

"The number of expected redundancies remained very low in September, there are more employees on payrolls than ever before and the unemployment rate has fallen for eight months in a row."

However, Yael Selfin, chief economist at KPMG UK, said labour market shortages "could stunt" the UK's economic recovery from the pandemic.

"The recovery is testing the capacity of the economy to adjust to a new post-pandemic environment, a task made more difficult by the reduced availability of overseas workers," she said.

"Acute skill shortages have pushed vacancies to record levels for a second month in a row in September, as employers struggled to find skilled staff."

'For every two people we hire, only one person stays'

Mark Jenkins says the pressure in the food supply industry is "extreme"

Mark Jenkins, a supply chain director for London-based food wholesaler Brakes, says pressure on the industry is "extreme". Staff retention is a problem, he says.

"For every two people we hire, only one person stays, because there are other jobs in the market.

"Wages have gone up by 15% to 20% in some parts of the business in order to attract the right kind of people. And on top of that we're paying retention bonuses to hang on to the staff we do have.

"Everything is making it really difficult for us to service our customers".

Mark says the cost of higher wages will have to be passed on.

"Our suppliers are passing on costs, we're passing some of those costs to our customers, and at the end of the day, the consumers will feel the pain."

Sectors that had large increases in vacancies included accommodation and food services, professional activities and manufacturing. Hospitality is the sector with the most vacancies per 100 workers.

A shortage of lorry drivers, which the industry has blamed on factors including Covid, Brexit and tax changes, has affected fuel supplies in recent weeks and also disrupted food supply chains.

The Institute for Employment Studies (IES) said labour shortages were "affecting the whole economy, and where likely between a quarter and a third is explained by lower migration".

Tony Wilson, director of the IES, said there were now fewer unemployed people per vacancy than at any time in at least 40 years.

In particular this is down to fewer older people in work and more young people in education he said.

"These shortages are holding back our economic recovery, and won't fix themselves by just exhorting firms to pay people more."

The number of people who were economically inactive - those who were not looking for work - fell by 91,000 compared to the previous quarter, but rose by 50,000 compared with last year.

It's a good time to be looking for a job.

The number of vacancies hit another record high of 1.1 million and average weekly earnings, including bonuses, are 7.2% higher than this time last year.

However, these numbers contain a number of Covid-related distortions.

The wage numbers are flattered by comparisons to last year when furlough schemes depressed wages and hours worked.

If you strip that out wage rises are closer to 4%.

That is higher than inflation currently, but the Bank of England expects inflation to rise to at least 4% by the end of the year.

That will offset wage rises for those lucky enough to get them.

But it will see lower living standards for the many who won't: 5.6 million public sector workers, for example.

Higher wages have understandably been welcomed by the government, but there is less evidence of the higher skills that it is hoped will accompany them.

And the high number of vacancies suggest that there is now a mismatch between the jobs people want and the ones that are available.

Katy Jordan is paying higher wages, but her firm is not more productive.

Like other sectors, the construction industry is struggling to fill vacancies at the moment.

Katy Jordan runs Storey homes, a small house-building company in Bedfordshire. She's having trouble recruiting for certain roles such as site managers, and is having to pay staff more to keep them.

"It's really tough. What we're finding is that it's difficult to employ people on a permanent basis because it's easy for our site staff to have their heads turned by more money elsewhere."

Katy is having to raise wages to attract people to the company, and keep the people she already has, but she says that's not addressing a shortage of skills and experience in the industry.

"We're paying people what we need to pay them to attract them to come to work for us, because the labour market is so hot at the moment, but what we're not seeing is the productivity of those people adding value to our business on all levels and at all times, and that's what businesses need."

"It's great that people can earn more money. We want people to be attracted to the construction industry. But we're not attracting people with the right skills at the moment," she says.

Furlough effects

The record level of vacancies and hiring rates in September "bode well for the million workers coming off furlough in October", the Resolution Foundation think tank said, and should "help limit any increases in unemployment".

The furlough scheme, which saw the government pay towards wages during the Covid pandemic, ended at the end of September with nearly one million workers expected to have been on it.

However, a wave of potential job cuts has not happened, early data has suggested.

The ONS data showed annual growth in average pay, excluding bonuses, was 6% in the June-to-August period.

However, the ONS stressed again this figure has been affected by the impact on lower paid jobs during the pandemic and also by comparisons with last year when more workers were on furlough.

The number of people unemployed in the June-to-August period fell by 126,000 to 1.5 million, the ONS said, external, while the number employed rose 235,000 to 32.4 million.

The rise in employment coupled with the strong wage growth "increases the chances of the Bank of England raising interest rates in the coming months despite other evidence that the economic recovery is spluttering" said Paul Dales, chief UK economist at Capital Economics.

The Bank could become the first major central bank to raise interest rates since the beginning of the pandemic as inflation shoots up.

Inflation is expected to rise above 4% by the end of the year, fuelled by rising energy costs.

But the Bank is watching to see how many people became unemployed after the end of the furlough programme before making a decision.

- Published12 October 2021

- Published16 November 2021

- Published7 October 2021