Hut Group boss dumps 'golden share' in overhaul

- Published

Hut Group owns the beauty website Lookfantasic

Fast-growing health and beauty firm The Hut Group (THG) has confirmed plans to overhaul its corporate governance after its share price crashed last week.

A "golden share" that allowed founder Matthew Moulding control over takeovers and acquisitions is being removed.

The structure also stopped THG - which owns Lookfantastic - joining the FTSE 100 under UK listing rules.

Shares in THG, backed by Japan's Softbank, plummeted 35% last week on investor concerns about the structure.

On Monday, the company, which listed on the stock market in September last year with a valuation of £5.4bn, promised to address corporate governance worries, which had stopped many blue chip investors from buying shares in the company.

THG's share price jumped by nearly 11% to 321.16p following the announcement.

As well as cancelling Mr Moulding's special share rights, THG said it would also carry out a review of its corporate governance.

There have been media reports that the company - whose brands also include make-up firms Illamasqua and Eyeko - needs to find an experienced non-executive chairman. Mr Moulding is currently both chief executive and executive chairman.

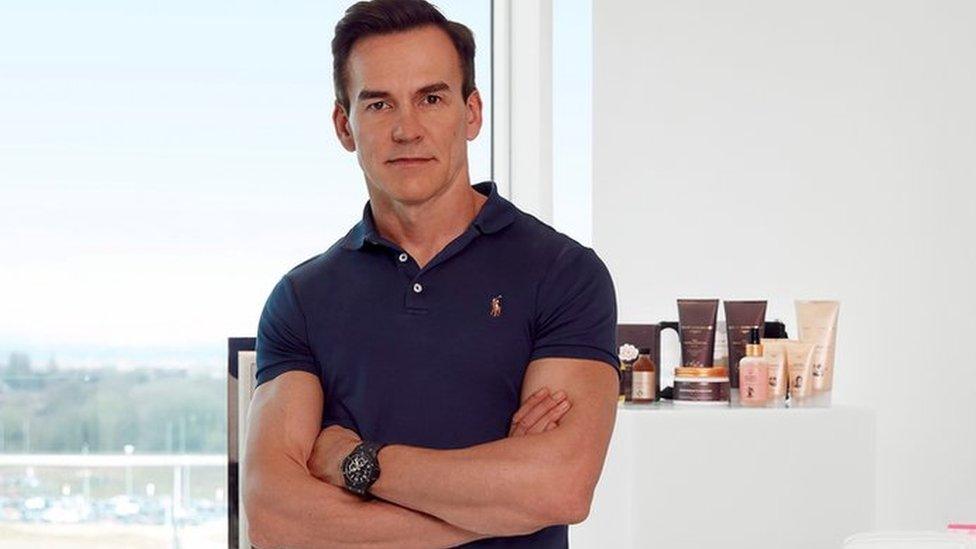

Matthew Moulding's Hut Group runs more than 100 websites

Mr Moulding said: "After the anniversary of our 2020 listing we feel that the time is right to make this next step and apply to the premium segment in 2022, thereby continuing the development of THG as we endeavour to deliver our strategy for the benefit of our shareholders, key stakeholders and employees."

Last Tuesday, THG executives held a routine meeting with shareholders at which Mr Moulding gave an update on the company's software and logistics arm Ingenuity, whose prospects had been behind THG's share price growth. Ingenuity sells its technology to other retailers in the online sector.

But after the meeting, THG shares collapsed, initially wiping about £2bn off the company's market value. There were reports that analysts were disappointed with Ingenuity's progress.

However, on Wednesday, the company issued a statement: "THG notes the fall in the share price yesterday following the capital market event, and confirms that it knows of no notifiable reason for the material share price movement, and that no material new information was disclosed at the event."

Last May, Japanese investor SoftBank signed a deal which would let it buy a fifth of Ingenuity when THG sells the unit. The agreement valued Ingenuity at £4.5bn.

- Published29 December 2020