Budget 2021: Six things that could affect you

- Published

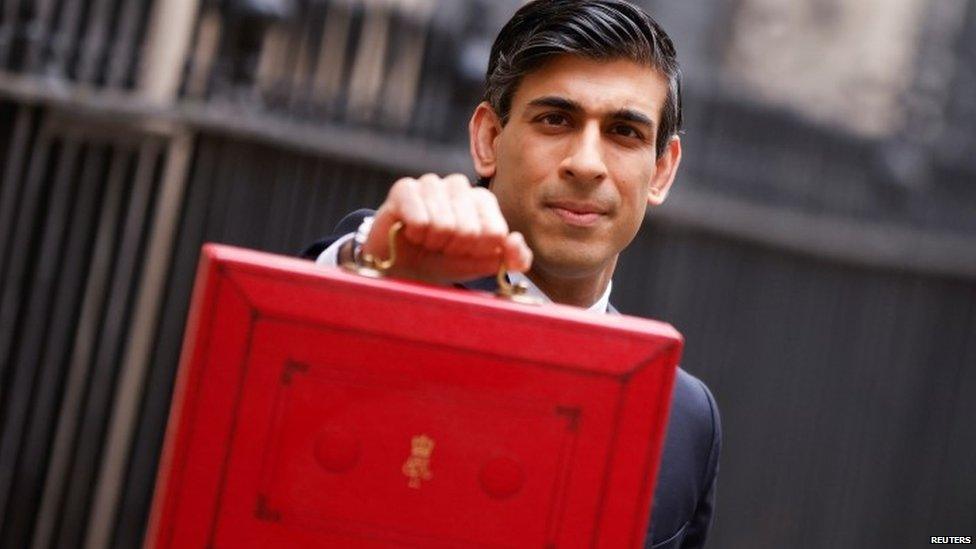

Chancellor Rishi Sunak will lay out the government's latest tax and spending plans on Wednesday 27 October.

It's the government's second Budget of the year, after one in March, and will coincide with the conclusions of the 2021 Spending Review, which will give details of how government will fund public services for the next three years.

Responding to the most recent public sector finance data this week, the chancellor said: "At the Budget and Spending Review next week, I will set out how we will continue to support public services, businesses and jobs while keeping our public finances fit for the future."

What are his options? Here we look at six things to watch out for in the Budget that could affect your personal finances.

1. VAT on energy bills

Energy bills are set to rise this winter

The chancellor is reportedly considering a cut to the 5% rate of value added tax on household energy bills.

The move would be popular and timely against the background of soaring energy bills this winter and is something the government is now able to do because of Brexit.

But the move could attract criticism as it would - in effect - mean subsidising fossil fuels ahead of the climate summit.

Also, a VAT cut on domestic energy bills would cost about £1.5bn a year, which may just be too much for the chancellor.

2. Alcohol tax

Extra tax on sparkling wine could be cut

There are rumours the chancellor is planning to simplify the way that alcohol is taxed in the UK.

The 2019 Conservative election manifesto promised to review it, so now could be the time.

One suggestion is to reduce the premium on sparkling wine to the same level as still wine, which could knock 83p off a bottle of Champagne or Prosecco.

"The government should stop trying to favour certain parts of the industry, instead focusing on removing distortions and creating a simpler system of alcohol taxes targeted at socially costly drinking," said Kate Smith, associate director of the Institute for Fiscal Studies.

The drinks levies have been in place since the 1600s and raise £12bn a year for the government.

3. Capital Gains Tax rates

If you sell a second home, you'll pay capital gains tax

There are rumours that the current Capital Gains Tax rates may be tinkered with.

The tax is paid when people sell assets such as shares or a second home.

It's been suggested that rates could be aligned more closely with income tax rates, which could mean scrapping the current tax rates of 10% and 20% (or 18% and 28% for property) and instead making everyone pay income tax rates on their gains.

A report by the Office of Tax Simplification, published in November 2020, recommended that CGT rates should be increased to bring them into line with income tax.

But it would be unlikely to raise significant extra amounts of tax, as it is typically paid by only about 275,000 taxpayers and raises less than £10bn a year.

4. Student loan threshold

Students could be asked to repay their loans sooner

There are reports that graduates may be asked to start paying back student loans earlier.

The chancellor could do that by lowering the threshold at which people start repaying their student loans, a move that could save the Treasury about £2bn a year.

Currently, English and Welsh students who enrolled at university after 2012 pay 9% of everything they earn above £27,295 per year. They repay the same 9% until the loan is fully repaid or until 30 years after graduating.

If the threshold were reduced to £25,000, it would cost anyone earning more than the current limit an extra £206 a year, while if it were slashed to £20,000, it would cost an extra £656 a year.

Ministers are rumoured to have proposed cutting the threshold to as low as £23,000 and giving graduates 40 years as opposed to 30 to repay their debt.

5. Minimum wage rise

A worker washing dishes could see their minimum wage rise

In his March Budget, Mr Sunak announced that the National Living Wage (what the governments call the minimum wage) would increase for workers over the age of 23.

Since then, the government has come under pressure to help employees further - especially as younger workers have been some of the worst hit by the economic downturn.

One solution the chancellor has been reportedly looking at is to increase the National Living Wage by 5.7% to £9.42 per hour from its current rate of £8.91.

That would bring it close to the Living Wage Foundation's current recommendation of £9.50 an hour.

6. Pension higher rate allowance

Pensions savers get generous tax relief

The government could raise cash by cutting tax relief on pension savings for those on high salaries.

But pension experts warn such a move would not be as simple as it sounds, Steven Cameron, pensions director at Aegon, said: "A move to a flat rate of pensions tax relief, rather than the current system where relief is based on the rate of income tax paid, would be far from simple to implement."

He said it would be particularly difficult for defined-benefit schemes and could mean medium to high earners, including doctors in public sector schemes, facing big tax bills.

"Removing higher-rate relief would be a direct attack on middle Britain, leading to people who do the right thing and save for their future being hit with extra tax costs," said Tom Selby, head of retirement policy at AJ Bell.

- Published26 October 2021