Second-hand car prices surge amid new car shortage

- Published

- comments

Second-hand car prices are rising at "unprecedented rates", the AA has said, as more people consider buying used cars amid a low supply of new vehicles.

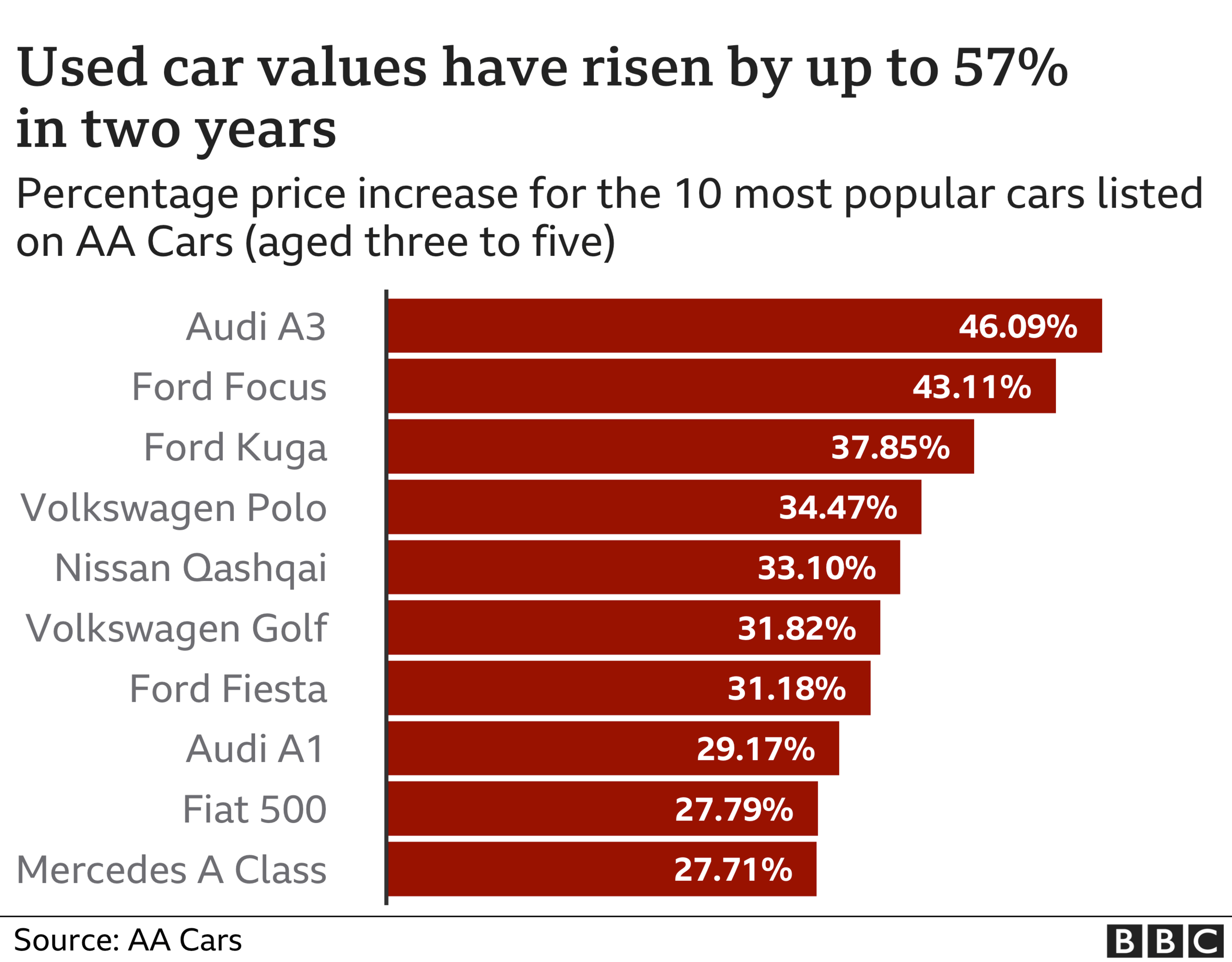

Research by the motoring group suggests the price of the UK's most popular cars have increased up to 57% since 2019.

Three to five-year-old Ford Fiestas, the most popular on its AA Cars website, were now valued at £9,770 compared to £7,448 two years ago.

Industry figures said "nearly new" used cars were in particular high demand.

Price rises have been driven by a number of factors.

A global shortage of computer chips used in car production, as well as other materials such as copper, aluminium and cobalt, has led to fewer new vehicles rolling off production lines.

That has meant more buyers turning to the used-car market.

AA Cars, which compared the prices of three, four and five year-old cars between 2019 and 2021, said demand for some models was so strong that they are increasing in value with age.

Analysis from the motoring group's website found the price of a three-year-old Mini Hatch in 2021 was 57% higher (£15,367) than a model of the same age in 2019 (£9,811).

Meanwhile, research said the price of a five-year-old Mini Hatch had jumped 15% compared to what a three-year-old model was worth in 2019, meaning the car gained in value despite getting two years older.

Audi A3s saw the biggest jump in prices since 2019 (46.09%), followed by Ford Focuses (43.11%), which were the second most popular car on the AA's website.

The motoring group said the first easing of coronavirus lockdown restrictions in summer 2020 had "unleashed demand" that had been "pent up" during the early stages of the pandemic.

It said a shortage of new cars for sale led many drivers to buy used rather than new, with "demand pressures pushing up second-hand prices at unprecedented rates".

James Fairclough, chief executive of AA Cars, said some popular cars were growing in value "even as they sit on the driveway".

"With the exception of houses and some classic cars, things rarely go up in value as they age," he said.

Mr Fairclough said despite the price growth in used cars, it was "still possible to get a good deal" if people shopped around.

Besides new car supply issues, used-car dealerships have also experienced a shortage of stock as trade-ins have been reduced, according industry figures.

The rise of online dealers with large advertising budgets such as Cinch, Cazoo and We Buy Any Car has also changed the market.

The used-car price surge along with rising energy, grocery and transport costs has contributed to the UK's higher inflation rate.

It has led to the Bank of England warning it "will have to act", suggesting interest rates may rise soon.

Fewer cars for more money

Peter Smyth, director of family business Swansway Car Dealers, told the BBC "nearly-new cars" were now a "desirable product" because of the slow supply of new ones.

He said "the more expensive cars" on his forecourts such as Audi Q7s and Land Rovers, were "selling the fastest".

"We are selling less cars for more money," he said. "You cannot replace the stock you have got."

"We look at our prices of our cars on a daily basis and we move them with the market place."

Mr Smyth said he expected prices to remain high for the next six to 12 months. He added he had been told by manufacturers that next year was going to be "tight" due to the shortage of materials such as computer chips.

"What you will find is manufacturers will have more supply of luxury cars next year than lower end stuff," he said. "They are going to put the chips in the high-value cars where they make the most margin."

In August, the Society of Motor Manufacturers and Traders (SMMT) said second-hand car sales in the UK had more than doubled.

Petrol cars made up most of the sales, with Ford Fiestas, Vauxhall Corsas, Ford Focuses and Volkswagen Golfs being the most popular models.

Mike Hawes, SMMT chief executive, said that while a buoyant used-car market was "important, as strong residual values support new car transactions", it was "critical we have a healthy new car market to help accelerate fleet renewal by allowing motorists to replace older, less efficient vehicles with the latest, cleanest models".

- Published10 August 2021

- Published7 September 2021

- Published14 July 2021

- Published5 July 2021