Budget 2021: Did you get what you wanted?

- Published

Chancellor Rishi Sunak has set out the government's spending and financial strategy in his Budget and Spending Review to the House of Commons.

He said while his plans do not "draw a line under Covid", they will prepare the economy for post-pandemic life.

The Institute for Fiscal Studies said disposable incomes were unlikely to rise by much over the next five years.

Labour has said Mr Sunak has not done enough to help families suffering from rising food and fuel prices.

We asked five people across the UK whether they got what they wanted from this Budget.

'No point' in national living wage increase

Ruby Torry, a 23-year-old waitress at Zizzi's restaurant in the Meadowhall shopping centre in Sheffield, lives in Rotherham with her mother.

She will see her wages increased after the chancellor announced a rise to the National Living Wage, however, Ruby believes her hourly rate uplift from £8.91 to £9.50 will be "useless" because of other rising costs.

"There's no point in them raising wages, because by the time they've raised your minimum wage, with higher national insurance and inflation, you're no better off," she said.

"They'll just stand on the pedestals - it's clear they're out of touch and just not bothered."

Ms Torry was disappointed to see no measures announced to help households cope with rising domestic gas and electricity bills or rising food costs.

"I've not got kids but I can't imagine what its like for single parents now wondering how they're going to cope with all these costs at Christmas," she added.

Still struggling on universal credit

Michelle and her daughter Charlize

Depending on their circumstances, about two million people who are working and receiving universal credit will be better off. However, another two million of claimants will see no benefit because they either do not work or do not earn enough.

Michelle Wilson, a single mother from Glenrothes in Scotland, will see no benefit because she is currently trying to find employment. Ms Wilson used to work as a support officer for Fife council, but left her job partly because she struggled with the cost of childcare.

She told the BBC it would have been "helpful" for the Budget to encourage more flexible working hours to make childcare easier as she is limited to working from 09:00 to 15:00.

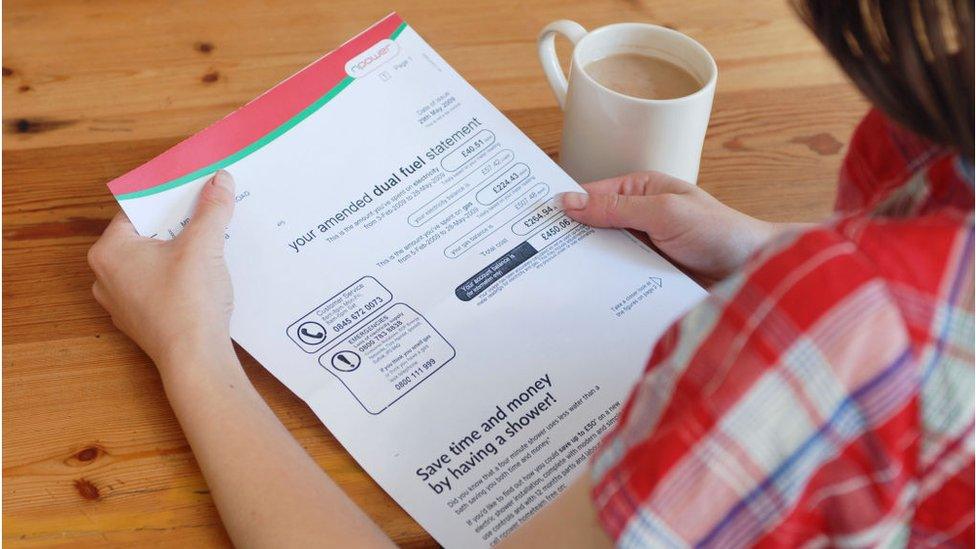

Ms Wilson said her finances had been challenged after the £20 weekly uplift in Universal Credit was ended on 6 October.

"It's a real worry because the uplift was almost £100 a month, which is my main shop gone now, so it's another big stress," she said.

"My kids have been eating healthier with that uplift and it's been a big drop when I'm worried about my gas and fuel bills."

However, Ms Wilson said the freeze on fuel duty was welcome.

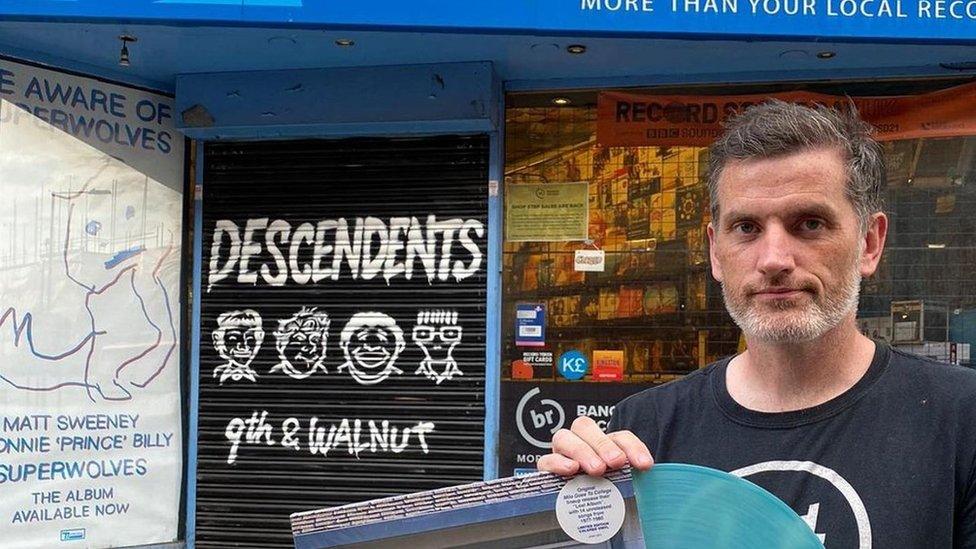

50% business rates cut is 'very welcome'

Jon Tolley, who runs an independent record shop Banquet Records in Kingston, Surrey, said the decision to temporarily cut business rates for shops, restaurants and bars by 50% was "probably more than we would have hoped for".

"The main thing to do is to encourage people to shop independently, it keeps money in the community," he said.

However, Mr Tolley said there was "nothing" in the Budget which he claimed could "make up for the problems caused by Brexit".

He was also disappointed to hear "little about climate action and climate change", but welcomed the increase to minimum wage.

"I want customers and my employees to have disposable income and cash in their pockets, so they can spend it on the High Streets," he added.

'More and more debt'

Nick Grey founded Gtech, which makes floor cleaning and garden products and has a turnover of £70m. The firm employs 200 people across the UK and sells more than 22 million products in 19 countries.

While Mr Grey thought the announcements on encouraging overseas worker visas and keeping R&D tax credits were good ideas, he said the Budget decisions were "based on popularity rather than sound future policy".

"We are now seeing a huge deficit every year which means the country is getting into more and more debt," he added.

"To counter this the government have reduced interests rates to 0.1%, conveniently putting the decision with the Bank of England so they are not held responsible for it."

Mr Grey said a forecasted 4% inflation rate meant that "in effect, all the responsible people and companies who 'save for a rainy day' are being penalised so that governments can splash public money around to boost their popularity".

'Delighted' by R&D tax credits

Hollie Whittles

Hollie Whittles, digital strategy specialist and HR director at Purple Frog Systems, said the business rates announcement was "great news" and will benefit some of her firm's high street customers "massively".

"Extra spending and cutting taxes is a really positive move but on flip side it doesn't help our national debt," she said. "We must however ensure that our economy is stable so I support the priorities."

Ms Whittles said she was "delighted" to see that the Research and Development tax credits now included cloud computing costs.

"This is excellent news for my business which specialises in data analytics and for all businesses working in big data," she added.

- Published27 October 2021

- Published26 October 2021

- Published27 October 2021