Energy price cap to be reviewed as firms go bust

- Published

- comments

The UK energy watchdog has said it will review how the price cap on gas and electricity bills is calculated following a series of company failures.

Ofgem said there had been an "unprecedented" rise in wholesale energy prices.

Suppliers are unable to pass on the full rise to consumers because of a price cap on household bills, prompting a number of firms to collapse.

Ofgem will examine if the price cap reflects the risks facing companies.

It said it will "consult on the price cap methodology to ensure it appropriately reflects the costs, risks and uncertainties facing suppliers".

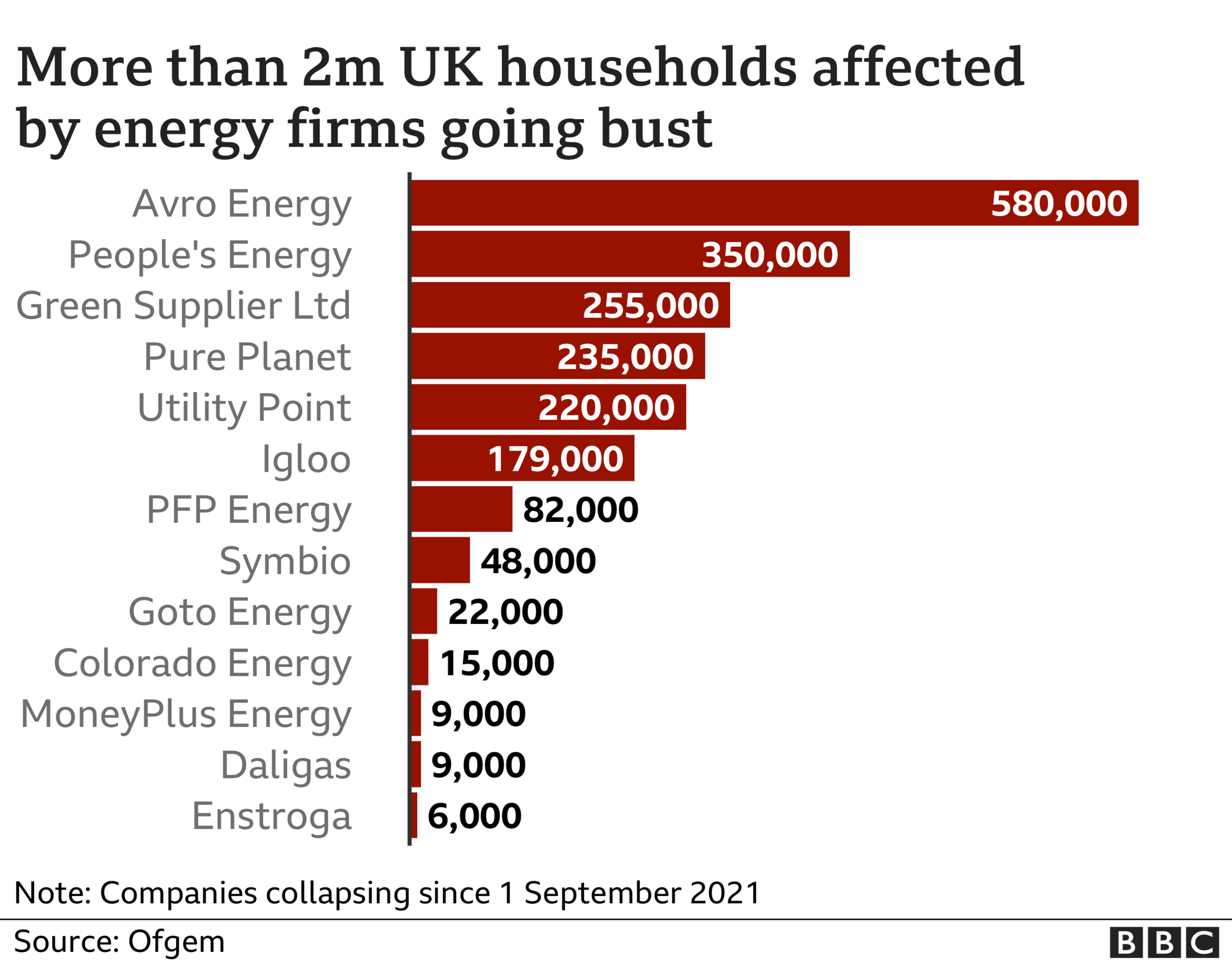

A number of UK energy firms have gone bust in recent weeks after wholesale global gas prices surged by as much as 250% since the start of the year.

Ofgem can review the price cap - which is the maximum amount per unit that a supplier can charge households on a standard tariff - twice a year.

The most recent review lifted the price cap by 12% to a record £1,277.

In a letter to the energy industry, Ofgem's chief executive Jonathan Brearley, said: "The unprecedented rise in energy prices this year has changed the perception of risk and uncertainty in this market.

"In order to protect the interests of consumers, we must ensure that the regulatory frameworks, including the price cap, fully reflect the costs, risks and uncertainties facing the supply companies we regulate."

'A bit clunky'

Over the past couple of months, more than two million households have seen their energy suppliers go bust because of the rise in gas prices.

Ofgem has stepped in to find a new energy supplier for these households.

However, it has also meant that consumers face higher energy bills because their new supplier may not be able to offer the tariff they were on before.

"We've got to take a cold, hard look at the energy market to understand what went wrong and to make sure we can stop this happening again," said Michael Lewis, UK chief executive of E.On, which has taken on customers from three collapsed energy companies.

"Customers are already facing steep rises in bills because of the sudden jump in wholesale energy costs, made worse by the added costs from the failure of more than a dozen energy companies."

Philippe Commaret, from EDF, said the review was good news: "The recent spikes in wholesale fossil fuel prices have undoubtedly had an impact on customers and we welcome Ofgem's review of the market to make sure customers are protected in the long term."

Ofgem currently calculates the cap by looking at wholesale gas prices, energy suppliers' network costs and costs of government policies such as renewable power subsidies.

Greg Jackson, the founder and chief executive at Octopus energy, said the current methodology was "a bit clunky".

"It looks backwards six to 12 months on historical prices, so when you see very big rapid changes, it is not agile to that," he said.

Scottish Power's chief executive Keith Anderson, said: "We need urgently to address the structural failures in the retail market - reforming the price cap so that it can respond more quickly to price shocks in the wholesale energy markets as well as focusing it on the most vulnerable customers, who will need our help the most."

Ofgem will launch the consultation in November. A decision on any changes will be published in February, when the new price cap will be announced before it is implemented in April.

The watchdog also said it would take an "enhanced" approach to making sure that energy companies had a "sustainable business model", which it said would minimise "risks to customers and the market as a whole".

Mr Jackson, whose firm has taken on hundreds of thousands of customers from bust firms, said the situation "is not just about the price cap".

"There are some questions about how companies were run," he said.

"The reality is most of the companies, if not all of them that have sadly failed, have done so because they were selling long-term energy contracts but buying short-term energy, and so when the wholesale cost rose, they weren't able to deliver on the prices they promised or even on the price cap," said Mr Jackson.

"So we need to make sure that energy companies are run prudently."

Mr Anderson said: "Irresponsible and reckless behaviours have gone unpunished and now customers are being told to bear the costs.

"Things are becoming desperate even for some well-run companies in our sector. Many more will go bust in the next few weeks."

Related topics

- Published26 October 2021

- Published8 October 2021