Inflation: UK prices soar at fastest rate for almost ten years

- Published

- comments

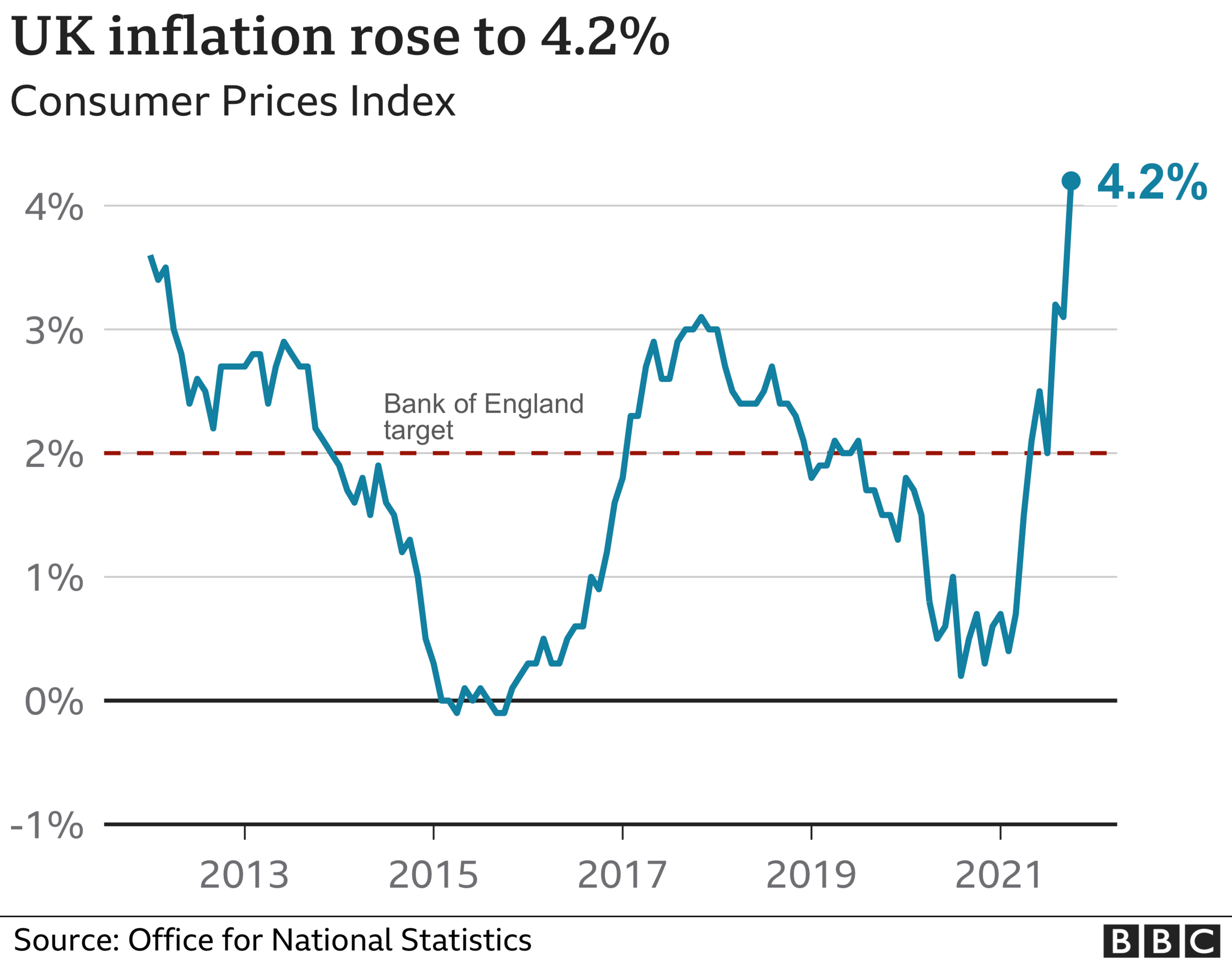

The cost of living has surged at its fastest pace in almost 10 years, hitting 4.2% in the year to October.

It is mainly due to higher fuel and energy prices but the cost of second-hand cars and eating out also rose, the Office for National Statistics said, external.

Inflation is up sharply since Covid restrictions ended this year and the economy reopened.

The Bank of England says it may have to raise interest rates in the "coming months" to tackle rising prices.

October's reading is far higher than the 3.1% rise recorded in the year to September and more than double the Bank's target of 2%.

What is inflation?

Inflation is the rate at which prices are rising - if the cost of a £1 jar of jam rises by 5p, then jam inflation is 5%.

It applies to services too, like having your nails done or getting your car cleaned.

You may not notice low levels of inflation from month to month, but in the long term, these price rises can have a big impact on how much you can buy with your money - sometimes referred to as the cost of living.

What items are getting more expensive?

Household energy bills were the biggest driver of inflation after Ofgem, the energy regulator, lifted the price cap on domestic gas and electricity last month.

It meant that gas bills rose by 28.1% in the year to October, while electricity climbed by 18.8%.

Petrol prices also rose by 25.4p to 138.6p per litre amid a surge in global oil prices. That's the highest price since September 2012.

Fuel prices have surged recently

Used car prices also rose by 27.4% since April this year, due to a global microchip shortage which has slowed the production of new vehicles.

Hotel stays, transport, clothing, household goods and raw materials also became more expensive.

Why are prices rising?

There are a number of reasons:

Demand for oil and gas is pushing up energy prices worldwide. This means higher bills for householders and for businesses, many of whom will pass on some or all of the extra energy costs to their customers

Shortages of many goods, including building materials and computer chips, are causing supply problems and pushing up prices

Government support to businesses during the pandemic - like reduced VAT for hospitality - has ended

Businesses are struggling to recruit lorry drivers and hospitality staff, and so are having to put up wages (costs that get passed on to consumers). This is partly due to the pandemic, but is also compounded by Brexit, according to international policy forum the OECD.

How is it affecting people's finances?

Paula Sharp and Sarah Allan

Paula Sharp and Sarah Allan, nursery workers from Halifax in Yorkshire, have increased the hours they work because of their rising household costs.

"I'm getting more money in, but I'm paying it out on fuel, food, clothes," said Paula.

Both women have seen a steep rise in their gas and electricity bills, and say they have to spend time shopping around to find the best deals on goods.

"We are tending to go for offers in the supermarket. The kids can't just put what they want in the trolley," says Sarah, who has 12 year-old twins. "Everything has gone up. It might only be 50p or 60p here or there, but it does add up."

How long could this last?

Earlier this month, Bank of England governor Andrew Bailey apologised for the rising prices and warned inflation could climb as high as 5%, before falling back again.

How have you adapted to rising prices? Are you shopping or living your life differently as a result?

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Sir John Gieve, a former member of the Bank's Monetary Policy Committee which sets interest rates, said that October's high inflation figures were not "a one-off".

"The Bank and other forecasters expect it to rise right the way through to April, and then to stay well above target for the rest of the year," he told the BBC's Today programme.

"So this isn't really a blip, this is quite a marked trend."

What do politicians say?

Commenting on the latest figures, Chancellor Rishi Sunak said: "Many countries are experiencing higher inflation as we recover from Covid, and we know people are facing pressures with the cost of living."

Chancellor Rishi Sunak says many countries face high inflation

But shadow chancellor Rachel Reeves said households would be more than £1,000 worse off a year due to the price rises.

"Instead of taking action, the government are looking the other way, blaming 'global problems' while they trap us in a high tax, low growth cycle," she said.

Are other countries experiencing high inflation?

Yes, many are facing similar problems as their economies reopen, such as surging energy prices and supply chain issues.

US consumer prices rose by 6.2% in the year to October, the fastest rate for three decades.

Inflation across the Eurozone was 4.1% in October, the highest since the 2008 financial crisis.

And Canada's inflation rate hit the same level in September, marking an 18-year high.

Will UK interest rates rise?

Most analysts now expect the Bank of England to increase interest rates from their current historic lows at its next meeting in December.

A low interest rate means it is cheaper for people and businesses to borrow money, which they then spend or invest which in turn fuels economic growth.

While growth is encouraged - especially following the various lockdowns - surging inflation could spell trouble for households.

If the Bank of England lifts the interest rate, High Street banks may put up the borrowing costs they charge individuals and businesses.

Higher interest rates mean people receive a better return on their savings, which should encourage them to save rather than spend.

The theory is that if more people to save, this should slow the increase in prices of everyday goods by tempering demand.

However, some analysts say a rate rise may not be effective in this case, because many of the factors driving UK inflation are global, such as higher oil prices.

Are higher energy prices good for the environment?

For any member of a household paying an energy bill, it's obvious why the sharply rising prices are concerning. And of course, for poor households, especially pensioners, it will hit them hard financially.

But at least from an environmental point of view, there may be an upside. Cheaper bills can carry hidden costs because they do too little to discourage us from wastefully emitting greenhouse gases. The effects of that may not be visible to us but they're not invisible if, for example, you live in a Pacific island nation.

Where we don't need to burn energy and do so, for example, because we prefer the house to be at 21C rather than a perfectly habitable 16C, higher energy costs will make us think twice.

That could do more to encourage us to invest in insulation, curb unnecessary emissions and to mindful of what we are doing to the planet than any resolution at last week's COP26 conference in Glasgow.

Related topics

- Published16 November 2021