Bank branches: Rival banks join forces to protect future of cash

- Published

- comments

Many hundreds of branches have closed in recent years

More shared banking hubs will open in UK towns and villages as banks continue to close a swathe of branches.

Major banks have signed a new voluntary agreement which means an independent assessment of local needs will be carried out each time a branch is shut.

These reviews could recommend a shared branch is opened, an ATM installed or a Post Office upgraded. Banks will commit to deliver whatever is recommended.

This should ensure vulnerable customers and businesses have access to cash.

An estimated five million people still rely on cash, and basic banking services are considered key to the survival of notes and coins. For example, small businesses unable to deposit their takings nearby may choose to only accept card, rather than cash, payments.

Each time a core banking service such as a cash machine or bank branch is closed, an assessment will be carried out by Link - the organisation which currently oversees the UK's ATM network.

The review will study the cash needs of the community, such as how easy it is to travel to the nearest alternative service, as well as the demographics and vulnerability of local residents. The criteria are set by a group of banks and consumer representatives.

Assessment trials over the past year will lead to 11 new ATMs, improved cash services in 30 Post Offices, and five new shared banking hubs all opening in early 2022.

A trial of the bank hub has been running in Rochford, Essex

At these hubs, run by the Post Office, customers of any bank can access their accounts, deposit cash and cheques, and withdraw money at any time. Trickier enquiries are dealt with by a representative from one of each of the major banks who each visit once a week.

The BBC visited a prototype shared banking hub in Rochford, Essex, earlier this year and was told it had been "a lifeline" for many people living in the area.

Running costs are the same as a small branch, but are shared between different banking groups that use it.

The new shared bank branches are expected to open in Acton in London, Syston in Leicestershire, Knaresborough in North Yorkshire, Carnoustie in Angus, and Brixham in Devon.

They have seen their last banks close and customers tend to have difficult journeys to reach the nearest branch services.

Life after the last bank closed

Brixham in Devon is earmarked for a new hub

Picturesque Brixham is a thriving fishing port popular with tourists, but when Lloyds closed in September it lost the last bank branch in town.

A third of residents are over 65 and often need to travel for basic banking services as the local post office can struggle to cope with demand.

Local businesses must also travel or queue for their banking needs, so many are welcoming the plan for a new shared hub.

Debbie Fisher has to travel to bank her cash

Debbie Fisher, the owner of the Buccaneer Boutique women's clothing store in Brixham, said she still received cheques from some of her customers and liked to accept cash payments too.

"Not having a branch is inconvenient as I have to go [to another town] before I open up the shop," she said. "It would be fantastic to have a hub.

"It is desperately needed to keep the town together."

From the summer of 2022 any community that has already lost its banking services can request an assessment by Link.

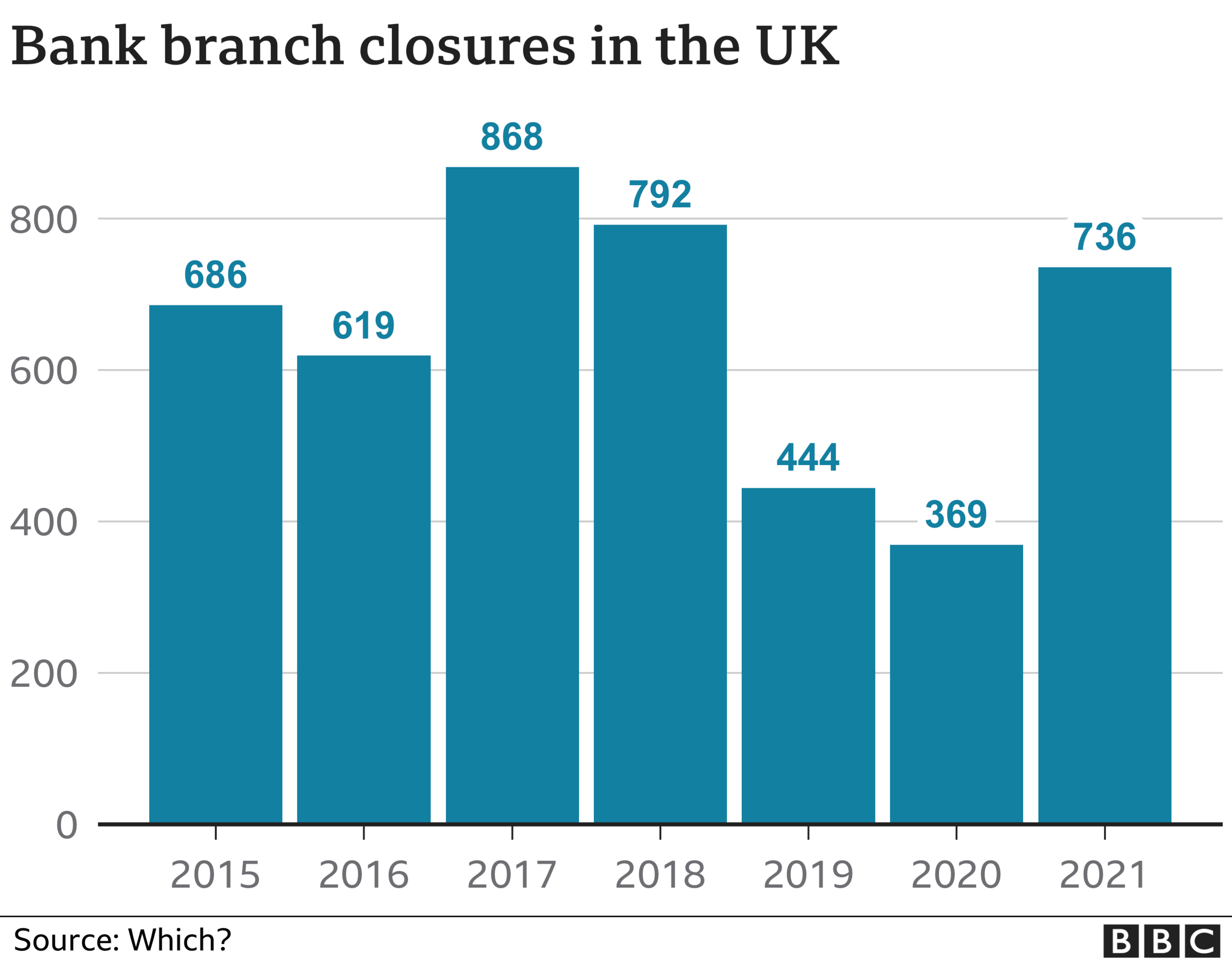

While shared hubs may be welcomed in these local communities, the plan for five hubs and the promise of more to come will be dwarfed by the scale of bank branch closures across the UK.

More than 4,000 branches have closed since the start of 2015, and another 220 are already scheduled to close next year.

Consumer group Which? has called for an immediate halt to more closures, to allow the new plans and legislation to be introduced.

"The alarming acceleration of bank branch closures has left many people who depend on them for essential banking services at risk of being cut adrift, which seems to fly in the face of work being done across the industry to protect access to cash," said Which? chief executive Anabel Hoult.

Natalie Ceeney, who chairs the Access to Cash Action Group, which drew up the plans, said concentrating solely on keeping branches open was "missing the point", as they only served a small section of the community who were customers of that particular bank.

"Bank branches are closing at a high rate. The alternative [to these plans] is nothing. [Under this new agreement] if there is a gap left by a bank branch closure, it will be filled," she told the BBC.

"Banks will continue to make their own commercial decisions. We have been making sure no community is left behind."

She said that voluntary agreement would be made a legal requirement with legislation brought by government in the next 18 months.

Martin McTague, from the Federation of Small Businesses, said: "This new strategy will bring hope to communities which are losing bank branches and ATMs.

"It is important that the new assessments of need outlined today are independent and fair - we will be watching their progress closely."

Cashback without purchase

The pandemic has cut cash use by 35%, but millions of people - often vulnerable - still rely on notes and coins.

Another system which trials showed to be successful in certain venues was cashback from shop tills, without the need to make a purchase.

During trials, half of withdrawals were for less than £20 and four in 10 were for non-round amounts - suggesting people were taking out relatively small amounts available in their bank accounts.

Cash machines are not set up to provide such a bespoke service.

Some 2,000 shops are expected to offer the service by the end of the year.

Related topics

- Published25 June 2021

- Published1 July 2021

- Published1 December 2021

- Published28 April 2021