Turkey cuts interest rates despite spiralling inflation

- Published

Turkey has cut interest rates again, despite red hot inflation and a worsening currency crisis.

Its central bank cut borrowing costs for the fourth straight month amid continued pressure from President Recep Tayyip Erdogan.

The lira fell as much as 5.7% to a record low following the decision.

The president also announced a 50% hike in the country's minimum wage to 4,250 lira per month ($275; £206) in a bid to offset the impact of rising prices.

He believes pushing interest rates lower will help alleviate red-hot inflation. It is a view that runs contrary to conventional economic theory.

In a statement, Turkey's bank compared its decision to those of other major Western central banks, which have kept rates low during the coronavirus pandemic to help boost economic growth.

Analysis: Erdogan's gamble

By Victoria Craig, BBC business correspondent

President Erdogan wants a high growth, low interest-rate environment. He thinks it will stimulate the economy and create jobs, fuel investment in the country because it keeps borrowing costs low. But, the problem is the currency crisis - caused in part by a loss in trust with policymakers - has caused the opposite to happen. Economic growth is still high here: Turkey is considered an emerging market, and the past few decades have been powered by credit-fuelled growth in sectors like construction.

The economic turmoil is hitting people from all walks of life. Locals are coping by just taking one day at a time but there is a lot of anger and frustration here. Everyone we spoke to says they are regularly monitoring the lira's exchange rate with not just the dollar, but also with the euro, the pound, and with gold.

Over the past year, it has become increasingly difficult for Turks to plan, save, or spend money on everyday goods and services.

Protests have been breaking out in the capital Ankara and in the biggest city of Istanbul.

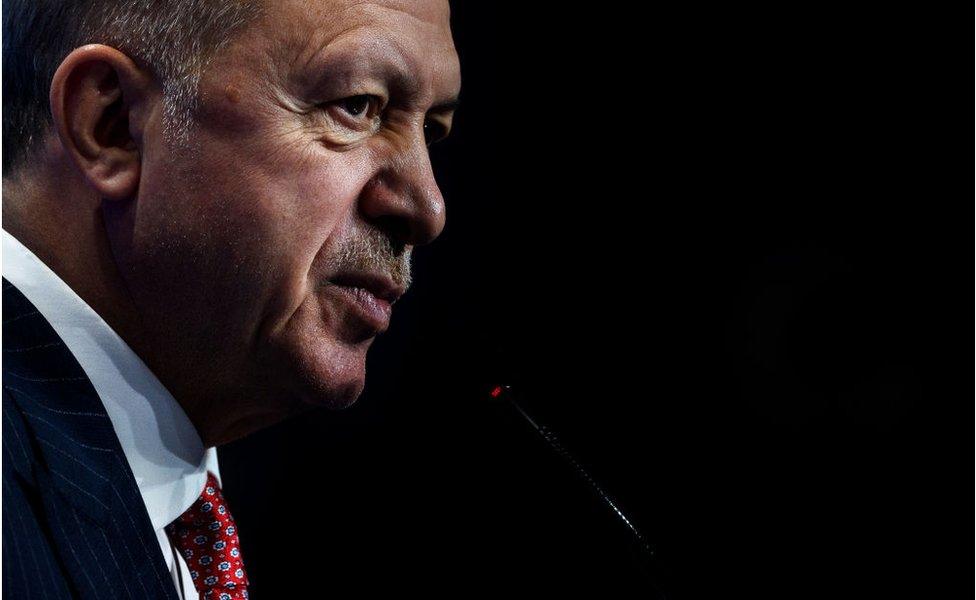

President Erdogan built his reputation on strengthening Turkey's economy

The president and his allies says that lower interest rates will boost Turkish exports, investment and jobs.

But many economists say the rate cuts are reckless. Last month, the country's inflation rate hit 21.7%.

Normally, central banks raise rates to combat rising prices, but Mr Erdogan has called such tools "the mother and father of all evil".

Although the bank has attempted to bolster the value of the lira by using its dollar reserves to buy the currency, analysts have said it does not have enough firepower to stop the slide.

Related topics

- Published3 December 2021