Business Review of 2021: Climate change and Covid

- Published

Extreme weather: Flooding in Bangladesh has taken a huge toll in lives and economic damage in recent years

Over the past year governments all over the world told businesses to radically step up their strategies for going green and shifting away from fossil fuels.

The Glasgow COP 26 Climate Conference in November saw the host, UK Prime Minister Boris Johnson, setting out why humanity had to "act now".

Mr Johnson declared: "If we don't get serious about climate change today, it will be too late for our children to do so tomorrow".

After the two weeks of talking in Glasgow, a draft deal pledging to "phase out" use of the dirtiest fuel, coal, was rejected by the biggest coal users, China and India.

But climate experts welcomed the fact that a reference to coal did stay in the final agreement, with a commitment instead to "phase down" coal use.

COP26 President Alok Sharma speaking at the close of the summit

Many established business leaders have already got the message and some have already completely changed what they do.

The Australian mining entrepreneur, Andrew Forrest, the CEO of Fortescue Metals Group, told the BBC how his firm's large iron ore trucks and trains were being converted to so-called "green hydrogen".

To make "green hydrogen", renewable energy - like wind power - is used to create electricity that then splits water into oxygen and hydrogen. That hydrogen is captured to use as a fuel. In a hydrogen engine, the main emission is harmless water vapour.

"This is the day the fossil fuel industry has denied would come. There are huge sources of green hydrogen - if the world bothers to make the transition. My own company is making the transition right now," he said.

The entrepreneur said he took a four year PhD to study the environment and had learned that "global warming is frighteningly real."

Fortescue Metals CEO Andrew Forrest with Australian Prime Minister Scott Morrison (left)

In April he took Australian Prime Minister, Scott Morrison, to his vast mining operations that dig out iron ore to make the world's steel.

Mr Forrest described how the prime minister faced "big beefy Australian workers" who would put an arm round Mr Morrison, saying "come on ScoMo we're all going green, what's taking you so long? Green is the future mate".

A few months after that visit, Scott Morrison committed to making Australia "net-zero" by 2050 in line with the US, Japan, the EU and UK.

"Net zero" means that any climate damaging emissions are offset by emissions that are removed from the environment.

China, Russia and Saudi Arabia are focussing on a 2060 "net zero" target. India's target is 2070.

These Danish wind turbines are being used to produce so-called green hydrogen

Meanwhile, in Denmark, green hydrogen is being created at a site at Brande in Jutland in the west of the country, using rows of dedicated wind turbines that tower over the countryside.

The hydrogen is then used to fuel the vehicles of a nearby green taxi firm called DRIVR, which have chosen the hydrogen option over battery electric taxis.

"In the taxi industry, the most important thing is time," Haydar Shaiwandi, chief executive of DRIVR told us.

"We can't charge electric vehicles fast. The hydrogen vehicles actually act like regular diesel vehicles because for recharging a hydrogen vehicle is a maximum of five minutes."

The hydrogen is being used by nearby taxi firm, DRIVR, to power some of its vehicles

But while change is happening, many say it is not happening fast enough.

One big concern is that the green option is usually still the more expensive one, so most businesses still put their cash into cheaper but polluting investments.

The fear is that without more decisive government action to change economic incentives, business and investors won't be able to deliver on the pledges set out by their nation's political leaders.

Among those worried is Tariq Fancy, a former high flyer in the world of sustainable investing. He used to work as chief investment officer for sustainable investing at Blackrock, one of the world's largest asset managers.

Mr Fancy says that - by law - managers like Blackrock need to maximise future retirement income for their investors.

He argues that managers can look at environmental considerations but "can't lose any money by investing in something that's good for the world" because they are legally prohibited from doing that.

Protesters at the COP26 summit demonstrating against the use of fossil fuels

"Little to none of what any of the financial services industry is doing is actually - in any meaningful way - doing anything to fight climate change," he says.

Because of this, he argues that the sector is therefore slower to enact reforms "that experts are telling us we need to".

Mr Fancy concludes: "All of this is what I call a deadly distraction."

The International Energy Agency, which is funded by governments of major western nations, made headlines in 2021 with a stark declaration.

The IEA said that to meet governments' goal of limiting warming for the planet to an extra 1.5C, then there should be no development of any new fossil fuel fields.

Many climate action groups have taken to the streets to protest for real progress to be made to reduce carbon emissions

The IEA's chief energy economist Tim Gould says the world got closer to that scenario at Glasgow but "we're not there yet", he says.

"In our view COP26 was all about setting ambitions. The acid test will be how quickly these are implemented. The time now is to really roll up the sleeves and put these pledges into practice."

For many years, Irwin Stelzer from the conservative US think-tank, the Hudson Institute, has supported a tax on carbon to encourage the private sector to invest more in green technology.

"Having waged this battle for a decade now and emerging bloody but unbowed, I would say a straight carbon tax will not pass," he tells me.

But he is watching closely EU plans for a "border tax" on imported goods produced using "dirty fuels" - such as steel produced in China.

Will the EU and US impose so called "border taxes" on goods such as steel, that are made using coal and other polluting fuels?

"The EU may turn out to be one of the engines of progress, which is not its usual role. When they have border taxes, that tax imports for their carbon content, other nations will have to respond with similar taxes that will have the same effect."

The US will end up with its own border tax as well, Irwin Stelzer says: "The politics is now falling in place to have some form of carbon pricing - directly or indirectly."

While policymakers were focussing on the long term in 2021, they also had a major job shoring up spending in the short term as the Covid pandemic hit activity for a second year.

Most of the worst forecasts for the impact of Covid on jobs and incomes did not materialise. Indeed most economies saw output return to levels seen before the pandemic.

And by the end of 2021, there was growing concern about inflation set off by governments and consumers spending too much.

Prices in the US are now 7% higher than a year ago - the fastest inflation rate since 1982.

US consumer prices rose in November a rate not seen in nearly 40 years

Ken Rogoff, former chief economist at the IMF, blames Covid-related supply chain issues in part, but says poor US government policy is also to blame.

"The stimulus - the American Rescue Plan - that the government put into place just after President Biden took office was just not well thought out or well designed. It was throwing money at the economy - too much, too late," he says.

"Frankly what they are doing now with infrastructure and social infrastructure would have done better to do back then."

For the big tech giants, it was another profitable year. Shares of the electric car firm, Tesla, rose 40%. Shares of Facebook (now known as Meta) were still up 20% despite a deluge of bad publicity after a former employee released internal documents.

Frances Haugen said Facebook's own research had shown evidence of Instagram's harmful effects on some teenagers, and that the firm prioritised "growth over safety".

Facebook said the leaks were misleading and said it had 40,000 people working on safety and security.

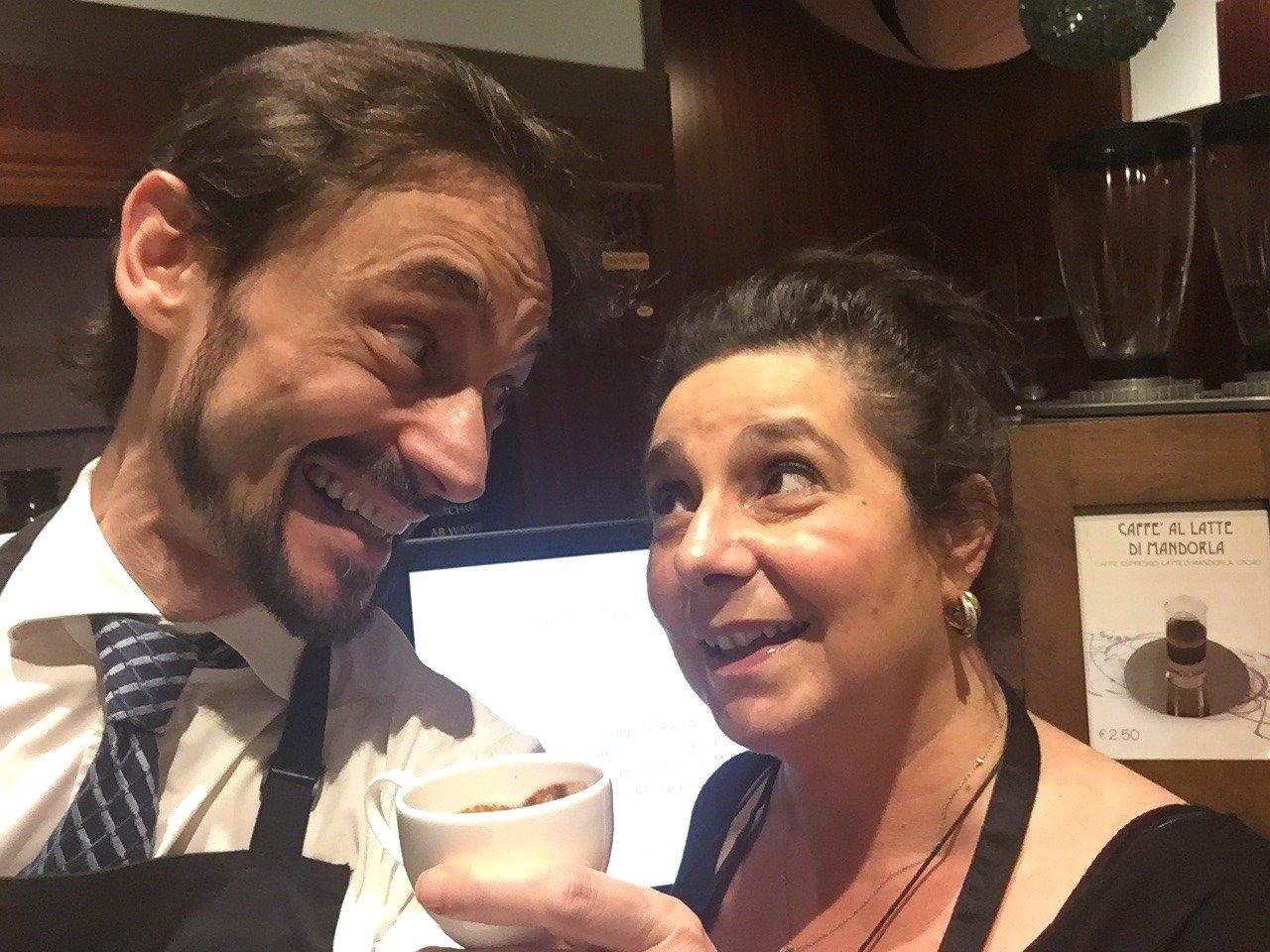

Toasting a healthy 2022: Cristina Caroli and partner Alessandro Galtieri, owners of the Aroma speciality coffee shop

Thanks to Covid, small business owners had a bleak time for much of 2021. But many of those that have survived now feel optimistic.

The owner of the Aroma speciality coffee shop in Bologna in Italy, Cristina Caroli, was overcome with joy when tourists returned last summer.

"It was literally a dream when we saw the first tourist after so long," she says.

"Somebody speaking another language. It was very emotional. Americans! I couldn't believe it - then the English, the Swiss, the Germans - it was incredible it was fantastic!"

Cristina's enthusiasm for the future of her café remains undimmed, telling me: "Activities are starting again, the situation looks really better, it's a kind of renaissance after this bad period."

Catch up with Martin Webber's Business Review of 2021 on World Business Report, BBC World Service, or download the latest podcast.