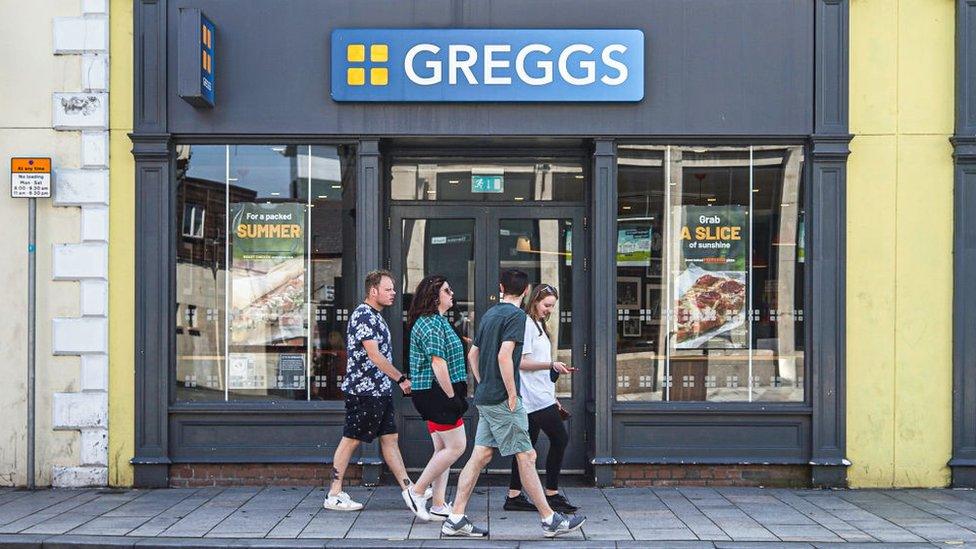

Next and Greggs raise prices as costs spiral

- Published

- comments

High Street giants Next and Greggs have both said they are raising prices as they seek to offset higher wage and manufacturing costs.

Next, which reported strong sales over Christmas, said its prices would increase by up to 6% next year.

Greggs, Britain's biggest bakery chain, said it had raised prices between 5p and 10p on items across its range of sausage rolls and cakes.

A Greggs spokesman said the move was "very much a last resort".

Next price hike

Next said that prices for its spring and summer clothing and homeware ranges would rise by 3.7% from a year earlier, while it expects a 6% increase for autumn and winter goods.

Its forecast, external came as it said sales for the three months to 25 December were up 20% compared with pre-pandemic 2019, boosted by a strong revival in "formal and occasionwear".

Next's online business saw sales soar by 45% from two years ago, whereas sales at its High Street stores were down 5.4%.

Next has said costs associated with wages, manufacturing and shipping are increasing

Next also upped its profit forecast for the year. It now expects to make an extra £22m, taking annual profits to £822m, which would be nearly 10% higher than in 2019.

The company is forecasting sales of full-price goods to rise by 7% overall in 2022, but it warned that this year could see a tougher trading environment, given the financial pressures facing households, such as higher energy bills.

Next also said it was facing higher costs itself, hence the need to increase its prices by more than previously expected.

The company said it had seen higher shipping and manufacturing costs. Wage costs were also climbing as a result of the increase in the National Living Wage and because of staff shortages in some areas, "most notably in warehousing and technology".

Next is the first of the big retailers to tell us its Christmas story. And it's had a strong one. The business had been expecting weaker growth, but it was much better than expected, adding an extra £70m of sales helped by a revival in adult formal and "occasionwear". And this was despite lower levels of stock.

Online sales were up 45%, which more than offset falling sales in its stores. Even before the pandemic, more than half of the group's sales were already online, making it well placed to benefit from the huge shift in shopping habits.

This performance puts Next firmly in the winner's camp. It says forecasting the year ahead is unusually difficult. With soaring fuel bills and a rise in the cost of living, the big question is, how much discretionary spending consumers will be able to make?

It's having to put up prices on products, too. But this is a retailer that's better placed than most to cope with the cocktail of cost increases and challenges facing retailers this year.

Analysts praised Next for its performance, with the retailer also announcing a special dividend of 160p a share.

"For all the tales of woe on the High Street, there is one shining jewel to be found in the form of Next," said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

"There aren't many bricks-and-mortar retailers dishing out special dividends or upgrading guidance multiple times over."

She added that Next had managed its business "very well - stock levels have reduced, and labour shortages didn't derail performance".

Greggs' chief executive, Roger Whiteside, said that the decision to raise prices, taken after an end of year review, was unavoidable.

"We try and absorb as many of the cost increases that get passed to us as possible and then put through price increases where we can't avoid it, and we've done that this year," he told the PA news agency.

"The question is, does the inflationary pressure recede or go up."

Greggs said sales at its stores had eased in the run-up to Christmas and staff absences increased due to the rise of the Omicron variant.

Like-for-like sales for 2021 were down 3.3% compared with the pre-pandemic levels of 2019, but in the fourth quarter, they were up 0.8%.

Mr Whiteside, who leads employees across more than 2,000 outlets, also announced that he would step down from the role later this year and retire.

He will be replaced by Roisin Currie, who is currently Greggs' retail and property director.

"This looks a solid internal appointment, particularly given her key role in developing the delivery business," said analysts at Jefferies.

B&M bonus

Next is the first major retailer to report on how it performed over the key Christmas trading period, although there were updates from other companies on Thursday.

Discount retailer B&M said its full-year profits were set to come in ahead of forecasts, with sales in the three months to 25 December up 14% from pre-pandemic levels. The company also announced its 24,000 staff would get an extra week's wages as a bonus for their "considerable efforts this year".

Homeware retailer Made.com reported a 38% rise in sales during 2021 to £434m. Boss Philippe Chainieux said he was "delighted" with how the business was performing, adding that measures it had implemented were now easing the impact of "industry-wide supply chain issues".

- Published5 January 2022

- Published27 December 2021

- Published20 December 2021