UK economy above pre-Covid levels in November

- Published

- comments

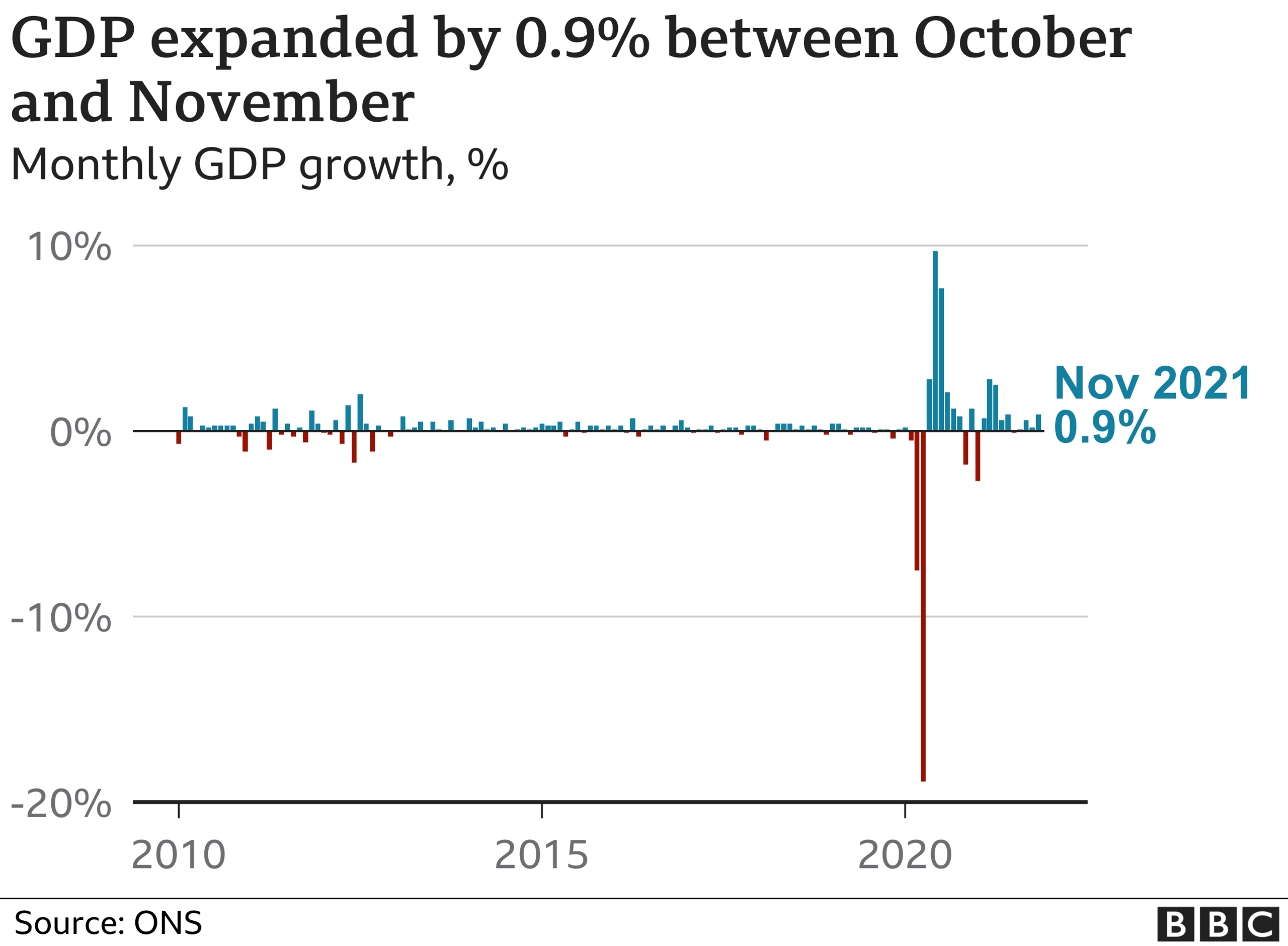

The UK economy surpassed pre-Covid levels for the first time in November after recording stronger-than-expected growth.

The Office for National Statistics said gross domestic product (GDP) expanded by 0.9% between October and November.

That was higher than economists' expectations and meant the economy was 0.7% larger than in February 2020.

But there is concern growth slowed again after the spread of Omicron and the introduction of Plan B measures.

"The economy grew strongly in the month before Omicron struck, with architects, retailers, couriers and accountants having a bumper month," said ONS chief economist Grant Fitzner.

"Construction also recovered from several weak months as many raw materials became easier to get hold of."

Analysts at Capital Economics said the economy was boosted by 3.5% growth in the construction sector, adding "the unusually dry weather probably helped".

It also said manufacturing output also improved and the professional sector also picked up, "apparently due to architectural and engineering activities being brought forward from December".

What is GDP?

GDP or Gross Domestic Product is one of the most important ways of showing how well, or badly, an economy is doing.

It's a measure - or an attempt to measure - all the activity of companies, governments and individuals in an economy.

GDP allows businesses to judge when to expand and hire more people, and for government to work out how much to tax and spend.

Rising GDP means more jobs are likely to be created, and workers are more likely to get better pay rises.

If GDP is falling, then the economy is shrinking - bad news for businesses and workers.

The Covid pandemic caused the most severe recession seen in over 300 years, hurting business and employment, and forcing government to borrow hundreds of billions of pounds to support the economy.

Economists had been expecting GDP to expand by 0.4% in November.

Chancellor Rishi Sunak said the stronger growth was "a testament to the grit and determination of the British people".

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: "GDP almost certainly dropped in December, as households hunkered down in response to the Omicron variant."

The Omicron variant emerged at the end of November and Plan B measures were introduced on 8 December.

Mr Tombs said data such as restaurant diner numbers, transport usage and cinema revenues "point to a pullback in consumer services expenditure" last month, while "Omicron also depressed labour supply".

However, he added: "Omicron looks set to fade almost as quickly as it arrived, thanks partly to the rapid rollout of booster jabs. As a result, we expect the government to allow Plan B rules to automatically expire on 26 January and for GDP to bounce back in February."

These figures show that the reopening and recovery of the UK economy was motoring just before Omicron struck.

The economy had for the first time regained, on a monthly basis, all the very heavy losses during the pandemic lockdowns. Business had been returning to something approaching normality after the government's decision to axe restrictions since the summer.

Monthly figures are quite volatile though and usually not provided by other countries. It is possible that the Omicron-linked hit to the economy in December could undo the impressive growth in November on the key fourth quarter figure. Using this more usual and internationally comparable quarterly basis, it is still not certain if the UK economy has recovered these losses.

The bigger question is about the impact of Omicron. With hopes that the rapidly-spreading variant has peaked, economists are now confident it will have far less of a hit than previous Covid waves. Retailers' results over the festive period have been very encouraging.

But the response of the public and its attitude to going out and spending is the big economic unknown. And while Omicron concern fades, the hits to disposable income from rising prices are very real.

So while the chancellor called today's GDP milestone "amazing" it's probably not the moment for celebration.

The ONS said that, on a quarterly basis, in the final three months of 2021 the UK economy will reach or surpass pre-Covid levels seen in the last quarter of 2019 if GDP grows by at least 0.2% in December and there are no downward revisions to figures for October and November.

However, several economists pointed to a bumpy road for growth in the first months of this year.

"We expect growth to slow in 2022 as it will no longer be able to simply rely on the [Covid] rebound effect to propel it," said Yael Selfin, chief economist at KPMG UK.

"In addition, rising taxes and borrowing costs, as well as elevated inflation, will squeeze households' purchasing power, while the lingering effects of supply chain bottlenecks together with a persistent shortage of labour could constrain production this year."

Inflation is expected to hit 6% by spring, according to the Bank of England which raised its key interest rate in December and is forecast to lift borrowing costs again this year.

The government will raise the National Living Wage by 6.6% for over 23 year-olds in April but that is the same month when energy regulator Ofgem will implement the new price cap on household gas and electricity bills.

Ofgem is widely expected to lift the price cap following a sharp rise in wholesale gas prices last year which forced around 20 smaller energy companies out of business.

Also from April, employers, workers and the self-employed will all pay 1.25p more in the pound for National Insurance.

- Published12 January 2022

- Published22 December 2021