1MDB scandal: US prosecutors allege ex-Goldman banker made millions

- Published

US prosecutors allege a former Goldman Sachs banker siphoned off millions of dollars from Malaysia's scandal-hit 1MDB sovereign wealth fund.

Roger Ng, who was Goldman's head of investment banking in Malaysia, is charged with conspiring to launder money and violate anti-bribery law.

The trial got underway in Brooklyn, New York on Monday after Mr Ng previously pleaded not guilty to all charges.

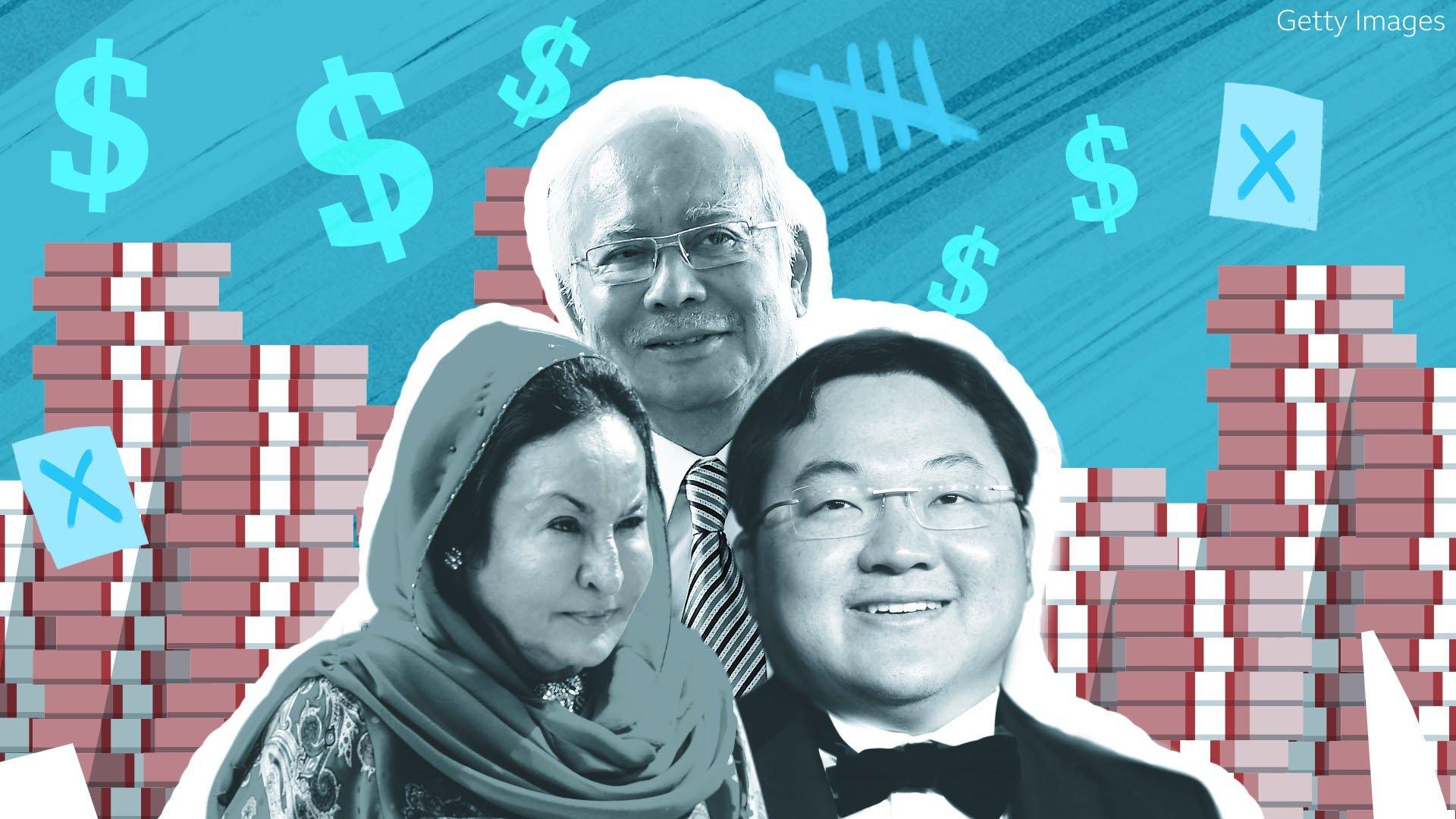

1MDB lost billions of dollars in one of the world's biggest financial scandals.

If found guilty, Mr Ng faces up to 20 years in jail for the money laundering charge and five years for each of the two bribery charges.

"The defendant saw an opportunity to make millions of dollars by cheating, and he took it," Brent Wible, a lawyer for the US Department of Justice said as the trial opened on Monday.

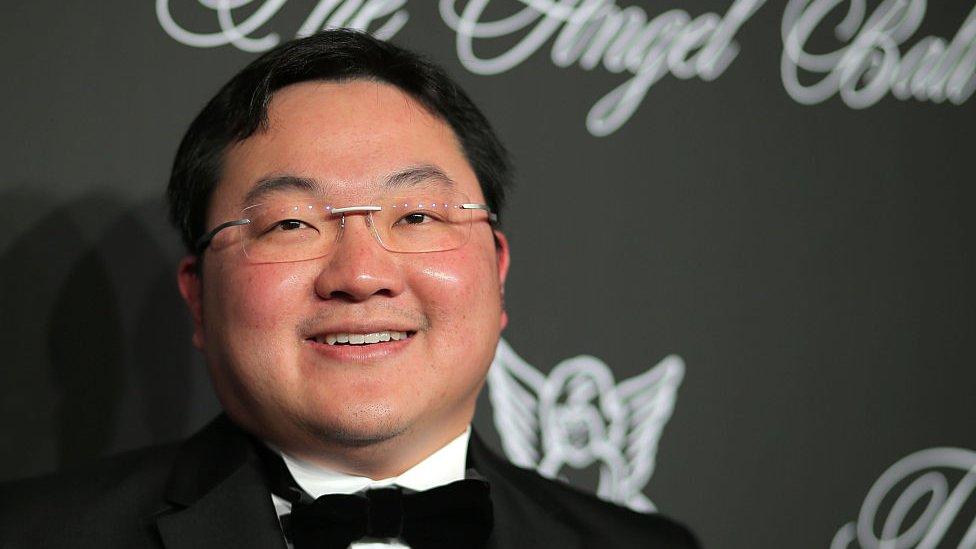

Mr Wible said Mr Ng conspired with two people - his former boss Timothy Leissner and Chinese-Malaysian financier Jho Low - to embezzle funds from 1MDB.

They allegedly used some of the stolen money to bribe Malaysian officials to get more business for Goldman Sachs.

The prosecutor said Mr Ng received $35m (£25.9m) from Mr Leissner for his role in the alleged scheme.

However, defence lawyer Marc Agnifilo said his client was not involved in the scheme.

Mr Agnifilo said the money was meant for Mr Ng's wife, who had started a business venture with Mr Leissner's ex-wife.

"They're not partners-in-crime. There's a gulf between these two men a mile wide. He's trying to use my client to... serve his jail time," Mr Agnifilo said of Mr Leissner, who is expected to testify against Mr Ng.

The case centres on Wall Street investment banking giant Goldman Sachs, which helped to raise $6.5bn for 1MDB through bond sales to investors.

Investigators found that the proceeds from the bonds, sold from 2009 to 2014, were largely stolen.

Goldman Sachs spent years being investigated by regulators across the world, including in the US, UK, Singapore, Malaysia and Hong Kong.

In 2020, Goldman Sachs reached a $3.9bn settlement with the Malaysian government for its role in the multi-billion-dollar corruption scheme.

It also paid nearly $3bn to authorities in four countries to end an investigation into work it performed for 1MDB.

The same year, Malaysia's former Prime Minister Najib Razak was sentenced to 12 years in jail after he was found guilty of abusing his power, laundering money and breaching the public's trust.

You may also be interested in:

Handbags and money seized in raids on former Malaysian PM's home (video published in 2018)

- Published14 June 2021

- Published27 January 2021

- Published9 August 2019