Sunak says he 'firmly believes in lower taxes' despite April increase

- Published

- comments

Chancellor Rishi Sunak told an audience today that not all tax cuts "pay for themselves"

Chancellor Rishi Sunak has pledged to "deliver a low tax, higher growth economy" amid criticism from MPs over rises to National Insurance.

Mr Sunak told an audience at the Bayes Business School on Thursday that he would cut taxes "sustainably".

It comes as National Insurance rates are set to rise from 1 April to help fund health and social care.

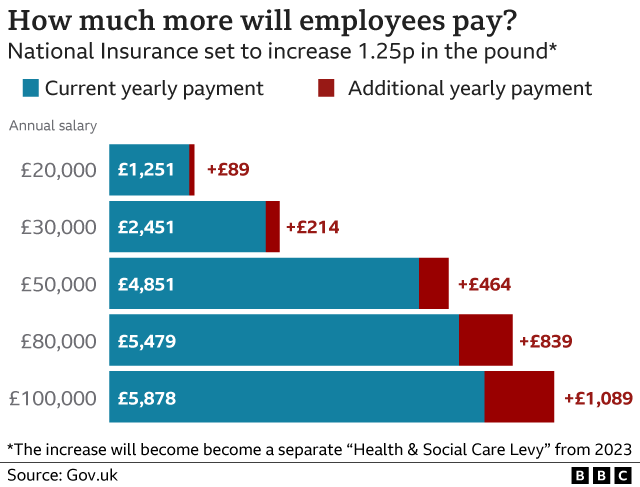

The rise means employees, employers and the self-employed will all pay 1.25p more in the pound.

"I am going to deliver a lower tax economy but I am going to do so in a responsible way, and in a way that tackles our long term challenges," Mr Sunak said in his speech.

"I firmly believe in lower taxes."

However, the chancellor also argued that taxes should not be cut if spending plans are unfunded.

Shadow chancellor Rachel Reeves said the Conservative Party was "now the party of high tax".

"The chancellor may say he 'believes' in low taxes in his lecture - but the hard facts are that Sunak has hit households and business with 15 tax rises in two years in post - with an unfair National Insurance rise down the line," Ms Reeves said.

"He has raised the most tax on average per budget than any chancellor in the last 50 years."

Labour Party leader Sir Keir Starmer was set to deliver a speech in Huddersfield outlining his party's approach to taxation and ending insecure employment, but it was cancelled due to the Ukraine crisis.

Sir Keir had planned to say that a Labour government would end the "economic fatalism" of the Conservatives and build "a new economy of security, where stable employment will be the bedrock of a better future for the next generation".

Mr Sunak said he was "disheartened when I hear the flippant claim that 'tax cuts always pay for themselves'".

"They do not," he added. "Cutting tax sustainably requires hard work, prioritisation, and the willingness to make difficult and often unpopular arguments elsewhere."

In Mr Sunak's two years in his role he has overseen hundreds of billions in Covid-related government spending through furlough payments, business grants and testing.

He has also been at the helm as taxation as a share of the economy has risen to its highest level since the 1950s.

Under the government's plans, employees, employers and the self-employed will all pay 1.25p more in the pound for National Insurance from April for a year.

After that, the extra tax will be collected as a new Health and Social Care Levy.

The changes will see an employee on £20,000 a year pay an extra £89 in tax, while someone on £50,000 will pay £464 more.

The Liberal Democrats and some backbench Tory MPs have called for the chancellor to scrap the incoming NI hike to ease the financial burden on households and businesses at a time of rising costs.

In the speech Mr Sunak also set out his priorities to increase the UK's economic growth, and argued that "what government does is far less important than creating the conditions for private businesses and individuals to thrive".

Tony Danker, director general of the business group the CBI, said setting out how firms could "achieve sustainable growth for the long term" was "vital" at a period of volatility in the economy.

"Government enabling firms to invest, thrive and deliver prosperity is absolutely the right direction of travel," he added.

Mr Danker has called for a permanent "super-deduction" tax break to boost business investment in the UK.

The super-deduction allowance currently gives businesses investing in certain types of equipment, like machinery, a much higher tax reduction than usual but will expire in March next year.

Related topics

- Published30 January 2022

- Published30 January 2022

- Published16 February 2022