Pub chain warns of higher food prices as VAT rises

- Published

- comments

Pub chain boss Clive Watson says the industry is facing a "minefield" of challenges

With hospitality businesses facing soaring costs, some are warning that a rise in VAT from Friday will force them to increase prices for customers.

"Everything's coming at once," says Clive Watson, chairman of the City Pub Group chain, which has 45 venues across England and Wales.

He says the industry is dealing with a "minefield" of challenges, including increases in food and energy costs, as well as the rise in National Insurance payments, which also kicks in from April .

The rate of VAT - the tax paid when buying goods and services - has been reduced for the tourism and hospitality sector since July 2020 to help it recover from the impact of the Covid pandemic.

However, from Friday it will increase from 12.5% to 20%, returning to the standard rate.

The Treasury said it had "always been clear" lower VAT rates were a temporary measure to support the reopening of industries impacted by Covid restrictions, adding it had "stood behind the hospitality sector" throughout the pandemic.

But Mr Watson argues now is not the time for a tax increase.

"I know the chancellor's got to recoup the money to pay for Covid but he shouldn't be suffocating industries that have suffered that badly," he says.

"As companies try and emerge from Covid a lot of them will just fall by the wayside because of this cocktail of cost increases."

Mr Watson says cost pressures mean his pub chain has already increased drink prices by 4% earlier this month and from 1 April it plans to increase food prices by an average of 7.5% to reflect the increase in VAT.

Even these increases will not cover the chain's increased costs, he says, but the business doesn't want to discourage customers from returning to pubs after the pandemic.

"We just couldn't put our prices up by 10% because that would just be too much of a turn-off," he says.

"But at the same time with all these additional costs we've got to try and claw back some of the lost revenue by price increases."

Industry body UK Hospitality has warned the increase in VAT will "restrict the sector's efforts to stifle price rises for customers".

"For many businesses, the removal of the lifeline of a lower rate of VAT might prove fatal," chief executive Kate Nicholls said last week.

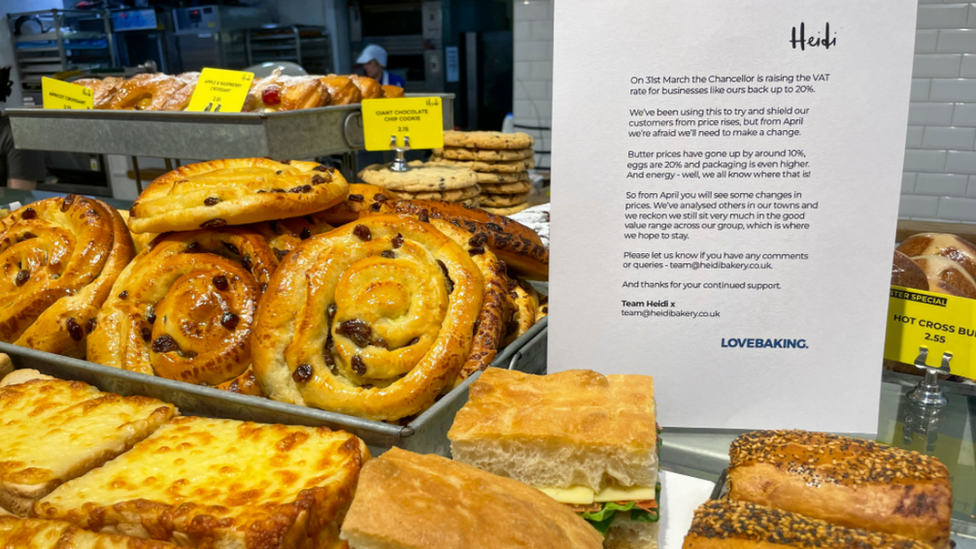

Heidi bakery chain, which has six stores in south-east England, is also planning to increase prices as a result of the VAT increase and has recently put up signs in its shops explaining the move to customers.

With the bakery facing increasing costs on everything from butter and eggs to energy, the chain's director Rory Shanks says the VAT rise "couldn't really have come at a more challenging time".

"Whilst the lower rate of VAT was designed to help with restrictions placed on our industry due to coronavirus, more recently it has also been helping protect our menu prices from rising alongside our costs," he says.

The Heidi bakery chain has explained why it is increasing prices by putting up signs in its stores

With the public also facing pressure on their budgets from the rising cost of living, Mr Shanks says his company will be watching closely to see how customers respond to the price rises.

"I think our customers have raised their eyebrows a little at the timing of this VAT increase knowing the challenges the industry has faced over the last few years," he says.

"But as well as general pragmatism about the situation, I think they are comforted knowing we'll also be using any increases to fund more wages for our teams that they interact regularly with."

He describes the decision to put up prices as "a difficult balancing act" and says the company is also looking at other ways to deal with tax rises. These include working with suppliers to push for lower costs and pivoting its products to use ingredients that are more widely available, he says.

Tom Ross says many businesses are still struggling despite the easing of Covid restrictions

But not all businesses are responding to the VAT rise by increasing prices.

Tom Ross, operations director at the Pig hotel chain, says room prices are set in advance and change at different points in the year so the company is not planning price hikes specifically linked to the VAT rise.

Menus in the hotel chain's restaurants change daily and Mr Ross says prices are more likely to be impacted by the products it gets from suppliers.

However, with the business facing many of the same challenges as the rest of the industry, he still believes now is not the right time to increase VAT.

"All of our suppliers are writing to us saying prices are going up and I think one of the things that will happen is people will have to put their prices up in the restaurant sector," Mr Ross says.

He says the chain is "very lucky" and has been busy since it reopened after lockdown, with the mostly countryside locations of its eight hotels proving popular with customers.

But Mr Ross is very aware that other hotel chains, such as city centre venues focused on events, are still struggling to recover from the impact of Covid.

"There are a lot that are still nowhere near where they were pre-pandemic."

In a statement, the Treasury said: "We've stood behind the hospitality sector throughout the pandemic with £400bn package of economy-wide support that saved millions of jobs."

It added that from Friday, eligible high street businesses will be able to get 50% off business rates bills.

Additional reporting by Jennifer Meierhans

- Published19 October 2021