Five reasons why prices and bills are going up

- Published

- comments

A cost of living crunch is hitting millions of people across the UK, as soaring energy bills start to bite into family finances and prices rise in the shops.

Much has been said about the squeeze on our budgets, and relatively few people will emerge from it with their personal finances unscathed.

April is a key month because it is when many of the most significant changes and bill rises take effect.

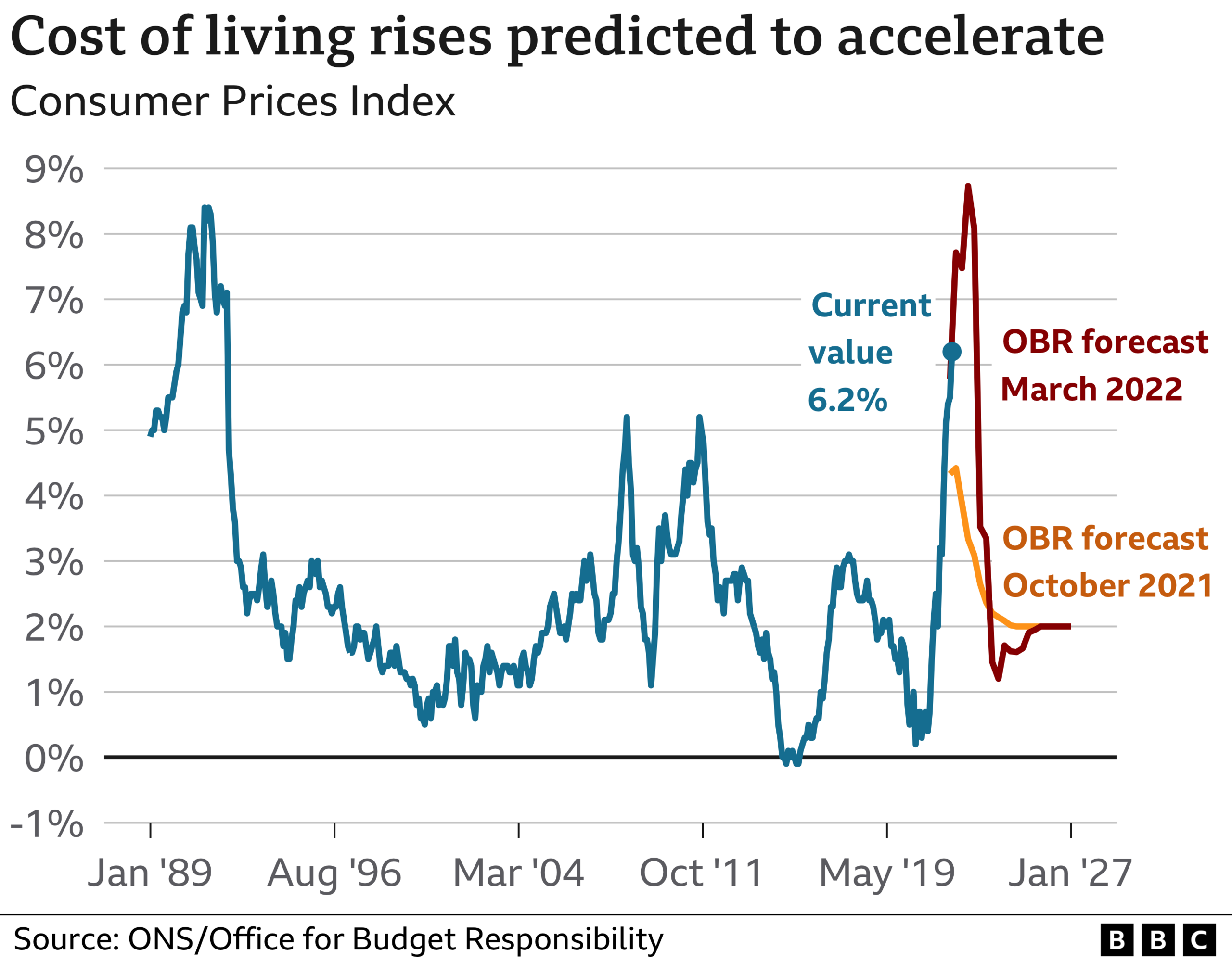

Inflation is the rate at which prices rise. If a bottle of milk costs £1 and that rises by 5p, then milk inflation is 5%. The optimum level, and the Bank of England's target, is a 2% inflation rate.

This first chart shows how inflation - charting the rising cost of living - is at its highest rate for about 30 years. Official figures reveal these price rises are widespread among the various things we buy.

They are about to accelerate. The government's official forecaster, the Office for Budget Responsibility (OBR), says the rate will peak at nearly 9% later in the year, before slowing. That means prices will continue to go up, but eventually not at such a rapid rate.

There is little sign of income keeping pace with pay rises and benefit increases (although minimum pay - through the National Living Wage - is going up by 6.6%), so our "real" income and standard of living will fall.

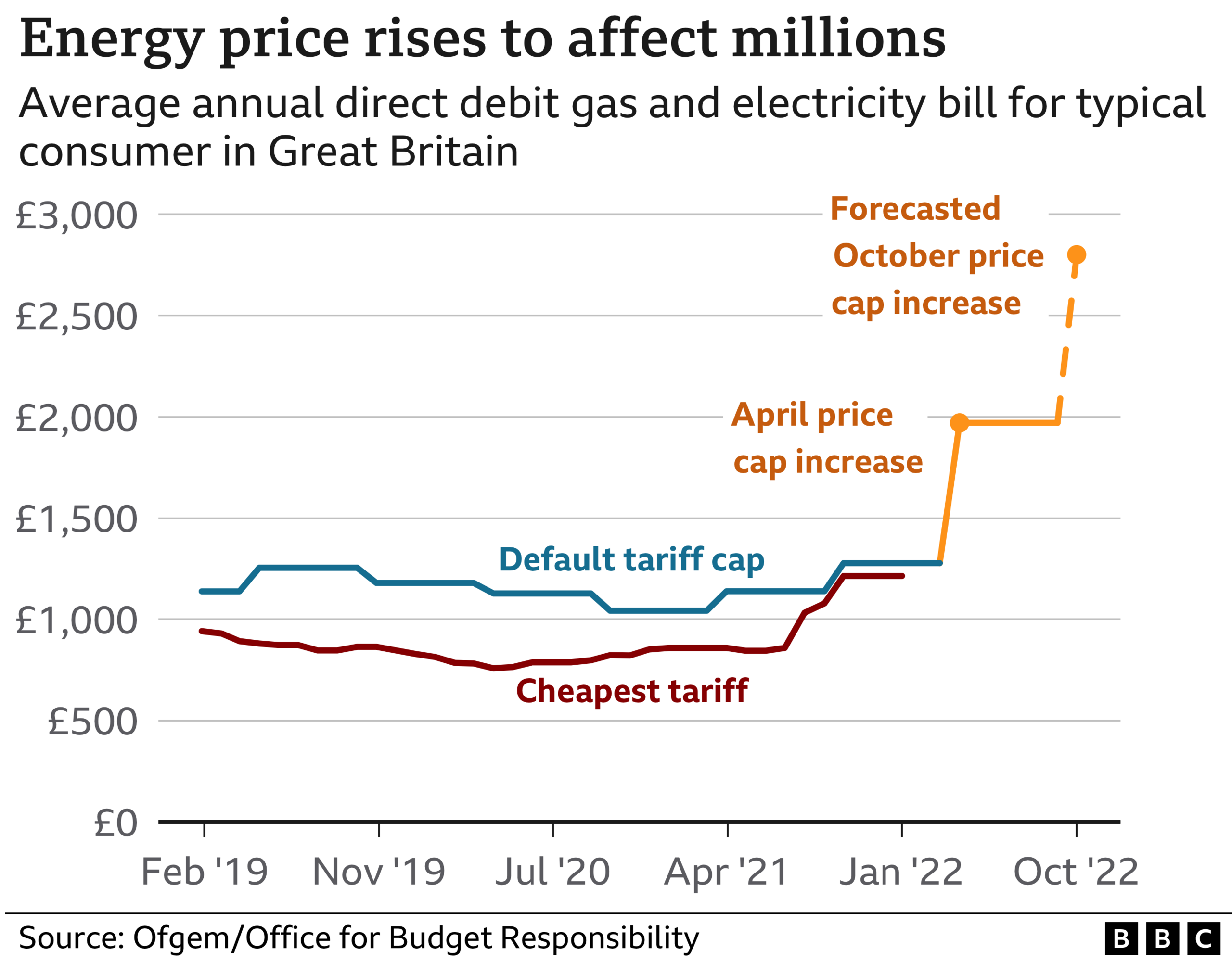

The biggest impact this year is the sharp increase in the cost of energy.

Businesses are passing on some of these costs to consumers in higher prices. Households are protected from the fluctuations owing to the domestic energy price cap.

Yet, the chart shows how the cap, and therefore the typical annual household gas and electricity bill is rising by about £700. The OBR is predicting a further rise of more than £800 a year in October.

The chart also shows how there is little bill-payers can do about it. They used to be able to shop around for a cheaper tariff but, at present, no deals are cheaper than the default price cap. The government is giving some support with a £150 council tax rebate in April, and a £200 government support payment in October which, although described as a grant, will need to be paid back, like an interest-free loan.

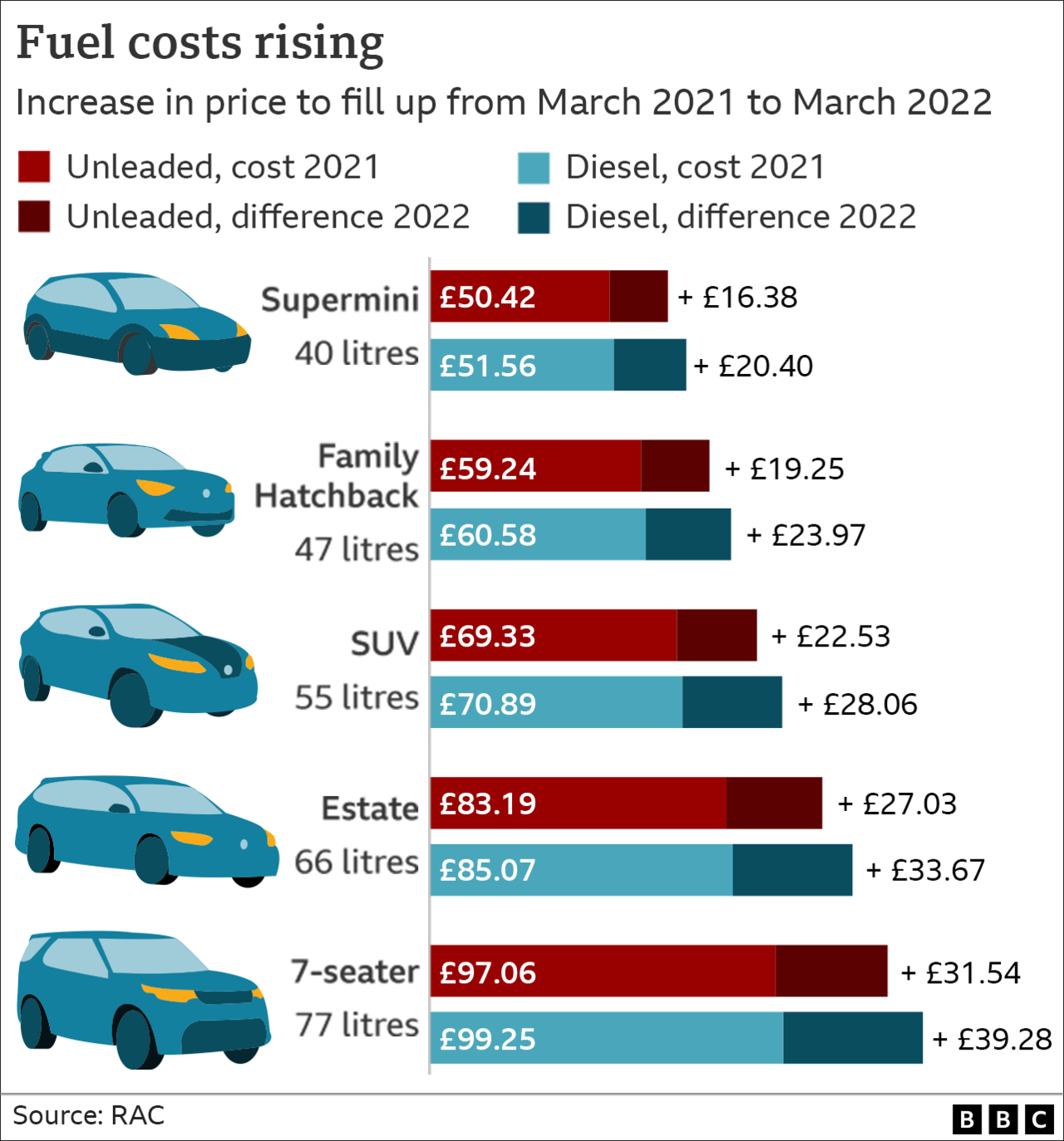

As well as the soaring cost of heating and powering the home, filling a car with petrol or diesel is getting more expensive too.

These prices can be quite volatile, week to week, unlike domestic gas and electricity.

The graphic shows the cost of filling a tank for different types of vehicles, according to the RAC motoring group. Even if you do not run a car, there is concern that pricier fuel will eventually feed through to more expensive bus and coach tickets.

The most expensive monthly bill for millions of people is their rent, or their mortgage repayment.

Three-quarters of mortgage borrowers in the UK are on fixed-rate deals, so only see a change in their repayments when their current term ends.

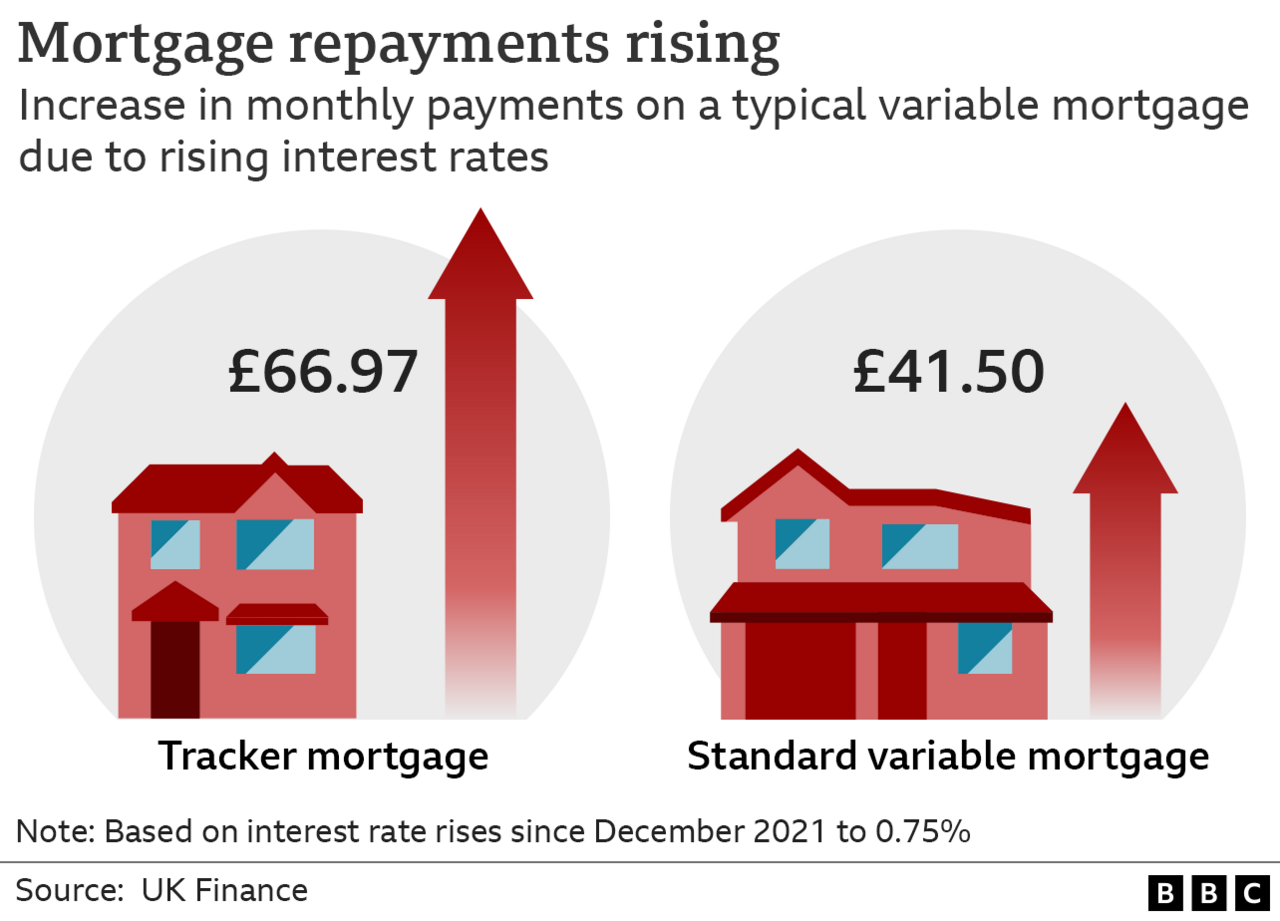

Another two million homeowners are on deals where the interest rate varies - known as tracker or standard variable rate mortgages. The Bank of England has raised the base interest rate three times in four months since December.

The chart shows how this has increased the monthly bill for these variable mortgage customers for the first time in a long time.

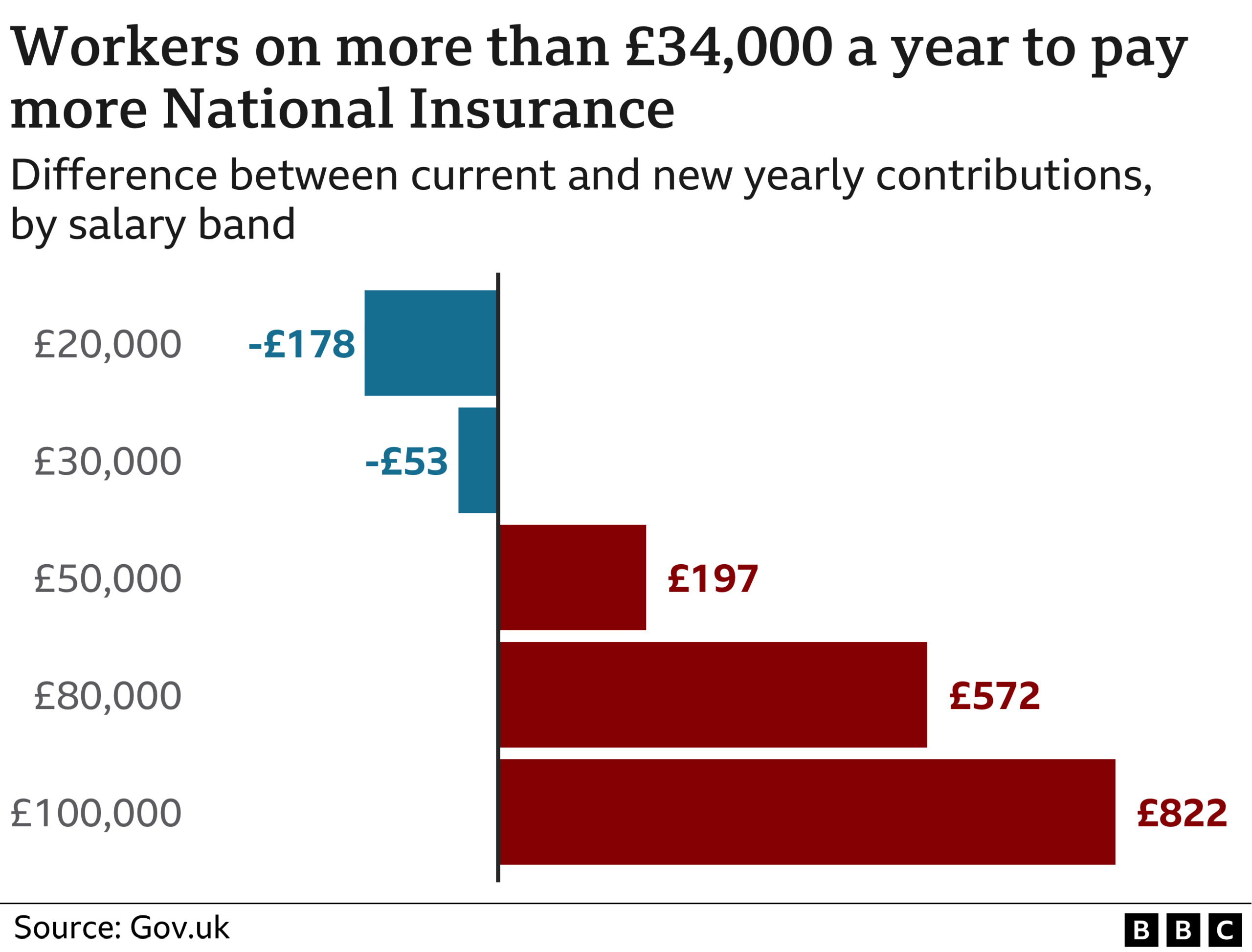

Many workers will be paying more tax from now, most significantly through increased National Insurance payments.

In July, people will be able to earn more before they start to pay this tax, following a change announced by Chancellor Rishi Sunak in his recent Spring Statement.

Combining those two measures means that in the next 12 months, anyone earning less than about £34,000 will pay less National Insurance than they did last year. Anybody earning more than that will pay more, as the final chart shows.

- Published3 February 2022