UK pay falls at fastest rate on record as inflation hits

- Published

- comments

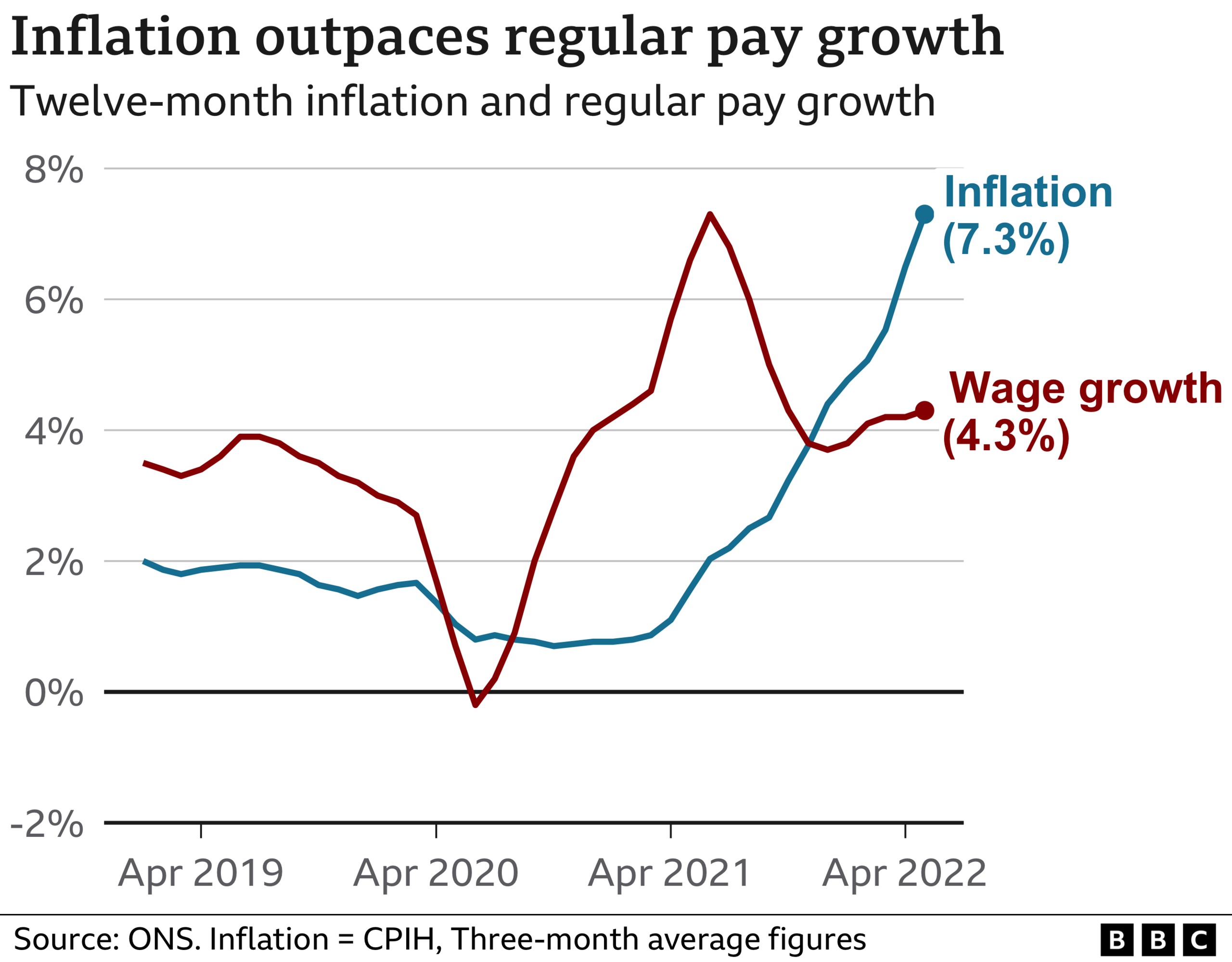

Regular pay is falling at the fastest rate since 2001 when taking into account rising prices, official figures show.

Between March and May, pay excluding bonuses was down 2.8% from a year earlier when adjusted for inflation - the fastest drop since records began.

Household budgets are being hit by soaring food, fuel and energy costs, with inflation at a 40-year high.

Pay growth was much higher for the private sector than the public sector.

For March to May, average total pay for the private sector was 7.2% higher than the same period last year, before taking account of inflation, according to the Office for National Statistics (ONS). For the public sector the figure was 1.5%.

Pay including bonuses was down 0.9% when adjusted for inflation.

It comes as the government is due to unveil this year's pay deal for 2.5 million public sector workers, including teachers, nurses, doctors, police officers and members of the armed forces.

Unions are calling for wages to reflect the cost of living - but ministers have signalled the pay deal will not match price rises, warning this would push inflation even higher.

Inflation - the rate at which prices rise - hit 9.1% in May, the highest level in 40 years, and is expected to climb further by the autumn.

James Reed, chairman of Reed, one of the UK's largest recruitment businesses, said the UK was seeing "a two-speed workforce", with big pay offers being made to people with certain skills.

"So you might be seeing 25% plus pay offer increases to get people to move jobs. But then we're seeing other parts of the economy where pay hasn't moved much at all and that is concerning because more and more people will end up living in in-work poverty," he told the BBC's Today programme.

Virgin Money is the latest company to offer a one-off payment to help employees cope with the rising cost of living, with all staff on a salary of £50,000 or less to get a £1,000 lump sum in August.

Firms including Lloyds Bank have also offered similar payments.

Max Poynton says his doughnut firm is finding it difficult to recruit new staff

With job vacancies at near record highs, many sectors are struggling to recruit.

Max Poynton, operations director at Project D, a doughnut firm in Derby, said it was particularly hard to find experienced people.

"I think a lot of people after the pandemic have gone and retrained, upskilled themselves and the same pool of people that was there before maybe isn't there anymore."

He knows staff are struggling, with some ride-sharing on their way into work to save money. Some have asked directly for a pay rise but with the business facing increased costs on everything from electricity to diesel to flour and icing, he says it is simply not an option.

"I'd love to be able to say yes but at the moment it's tough to offer any sort of pay rises, especially with the uncertainty of not knowing how much our costs are going to increase over the next six months."

Dan Bond is feeling the impact of rising prices

Dan Bond, who works in the doughnut factory, said his last pay rise was in April when the minimum wage went up. Since then Dan, who drives to work, has seen a huge rise in the cost of filling up his tank.

However, he is unsure whether he would ask his employer for a pay rise.

"I know they're also experiencing hard times," he said. "So do I put that pressure on as well?"

Business groups, including the British Chambers of Commerce (BCC) and Make UK, which represents manufacturers, said companies were struggling with higher wage demands from staff and that salary increases were beginning to hold back growth and investment.

Jane Gratton, from the BCC, told the Commons Business Committee small businesses were losing candidates to other employers offering higher pay and were worried about how they could compete with bigger firms.

But Frances O'Grady, general secretary of the Trades Union Congress, told the committee workers were facing a "pay crisis" and the argument that the country was in a "pay inflation spiral" was "nonsense".

The jobs market is still hot, with unemployment down and vacancies up near records. However, the ONS says it doesn't see evidence of the dreaded "wage-price" spiral that would entrench the current high rates of inflation.

Indeed the flip side of that is the biggest real squeeze on pay since these records were first collected two decades ago, and probably for significantly before that too.

Pay settlements are not "inflationary" as they are not exceeding inflation. Though there is some evidence in certain sectors and local settings, with worker shortages, of unionised workplaces securing double digit pay rises.

Other workplaces in construction and manufacturing see employers paying retention bonuses and cost of living lump sums. On average, while not inflationary, these settlements are high in cash terms.

It is notable too that from March to May, average total pay including bonuses was up 7.2% in the private sector compared to the previous year, but up just 1.5% in the public sector.

Little wonder that those in the public sector say that some of the visible chaos seen in social care and the health system reflects low-paid public sector workers jumping ship to better paid jobs at the likes of supermarkets and Amazon.

This reduction in the social care workforce is crippling the sector enough to cause queues of ambulances unable to offload patients into hospitals unable to discharge their patients.

Much of this boils down to a singular factor, not even discussed in the current contest to run the country - significant shortages of labour.

Job vacancies continued to increase between April and June - up 6,900 compared to the previous quarter - although the rate is slowing.

The accommodation and food service sectors saw the biggest rise but this was offset by falls in other industries, including wholesale and retail trade and motor vehicle repairs.

ONS head of labour market and household statistics, David Freeman, said demand for labour was "clearly still very high", with unemployment falling again and another record low for redundancies.

For March to May, the unemployment rate was estimated at 3.8%, a fall of 0.1 percentage points compared to the previous three-month period.

Chancellor Nadhim Zahawi said the figures "underline how strong our jobs market continues to be".

But he added: "I am acutely aware that rising prices are affecting how far people's hard-earned income goes, so we are providing help for households through cash grants and tax cuts."

However, Labour's shadow chief secretary to the Treasury, Pat McFadden, said the Conservatives had "failed to grow the economy, which has left people more exposed to inflation and the cost-of-living crisis".

- Published13 July 2022

- Published14 June 2022