Gas prices jump as Russia cuts German supply

- Published

- comments

Serious rationing of energy possible this winter, says IEA head.

Gas prices jumped after Russia further cut gas supplies to Germany and other central European countries after threatening to earlier this week.

European gas prices rose almost 2%, trading close to the record high set after Russia invaded Ukraine.

Critics accuse the Russian government of using gas as a political weapon.

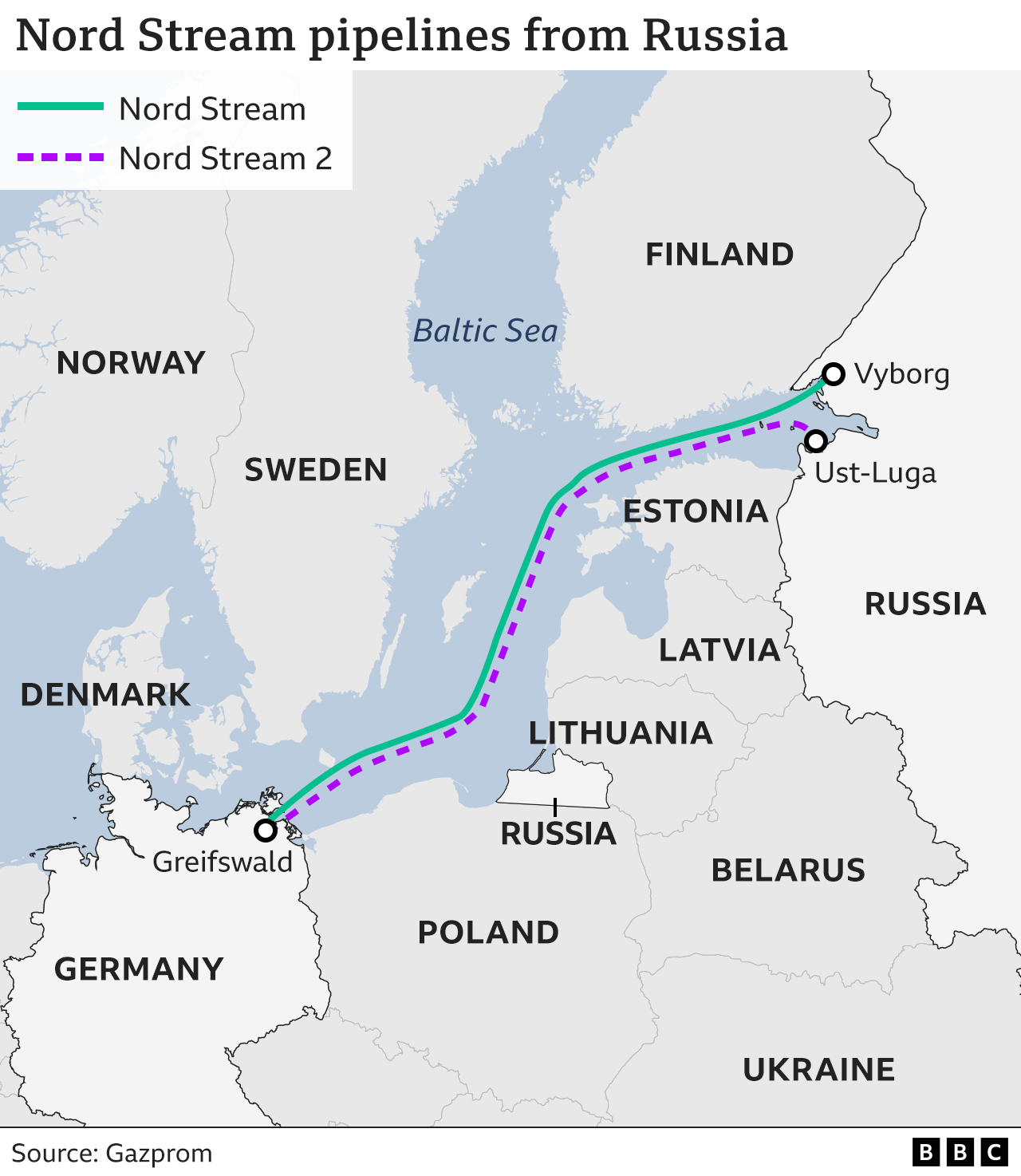

Russia has been cutting flows through the Nord Stream 1 pipeline to Germany, with it now operating at less than a fifth of its normal capacity.

Before the Ukraine War, Germany imported over half of its gas from Russia and most of it came through Nord Stream 1 - with the rest coming from land-based pipelines.

By the end of June, that had reduced to just over a quarter.

Russian energy firm Gazprom has sought to justify the latest cut by saying it was needed to allow maintenance work on a turbine.

The German government, however, said there was no technical reason for it to limit the supply.

Ukraine has accused Moscow of waging a "gas war" against Europe and cutting supplies to inflict "terror" on people.

Meanwhile, Poland has said it will be fully independent from Russian gas by the end of the year.

Prime Minister Mateusz Morawiecki said: "Even now, Russia is no longer able to blackmail us in the way it blackmails Germany for example."

The UK would not be directly impacted by gas supply disruption, as it imports less than 5% of its gas from Russia. However, it would be affected by prices rising in the global markets as demand in Europe increases.

European wholesale gas prices closed at €204.85 (£172.08) per megawatt hour - the third highest price on record. The all-time high was achieved on 8 March when prices closed at €210.50 (£176.76) per megawatt hour, according to analysts Icis.

However, this time last year the wholesale gas price in Europe was at just above €37 (£31.08) per megawatt hour.

UK gas prices rose 7% on Wednesday so the price is now more than six times higher than a year ago. However, it is still well below the peak seen in the aftermath of Russia's invasion of Ukraine.

UK energy bills increased by an unprecedented £700 in April, and are expected to rise again with one management consultancy warning a typical energy bill could hit £3,850 a year by January, much higher than forecasts earlier this month.

BFY said its forecast reflected the increase in wholesale prices over the past few weeks with the ongoing tensions with Russia sparking concerns over winter supplies.

The latest reduction in flows puts pressure on EU countries to reduce their dependence on Russian gas even further, and will likely make it more difficult for them to replenish their gas supplies ahead of winter.

Since the invasion of Ukraine European leaders have held talks over how to reduce its dependence on Russian fossil fuels.

On Tuesday, the European Union agreed to cut gas use in case Russia halts supplies but some countries will have exemptions to avoid rationing.

EU members have now agreed to voluntarily reduce 15% of gas use between August and March.

However, the deal was watered down after previously not having exemptions.

The EU has said its aim from the deal is to make savings and store gas ahead of winter, warning that Russia is "continuously using energy supplies as a weapon".

The voluntary agreement would become mandatory if supplies reach crisis levels.

The EU agreed in May to ban all Russian oil imports which come in by sea by the end of this year, but a deal over gas bans has taken longer.

Since Russia invaded Ukraine in February the price of wholesale gas has already soared, with a knock-on impact on consumer energy bills across the globe.

The Kremlin blames the price hike on Western sanctions, insisting it is a reliable energy partner and not responsible for the recent disruption to gas supplies.

Across the EU, the heat is on to conserve supplies, build up reserves and see off competition from the likes of China to secure alternative sources for the 40% of its gas it gets from Russia - all ahead of winter.

The UK may only source less than 5% of its gas from Russia, an amount far easier to replace. But the International Energy Agency has warned that this is the first truly global energy crisis. Europe may be at the epicentre but we're all feeling the shockwaves of Moscow's "weaponising" of energy in an acute way.

Amidst the current tensions and with global supplies stretched more thinly, UK wholesale gas prices are six times what they were a year ago.

And the UK is actually more reliant on fossil fuels than the EU for its total energy consumption, our fortunes - inflation and growth - more vulnerable to swings in those prices.

The predicted hefty increase in the energy price cap in the autumn may not be the last; analysts are warning that we could see prices remaining volatile for an extended period of time.

Our best hope may be for a mild winter.

- Published26 July 2022

- Published26 January 2023