Bank of England warns the UK will fall into recession this year

- Published

In a 'blunt message" the Bank of England governor warns interest rates may have to rise even higher

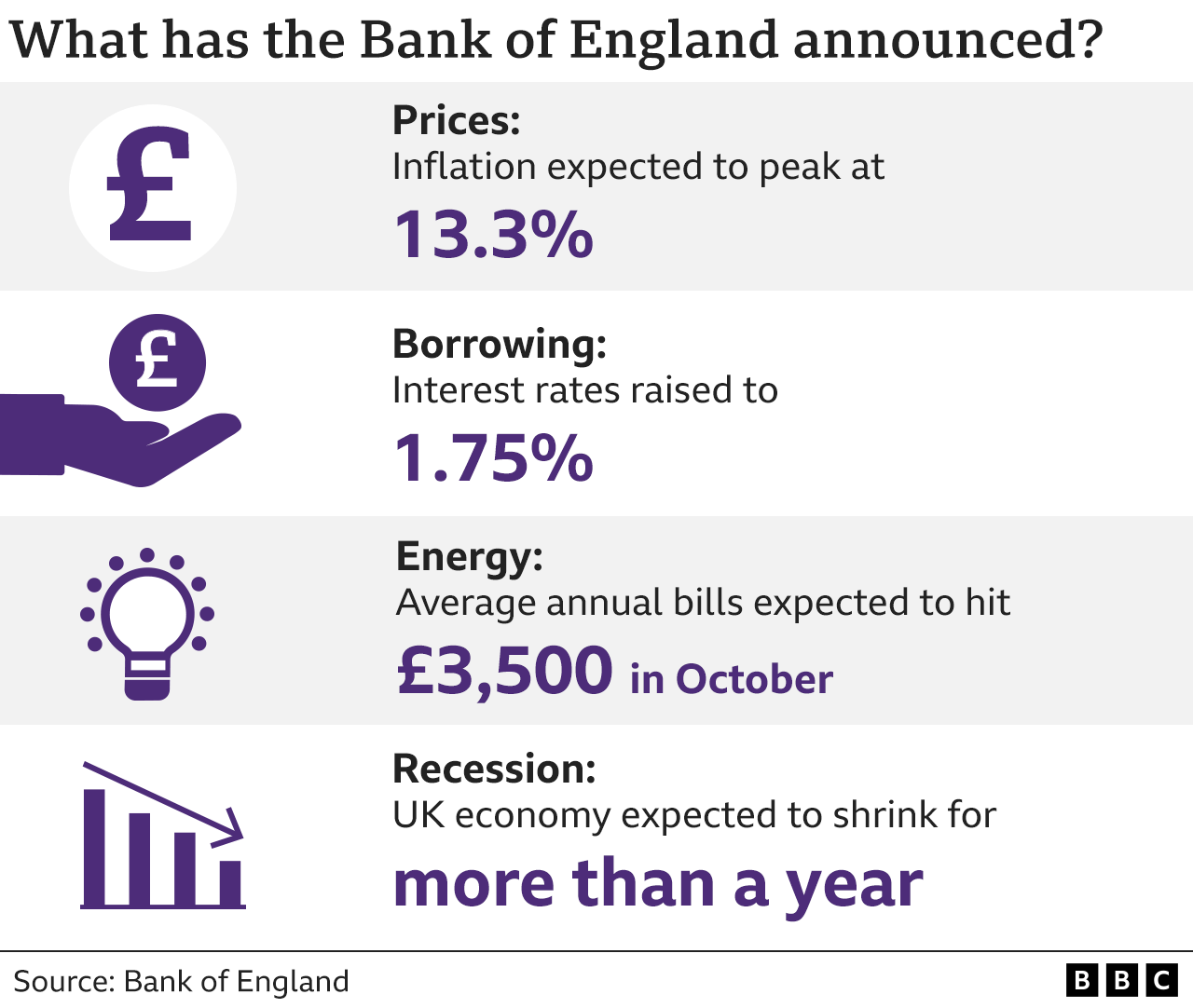

The Bank of England has warned the UK will fall into recession as it raised interest rates by the most in 27 years.

The economy is forecast to shrink in the last three months of this year and keep shrinking until the end of 2023.

Interest rates rose to 1.75% as the Bank battles to stem soaring prices, with inflation now set to hit over 13%.

Governor Andrew Bailey said he knew the cost of living squeeze was difficult but if it didn't raise interest rates it would get "even worse".

The main reason for high inflation and low growth is soaring energy bills, driven by Russia's invasion of Ukraine.

A typical household will be paying almost £300 a month for their energy by October, the Bank warned.

The expected recession would be the longest downturn since 2008, when the UK banking system faced collapse, bringing lending to a halt.

The slump is not set to be as deep as 14 years ago but may last just as long.

The Bank's governor Andrew Bailey said he had "huge sympathy and huge understanding for those who are struggling most" with the cost of living.

"I know that they will feel, 'Well, why have you raised interest rates today, doesn't that make it worse from that perspective in terms of consumption?', I'm afraid my answer to that is, it doesn't because I'm afraid the alternative is even worse in terms of persistent inflation."

Increasing interest rates is one way to try and control inflation as it raises borrowing costs and should encourage people to borrow and spend less. It can also encourage people to save more.

However, many households will be squeezed further following the interest rate rise including some mortgage-holders.

Now rates have gone up to 1.75%, homeowners on a typical tracker mortgage will have to pay about £52 more a month. Those on standard variable rate mortgages will see a £59 increase.

It means tracker mortgage holders could be paying about £167 more a month compared to pre-December 2021, with variable mortgage holders paying up to £132 more. Interest rates have risen six times in a row since the end of last year.

Higher interest rates also mean higher charges on things like credit cards, bank loans and car loans.

Patrick Reid, a business owner in London, owes £25,000 on credit cards and loans and fears an interest rate rise will cost him.

Patrick Reid owes £25,000 in loans and credit cards

"At present I repay around £1,800 a month but I have worked out that I will conservatively need to pay another £250 a month to keep up with the debts," he said.

"I will simply have to tighten my belt and be extra cautious in my spending, which means all of those non-essential items will be cut from my budget."

Rebecca McDonald, chief economist at the Joseph Rowntree Foundation, said "staggeringly" high inflation was "going to hit low income families hard".

"Many took on credit to pay their bills and are falling behind on their payments. This will be much harder to pay off with higher interest rates putting more families in financial peril."

Speaking to BBC Radio 4's Today programme, shadow work and pensions secretary Jonathan Ashworth said the cost of living support announced so far was "clearly not enough".

"There will be families and pensioners across the country waking up this morning, reading the news, who are absolutely terrified because a juggernaut is heading [their] way which will smash through family finances," he said.

He said a Labour government would reduce VAT on energy bills, abolish the tax relief currently offered to oil and gas companies who invest, and provide support to help people retrofit their homes to make them more energy efficient.

Chancellor Nadhim Zahawi said he was confident the action the government was taking meant it could overcome the economic challenges.

Both Mr Zahawi and Boris Johnson have also been criticised by Labour for being on holiday when the Bank detailed its gloomy outlook.

Mr Zahawi insisted he was still working and had a call with Governor Andrew Bailey after the interest rate announcement.

"For me, like I'm sure lots of others, there is no such thing as a holiday and not working. I never had that in the private sector, not in government," he said.

He added: "The privilege and responsibility of public service means that you never get to switch off, that's why I have had calls and briefings every day and continue to do so."

It is the most piercing of warning sirens set off by the Bank of England.

Announcing the largest rate rise in more than a quarter of a century in an attempt to temper even higher peaks in inflation of an incredible 13% is what the Bank of England actually did. But it is its prediction of a recession as long as the great financial crisis and as deep as that seen in the early 1990s that is the big shock here.

This is a proper full fat recession at the same time as the inflation rate is forecast to hit a 42-year high. It is a textbook example of the combination of a stagnating economy and high inflation - stagflation.

It obviously will raise questions as to why rates are being hiked into a recession at a time when consumers are already pulling back from spending.

Energy bills have already risen sharply this year, squeezing household incomes and leading to slower growth for the UK economy.

Russia has reduced supplies to Europe as it wages war in Ukraine and fears are growing it may switch off the taps altogether.

The potential of gas supply problems has led to the wholesale price soaring, which has led to energy firms passing those costs onto customers - pushing up household energy bills by unprecedented amounts.

As well as energy, households have been hit by higher petrol and diesel costs and food prices.

The Bank warned UK economic growth was already slowing, adding: "The latest rise in gas prices has led to another significant deterioration in the outlook for the UK and the rest of Europe".

The rate of inflation is expected to stay at "very elevated levels" throughout much of next year, the Bank said. It will eventually return to the Bank's 2% target the following year.

How will the rise in interest rates affect you? Do you have any questions you'd like answered? Email haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published5 August 2022

- Published20 July 2022