'I'm borrowing £5,000 to pay my energy bills'

- Published

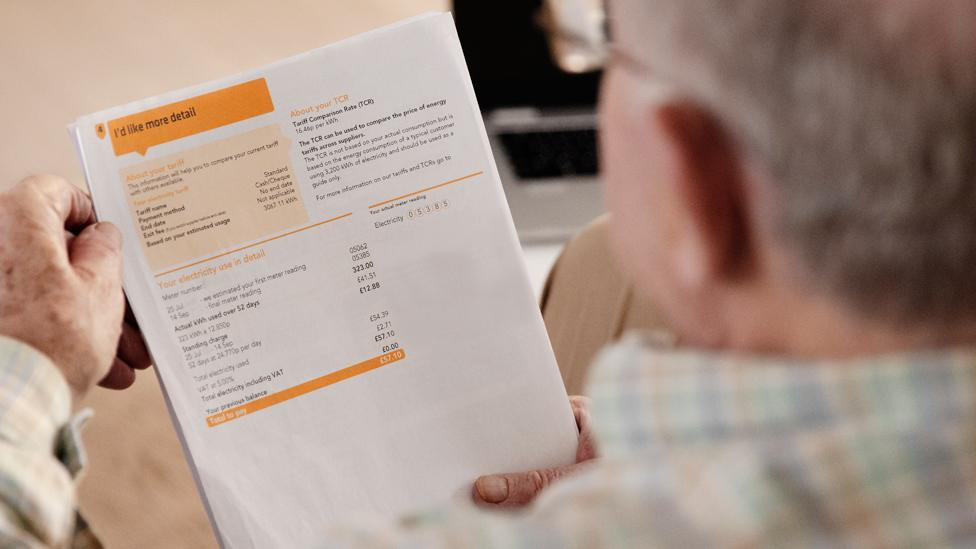

Soaring energy bills are leading to desperate measures.

Some people contacting the BBC are turning to debt or are worried about their businesses failing.

Many are simply bewildered about how they can find themselves in the position of not being able to afford to heat or light their homes.

We spoke to just a few about their concerns, but there are many more unsure how they're going to cope with what consumer expert Martin Lewis has described as a "national crisis".

He was referring to energy bills effectively doubling between May and October this year, when the new higher energy price cap - which sets a limit on the amount that can be paid for each unit of energy - comes into effect.

The latest forecast from analysts Cornwall Insight has predicted it will hit £3,582 before climbing again in January to £4,266.

Energy watchdog Ofgem will reveal the actual level of the cap later this month but it will certainly leave many consumers struggling and some unable to afford gas and electricity.

'I'm borrowing £5,000 to pay my energy bills'

With his monthly energy bills set to double in the autumn, James Gilmour has borrowed thousands now to keep his family afloat.

He lives in Essex with his partner and three kids and their gas and electricity bill has already doubled from £145 per month to £320.

From October he expects to be paying more than £600 based on current estimates.

"As a family of five we simply cannot afford to pay this," he said.

"We are already getting halfway into the month with no money left for food and essentials."

He's borrowing £5,000 - to be repaid over five years - to help get through the current cost-of-living squeeze.

James works in the car industry while his partner is a part-time teacher

He reckons the £93 monthly loan repayments - which mean he'll repay a total of £5,567 - will be worth it to keep the family's finances from spiralling out of control.

He's hoping to avoid falling into expensive debt such as running up a huge overdraft, where interest rates are nearer 30%. The loan he's taking is charged at 4.4%.

"This is the only way to survive through this crisis and I am just hoping it settles back down as another loan will not be possible if this continues for years to come," James told the BBC.

'We're fighting for survival'

Emily Wilkinson, runs a gym with her husband in Macclesfield, says the energy crisis has left her business "fighting for survival".

"We're facing a double whammy. Not only will our household bill rise to £3,000 a year, but we're seeing an even more dramatic increase in the cost of electricity at our gym.

"Just as we were starting to recover post-Covid, we were hit with an energy bill for £1,000 per month, up from £480 per month previously.

"That was in October 2021, six months before the energy price cap increase.

"On 24 September, our electricity standing charge will increase by 818% per day.

"I know everyone is struggling, but I think small business owners have been forgotten."

She says many businesses like hers can't risk raising their prices in line with the increased energy costs because they will lose customers.

She questions what the government will do to support small businesses who are struggling to afford soaring energy bills.

"The general public think it's all over now Covid restrictions have been dropped, but we feel like the fight is only just getting started."

She's one of many concerned people who have contact the BBC in recent days.

'I've been forced to use foodbanks'

Graham West has turned to using foodbanks for the last six or seven weeks after seeing the cost of energy and groceries rocket.

The 68-year old is retired and lives in sheltered accommodation in Sheffield.

"As a pensioner on the basic state pension of £185 a week, I class myself as low income, yet I don't qualify for any extra help because I'm £2.50 a week over the limit to get pension credit."

That means he'll just miss out on the £650 extra cash the government has earmarked to send to hard-up folk to help with the cost-of-living squeeze. The payment will be made to more than eight million low-income households who receive Universal Credit, tax credits, pension credit and other means-tested benefits.

"I only use electricity in my home but my bill has gone up from £30 a month to £42, and will hit £60 in October," Graham says.

"I can't really afford to pay the increase now so am relying on the extra £66 a month the government has promised us from October.

"That will have to cover the higher bills and make up the shortfall that I'm building up at the moment.

"I've been using foodbanks for the last few weeks or else I would not be eating. I cannot get any extra help from anywhere.

"People like me desperately need help now, not in a few months."

'I can't pay the £500 I owe my energy company'

Like many others Dallas Lucas is struggling. The 48-year-old from Greater Manchester is trying to survive on £635 Universal Credit a month.

But with £330 going on rent for her one-bedroomed flat, she can't make the rest stretch to cover everything, and has fallen behind on energy payments.

Her gas bill was £30 a month but when it shot up to £150 a couple of months ago, she couldn't afford to pay.

"I asked my supplier to disconnect me so that I could just pay what I owe, but they've refused to take my pre-payment meter out."

She got into arrears on rent and council tax and has been forced to sell as much as she can to raise cash to get back on track.

"I've sold all my furniture and belongings to try keep up with payments which is impossible on Universal Credit."

She says in her kitchen all that's left is a fridge, a microwave and a kettle.

"Everything else has gone, I sold it to try and pay the bills. It's the gas company that's demanding everything. Everyone else has been reasonable."

- Published10 August 2022

- Published3 April 2024