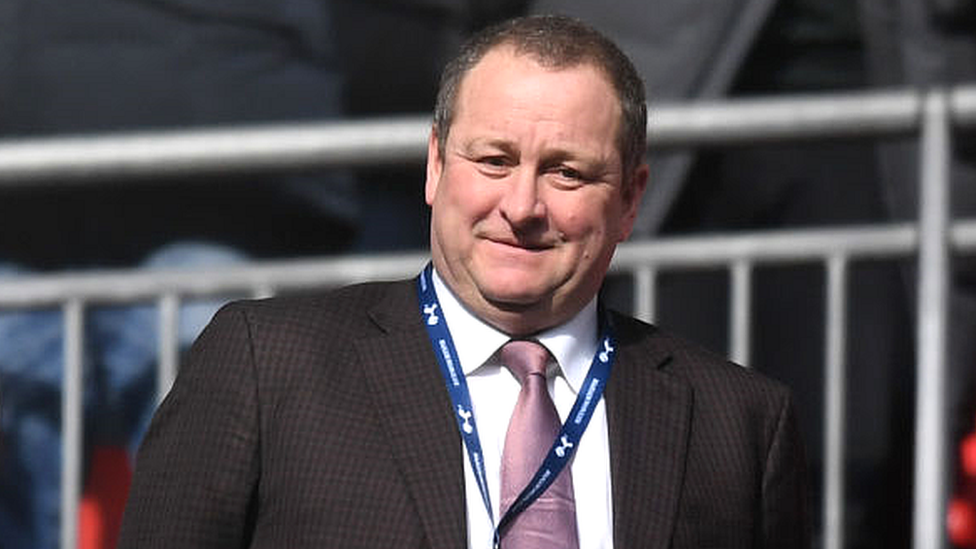

Sports Direct founder Mike Ashley to quit Frasers' board

- Published

Mike Ashley is to step down from the board of Frasers Group, owner of the Sports Direct chain that the retail billionaire founded 40 years ago.

Mr Ashley had already handed over the running of the group to his son-in-law Michael Murray earlier this year.

Frasers said Mr Ashley would not be standing for re-election as a director, and would leave the board next month.

The company also announced that Mr Ashley will provide the company with £100m worth of funding.

In a statement, the firm also said Mr Ashley would continue to be available to the board and management for advice "when called upon".

Mr Murray, Frasers' chief executive, said Mr Ashley had "built an incredible business over the past 40 years".

Mr Ashley has been one of the High Street's most prominent and colourful figures since founding his business. He first entered the fitness industry as a squash coach before opening his first High Street sports shop in Maidenhead, Berkshire, in 1982.

The Sports Direct business grew as Mr Ashley bought up well-known names such as Dunlop, Slazenger and hat-maker Kangol. It is now the UK's largest sportswear retailer, with more than 400 stores.

In 2007, Mr Ashley floated the business as a public company on the London Stock Exchange in a move which valued it at £2.5bn.

Later that year, his public profile increased when he bought majority control of Newcastle United. However, his tenure was criticised by fans over his ownership style and perceived lack of investment, and he sold his stake in the club in October last year.

As well as buying brands, the Sports Direct group also bought chains such as lingerie firm Agent Provocateur and luxury fashion chain Flannels.

Who is Mike Ashley?

Mike Ashley may be stepping down from the board of Frasers Group but he is by no means out of the picture though. He is still the group's controlling shareholder with a stake of nearly 70% and has agreed to lend the business £100m.

Starting out as a single sportswear shop, his retail empire now includes the likes of Game, Jack Wills, and Evans Cycles.

The move does, however, mark a significant change of the guard and one which may bring major change to the business, of which Mr Ashley built the foundations for 40 years ago.

In 2018, Mr Ashley bought the House of Fraser department store chain for £90m and the following year he changed his company's name from Sports Direct International to Frasers Group.

As his retail empire grew, Mr Ashley frequently courted controversy. His dealings with the City started badly when shares in Sports Direct halved shortly after the company's flotation.

Many investors were unhappy at the way the company was run, but in a Sunday Times interview Mr Ashley called them "cry babies", telling the paper: "Sports Direct should come with a government health warning - this stock is not for the fainthearted."

In 2017, London's High Court heard that the businessman once hosted a management meeting in a pub where he drank 12 pints and vomited into a fireplace.

The company was also accused of building its success by exploiting workers. In 2016, in a hearing before MPs, Mr Ashley admitted workers at its Derbyshire warehouse had been paid below the minimum wage and that its policy of fining staff for being late was unacceptable.

Mr Ashley stepped away from running Frasers Group when he handed over the role of chief executive to Mr Murray in May this year.

Michael Murray, Mike Ashley's son-in-law, took over as chief executive of Frasers Group

Shortly after taking over the role, Mr Murray became Mr Ashley's son-in-law after marrying his daughter, Anna, in a lavish ceremony at Blenheim Palace.

In an interview with the BBC in May, Mr Murray said that Mr Ashley was "not pulling the strings".

"We have vocal debates. We agree, we disagree. But ultimately the decision lies with me on the outcome of where we take the company."

Mr Murray is in line for a £100m pay-out if he can double Frasers' share price to £15 within the next three years.

In order to get the payment, the company's share price needs to reach £15 for 30 trading days in a row before October 2025. The shares are currently trading at about £7.70.

Related topics

- Published20 September 2022

- Published5 May 2022